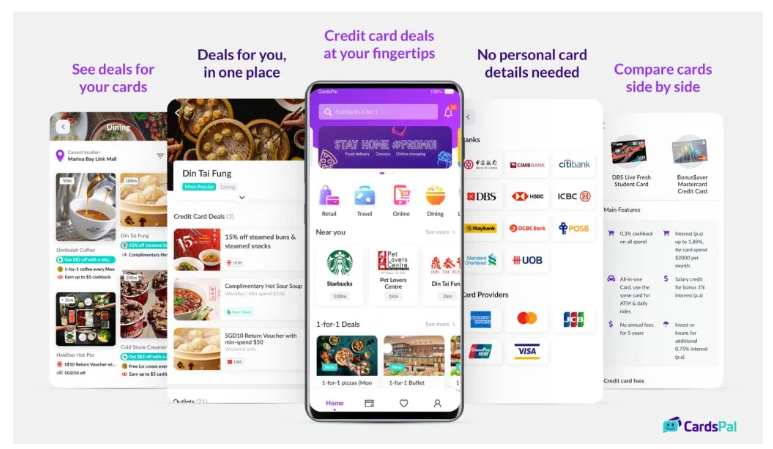

CardsPal is a one-stop credit card deals mobile app that just might take the strain away from credit card deal-hunting and as Douglas Blakey reports, it has the backing of Standard Chartered and a debut partnership with Mastercard

Sometimes the simplest ideas turn out to be banking winners and the launch of CardsPal looks like an award-winning product innovation in the making.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

CardsPal is a one-stop credit card deals mobile app that is a 100% Standard Chartered-owned venture incubated by SC Ventures, the Bank’s innovation, fintech investment and ventures arm.

The platform aggregates credit card deals from all banks and card issuers in Singapore, while allowing users to personalise the deals according to the credit cards they own.

Being backed by Standard Chartered is a good start and now CardsPal has teamed up with Mastercard to bring to users real-time, personalised credit card deals from all Singapore-issued Mastercard credit cards. This includes:

- Featuring the latest Mastercard deals for all Mastercard credit cards in Singapore, updated through API integration; and

- Collaborating on marketing campaigns to bring exclusive Mastercard deals and promotions to CardsPal’s users.

The partnership has future ambitious plans to further enhance the user journey on CardsPal. By leveraging Mastercard’s wealth of data and insights about merchants, global deals and exclusive experiences, CardsPal aims to deliver a seamless user journey and grow into an everyday app for every spending decision.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAlex Manson, Global Head of SC Ventures at Standard Chartered, said, “CardsPal is on the cusp of creating an entirely new experience for benefit optimisation.

“The app addresses the information gap between consumers and merchants, allowing its users complete and easy access to the best deals available, wherever they go.

“I’m already excited by the experience designed by the CardsPal team and the partnership with Mastercard will bring it to greater heights.”

Deborah Heng, Country Manager, Singapore, Mastercard, adds: “Over the years, Mastercard has built a strong reputation with Mastercard cardholders as a network that delivers rewarding experiences.

Its seamless payment integration gateway has paved the way for meaningful partnerships in an easy and cost-effective manner. Through the new partnership with CardsPal, Mastercard is excited to connect consumers with the best Mastercard deals all in one digital platform, while also supporting its merchant and business partners by bringing their exciting offers closer to cardholders.”

Nexus debuts in Indonesia

Standard Chartered has been actively experimenting with new business models to meet the evolving needs of its clients. For example, in March StanChart announced nexus, its ‘Banking as a Service solution with Assembly Payments.

This will develop and deliver next generation payment solutions.

Moreover, through nexus, digital platforms and ecosystems like e-commerce, social media or ride hailing companies, will be able to offer loans, credit cards and savings accounts co-created with the bank to their customers under their own brand name.

Bill Winters, Group Chief Executive of Standard Chartered said: “nexus is potentially transformational for the bank and our customers. We will actively partner with leading consumer platforms in our markets to enable convenient access to financial services to millions of new, tech-savvy customers.

“We are starting with Indonesia, as part of our strategy to grow digitally and expand our business in this important, fast growing market.”

Mox pilot live in Hong Kong

But it is to Hong Kong that Standard Chartered watchers are eagerly tracking the progress of Mox, its standalone digital retail bank.

The Mox external pilot went live in April ahead of a scheduled launch to the broader public in the second half of 2020. Mox runs on a tech platform from Thought Machine and will offer digital onboarding and numberless bank cards.

In addition, StanChart has built a digital open platform dubbed Solv. This aims to help small and medium enterprises in India and other markets to grow by providing access to financial and business services.

Solv uses an open API platform and will use blockchain and machine learning as it builds up its data models. The aim is to mature into an AI-driven platform harnessing the power of Big Data.