Despite dire warnings for banks, it is looking increasingly likely that banks will be making the early running when it comes to demonstrating the potential of open banking, argues Patrick Frith, operations at Bud.

Ever since the very first utterance of the phrase ‘Open Banking’ there has been speculation about what this might mean for our banking system.

The banks had built a position that was hard to contest, defended both by their ownership of data and the technical difficulty of processing it. For years previously, the falling price of processing power had busily eroded the defensibility offered by banking ‘systems’, but ownership of data had looked to be the banks’ pocket ace.

As the Open Banking vision took shape, people could see how smaller, more agile tech companies could make genuine inroads into the primary relationship between people and their money, and as the 13 January deadline came closer, the excitement among the potential benefactors of the new data regime became palpable.

The reality has been far more measured. Ignoring the extensions granted to the majority of the CMA9 – the leading nine banks in the UK – the complexity of delivering on the promise of a connected financial experience represents an immense challenge, and one for which open access to APIs is not a panacea.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

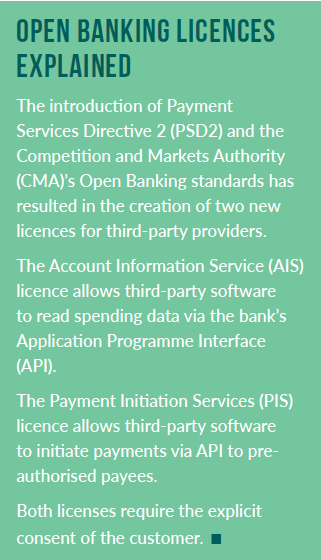

By GlobalDataAt Bud we have been granted both of the new licences (AIS and PIS) on top of our previous regulatory permissions, allowing us to introduce and arrange a financial marketplace. In essence this gives us the end-to-end permissions to realise the concept of ‘marketplace banking’.

Permission aside, though, the actual delivery of the concept will doubtless involve a deep collaboration with banks and financial service providers. In fact, the more we explore the possibilities that these licences open up for us, the more it becomes clear how vital collaboration with banks is going to be when it comes to delivering the new experiences that Open Banking allows.

This is easy to say in principle, but there are concrete examples. One of the most commonly quoted use cases for Open Banking technology is the idea that a financial manager app could know when you are paying too much for gas and electricity, and could switch you to a new supplier with very little effort. Even a basic implementation like this looks like it will be impossible without some form of partnership with a bank.

The payment-initiation tools that the Open Banking APIs provide are brilliantly useful, but they are – quite rightly – limited. You cannot, for example, set up a new payee as a third party. The customer would have to log in to their banking app separately, and in doing so dramatically increase the level of friction in the experience. There may, of course, be ways to address this issue, but not in the absence of a set of shared goals with a bank partner.

In fact, in the short term, the new tech is probably more readily used entirely in an internal context by banks. The capacity to do easy transfers internally using a third party with the payments licence has a clear business case, and is easy to implement.

Our work with HSBC and first direct is the first step for any regulated Open Banking company working with a bank to show what these in-phone financial experiences will look like.

Artha, the first direct and Bud collaboration, will show first direct and non-first direct customers how they are spending their money. It will also have third-party services – products that are non-first direct products – within it. Customers will be able to use these services to invest their money or switch their bill providers for better rates.

In the future, as these open banking experiences – and their value – become more mainstream, we envisage your bank being the place where you interact with anything money-related, from bill switching to obtaining a new travel insurance policy.

Bud’s work is entirely geared around moving the industry this way so everyone benefits from Open Banking – providing much-needed assistance for customers when making financial decisions, reach and distribution for financial service providers, and time and attention maintained within the bank’s ecosystem.

I do not doubt that, in the medium term, entirely standalone solutions will find interesting and engaging things to do with Open Banking data, but in the short term, if you are looking for new financial experiences, it is probably a safer bet to look to your bank and the collaborations they are pursuing.