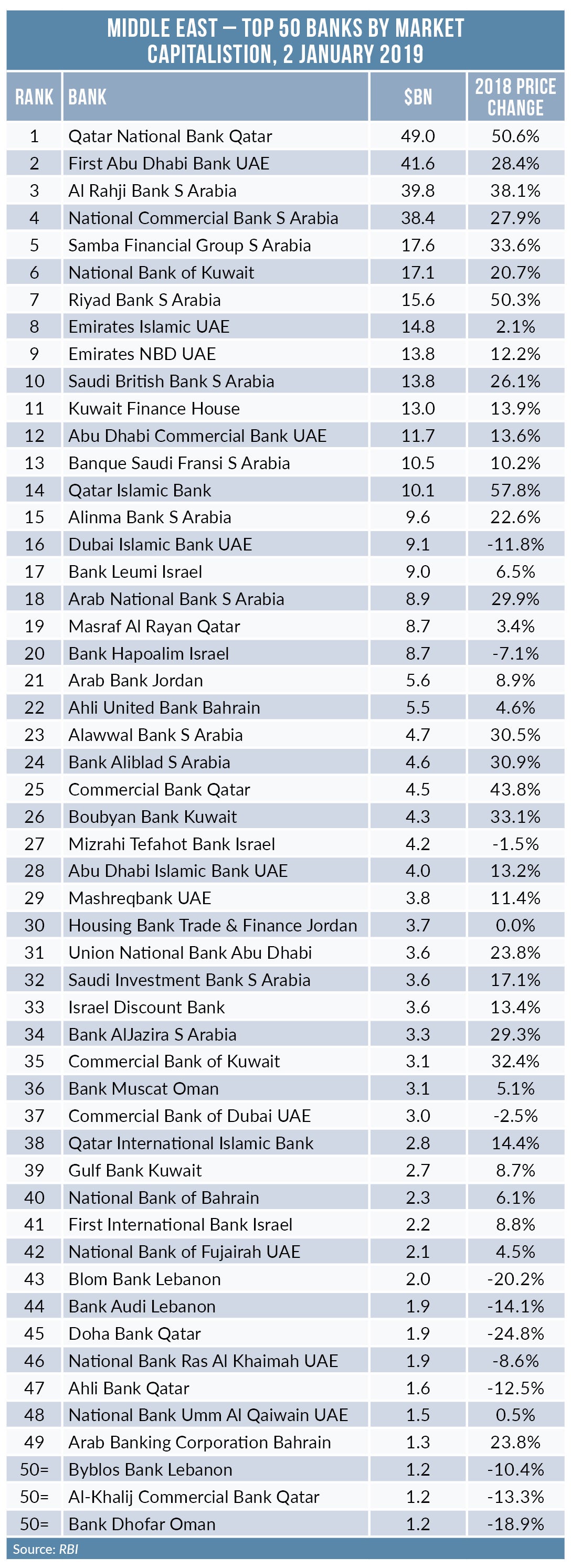

2018 was an excellent year for the share price performances of Middle East banks. As Douglas Blakey reports, more than one half of the region’s largest banks by market cap posted double-digit price rises

Ending 2018 as the largest Middle East bank by market capitalisation is Qatar National Bank (QNB). QNB’s share price soared by just over 50% during 2018 for a market cap of $49.0bn. Qatar Islamic Bank’s share price is up by 57% while Commercial Bank of Qatar (+40%) also enjoyed a strong 2018.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

And each of the above Qatari banks outperformed the Qatari stock exchange, which soared by 20% in US dollar-denominated terms in 2018.

Qatari strength

In all, eight banks from Qatar feature in the list (see table). The performance of Qatar’s banks is all the more impressive after four countries cut trade ties with the country: the UAE, Saudi Arabia, Bahrain and Egypt cut diplomatic ties with Qatar in June 2017, alleging Qatari support for Islamist groups.

But Qatar’s banks boast strong levels of liquidity, high asset quality and strong capitalisation. The largest eight Qatari banks posted combined net profits of QAR12bn ($3.3bn) in the first half of 18, up more than 10% year on year. Liquidity injections from the Qatar Central Bank are helping to offset the effects of the trade blockade.

There is also evidence of non-resident deposits returning to Qatari banks, highlighting foreign depositors’ confidence. Analysts do not expect the Qatari banks to require any additional central bank support. Capital levels at Qatari banks of around 17% remain well above Basel III guidelines, and non-performing loans remain at around 1.7% of capital – and well within the bank’s risk appetite.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe largest eight Qatari banks posted combined net profits of QAR12bn in the first half of 18, up more than 10% year on year. Returns on equity are about 14% across the sector. Analysts forecast deposit growth of around 6% in 2018, rising to 7.5% in 2019. Loan growth of 5% in 2018 is forecast to rise to 7% in 2019.

UAE gains

Eleven of the largest 50 Middle East banks by market cap are based in the UAE.

The UAE ADX General Index rose by more than 11% in 2018, and a number of UAE banks share prices performed even more strongly – notably, the country’s largest bank, First Abu Dhabi Bank: its share price rose by 28.4% in 2018.

Emirates NBD (+12.2%) and Abu Dhabi Commercial Bank (+13.6%) also outperformed the market. 2018 represents a most significant year in the history of Emirates NBD. In May, it agreed to acquire Turkey’s fifth-largest bank, Denizbank, from Russian state lender Sberbank for $3.2bn.

Emirates NBD’s reputation for digital innovation is also being boosted by a number of successful initiatives.

In December, Emirates NBD became the first bank in the region to support Fitbit Pay and Garmin Pay. That news followed the November announcement that Emirates NBD debit and credit card customers can use Google Pay.

Liv goes from strength to strength

In addition, Emirates NBD is the first bank in the region to integrate its core systems with WhatsApp, enabling the bank to launch customised banking services via the messaging app in the UAE.

Liv, the Emirates NBD digital sub-brand, also goes from strength to strength. It was established as a lifestyle-led proposition featuring intuitive tools to help customers keep track of finances on one app. Liv now has over 100,000 customers.

Another 2018 highlight for Emirates NBD is the roll out of EasyHub. In partnership with Diebold Nixdorf, EasyHub is the region’s first integrated digital mini-branch. It enables customers to sign up for new products, and also offers a variety of teller services open beyond normal banking hours.

Elsewhere in the UAE, local banks’ 2018 performance was mixed. Loss-making Invest Bank, in particular, is being hit by exposure to the UAE’s challenged real estate and construction sectors. The 15-branch strong Invest Bank’s loan book comprises loans to these sectors of around 40%.

At the end of 2018, the Sharjah government announced that it was to take a majority stake in struggling Invest Bank, in an effective bailout. Invest Bank has been linked to a potential merger with local lender Bank of Sharjah.

Mergers accelerate

Looking ahead to 2019, bank merger talk will remain front-page news in the region.

The UAE is grossly overbanked, with 22 local banks serving a population of less than 10 million. That is changing, however, with one mega-merger expected to close in the first half of 2019.

This involves a three-way merger of Abu Dhabi Commercial Bank, Union National Bank and Al Hilal Bank.

If successfully concluded, the new bank will have combined assets of about $115bn. It will be the fifth-largest bank in the region, after QNB, FAB, Emirates NBD and National Commercial Bank.

Saudi Arabia soars

Of the 50 largest 50 Middle East banks by market cap, 12 are based in Saudi Arabia. In 2018, 11 of the 12 Saudi banks posted double digit-rises in their share prices.

Merger activity is also in evidence in Saudi Arabia. In particular, Saudi British Bank agreed a $5bn deal to snap up Alawwal Bank in May 2018. Once that deal closes, the new bank will have assets of more than $70bn.

An even bigger deal may result from a possible merger involving National Commercial and Riyad Bank. If that deal comes off, the combined entity would have assets of around $180bn. Elsewhere in the region, Barwa Bank and International Bank of Qatar reached an agreement to merge in August.

And in Oman, National Bank of Oman is considering a merger with Bank Dhofar. Looking ahead, the World Bank is upbeat about the region’s growth prospects. Growth in the GCC countries is estimated to have improved to 2.0% in 2018. Increased oil production and prices have eased fiscal consolidation pressures, enabling higher public spending and supporting higher current account balances.

In 2019, the World Bank forecasts GCC growth of 2.6%, with higher investment and regulatory reforms anticipated to support stronger growth.