UK design agency I-AM has overhauled the customer experience at the 65-branch network of OAB, writes Douglas Blakey. The result is a reduction in waiting times, and a boost in customer use of digital services

Oman Arab Bank (OAB) has remodelled its branch network across the sultanate. The resulting transformation combines what it terms “expression of local landscapes and culture” as well as increased customer engagement due to a more personal and interactive branch experience.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

OAB worked with international branding and interior design agency I-AM on two concept sites – a ‘street’ format and a ‘mall’ – serving the bank’s retail customers, as well as incorporating a premium Priority Banking Lounge to attract and serve Elite customers in an exclusive area.

The move has led to average customer wait times being slashed from eight minutes to three minutes 40 seconds, and a 38% hike in the use of self-service facilities.

The project was co-ordinated by I-AM’s regional base in Dubai, I-AM Middle East, and focused on customer journey competitor benchmarking, retail experience inspiration, and collaborative storyboarding of the “key principles for the new target customer experience”.

Oman’s cityscape

The revamped design is inspired by Oman’s land and cityscape, with the layered concept surrounding the distinctive cubic shapes of the traditional Omani built environment.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis is revealed in the central seating, planting and low dividers within slices of transparent blue – the ever-changing skyline – and set against a backdrop of the mountains in the form of mural-scale photography.

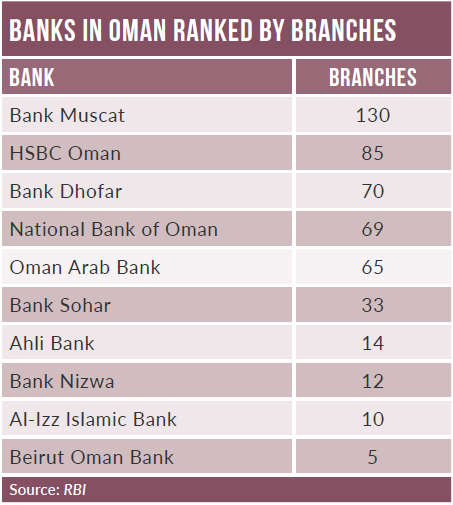

Nicholas Griffin, Dubai-based global strategy director for I-AM, tells RBI: “It was essential to ensure – as a bank for the Omani people in a market with new international entrants such as HSBC – that customers perceived and inhabited the connection between OAB and its territory.

“A key focus was to create a better welcome for customers at the transition point between exterior and interior, as well as to facilitate easier introduction by the branch hosts of customers to automated transaction facilities – key to transforming the cost model of the branch network into the future.

“The welcome point houses a touch-screen check-in to an intelligent customer flow management system, allowing queues to become invisible. Now customers can wait in a comfortable central landscape of seating while browsing product and service information, or simply taking advantage of the Wi-Fi provided.”

Amin Al-Hussein, CEO of OAB, adds: “I-AM went the extra mile to arrive at a thorough and deep understanding of our current and future clients’ dynamics. We could not have chosen a better partner to set the stage for the future of OAB’s retail bank.”

I-AM, headquartered in Shoreditch and with overseas offices in Istanbul and Mumbai, as well as Dubai, has a portfolio of clients in many sectors, including food and drink, fashion, retail estate, telecom and tech, showrooms, education, transport and destinations – as well as banking.

OAB was one of the first banks to be established in Oman, and operates a nationwide network of 65 branches and representative offices and 148 ATMs spread across the sultanate. It provides a full range of financial products and services for personal banking, corporate and investment clients.