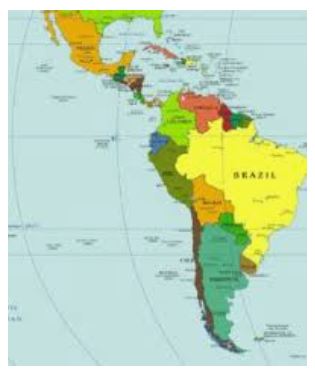

Addressing Financial Exclusion: Initiatives in Latin America

The pandemic has brought about a reduction of 40 million in the unbanked populations of Brazil, Colombia and Argentina. Mohamed Dabo reports on a study by Americas Market Intelligence, commissioned by Mastercard

The World Bank has declared that an average of only 55% of Latin American adults have an account at a financial institution, meaning 207 million as of January 2020.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The impact of the coronavoucher programme has been immense. As of 5 August, 66 million people have received the subsidy – an estimated 36 million of them were previously unbanked.

That means more than 17% of Latin America’s unbanked population has been brought into the financial system in mere months.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBut cash is sticky.

The ‘coronavoucher’ pushes Brazilian poverty to record lows

Following this, subsequent coronavoucher installments were therefore deposited exclusively to free CEF digital accounts, where the funds couldn’t be transferred or withdrawn in cash for around 30 days.

And this strategy worked. As of 11 May, less than 5% of coronavoucher funds had been used to make digital transactions within the Caixa Tem app. By August 3, that figure had jumped to 63%.

The programme’s impact on regional poverty was nearly equally profound. The Instituto Brasileiro de Economia da Fundação Getulio Vargas states that the extreme poverty level7 is at its lowest in 40 years, down to 3.3% of the population in June compared to 4.2% in May.

Other Brazilian and Latin American programmes have had nearly as great an effect by employing fintechs and neobanks.

The state-level programme in Brazil, Merenda em Casa – a programme paying out food subsidies to families with kids in public schools – leverages partnerships with fintechs PicPay and PagBank to distribute funds.

The government subsequently restricted payment to bank accounts only, but the incentive of ARS10,000 ($140) was still powerful enough to move 3 million previously unbanked to open an account.

Both national programmes automatically assigned unbanked benefit recipients to the institution where they would receive their benefit. This simplified the process for millions of Latin Americans, providing a straight, clear path to accessing their much-needed funds – and a strong start toward eventual financial integration.

In total, Covid-19 related social benefits programmes helped financially integrate more than 40 million people in Brazil, Colombia and Argentina alone.

Brazil reduced its unbanked population by an astounding 73%, while Colombia and Argentina also made admirable reductions of 8% and 18% respectively.

While markets like Chile, Peru and Uruguay were not included in the study, if their programmes had a similar effect, the unbanked population in all of Latin America will have been reduced by 25% due to the impact of Covid-19 social benefit programmes alone.