Alex Cheatle, CEO of Ten Group, discusses his firm’s technology-enabled lifestyle, travel platform and concierge services with Douglas Blakey. It is a premium service already on offer to customers of a growing number of leading banks, including Coutts, Investec, Barclays, OCBC and HSBC

Cheatle has a simple but persuasive pitch to retail and private bankers: “Would you like to deliver services to your most premium customers that will allow you to increase retention rates, increase acquisition rates and grow clients’ engagement overall with your bank? We can prove that we do that.”

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

It may be simple, but it has resulted in Ten Group being successful with 28 of its last 32 pitches to financial institutions. Not many service providers or tech firms can boast such a successful tendering track record.

Off the back of that kind of hit rate, backed up by revenue growth – in 2015 revenue of £20m ($26.5m); 2016: £24.3m and 2017: £33.2m – Ten Group listed successfully in late 2017 on London’s AIM market. Ten is no new kid on the block, however, having been launched by Cheatle 20 years ago, but is coming to the fore on the back of impressive results and a stellar client list.

Looking back, Cheatle says concierge and related services have had an interesting history: “We are now witnessing the second wave of concierge. In the early days, it was little more than a tick-box indicator for banks.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBanks wanting to repeat the success of the American Express Centurion card would offer something that looked premium – little more than a signifier and dismissed by Cheatle as “a marketing thing”.

He explains: “We have taken concierge to being a strategic tool. The top end of retail banking is crucial for us, and represents the majority of our business.”

Clients include NatWest Black and Barclays Premium in the UK, internationals OCBC and Itaú, and private banks such as Coutts.

Emerging markets are especially promising, with exciting growth in China, Japan and South East Asia. In Latin America, Ten Group employed fewer than 50 staff six months ago; today that number has risen to over 200.

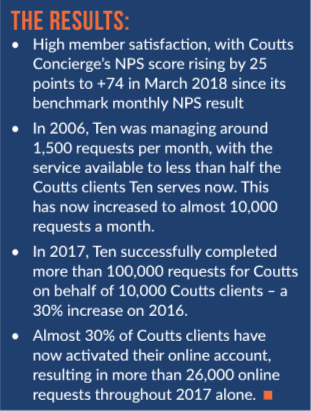

“Our net promoter score has gone through the roof, and that directly impacts the NPS of the retail or private bank – and impacts on people’s intention to stay with their bank.

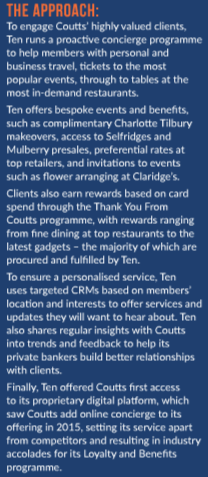

“Our services have got to the point where members get access to the world’s best restaurants; we can get tables all over world. In London alone, we hold hundreds of held tables at the top restaurants. Members of the public calling the same restaurants will be told there is no table available for the next three months.

“Tickets at face value for Adele, Coldplay or the Rolling Stones? Not a problem. Everyone else has to rely on the secondary market. On hotel pricing, we can beat Expedia; on flights we can offer better pricing than is available on the airlines’ own websites.”

In the early days of concierge, the benefits would be attached to a single product, generally the credit card. Today, banking clients of Ten tend to attach the benefits to the entire banking relationship, so benefits are felt across the whole banking and wealth management proposition.

“We are offering genuine value-add – real value that drives people to love their bank,” concludes Cheatle.