Social media stars, influencers and bloggers have become the norm in society, with many of them reaching millions of followers every day. This creates a great opportunity for banks to engage with customers and increase onboarding rates. Evie Rusman writes

More and more, banks and fintechs are beginning to tap influencers to not only promote their products but engage with their customers also.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

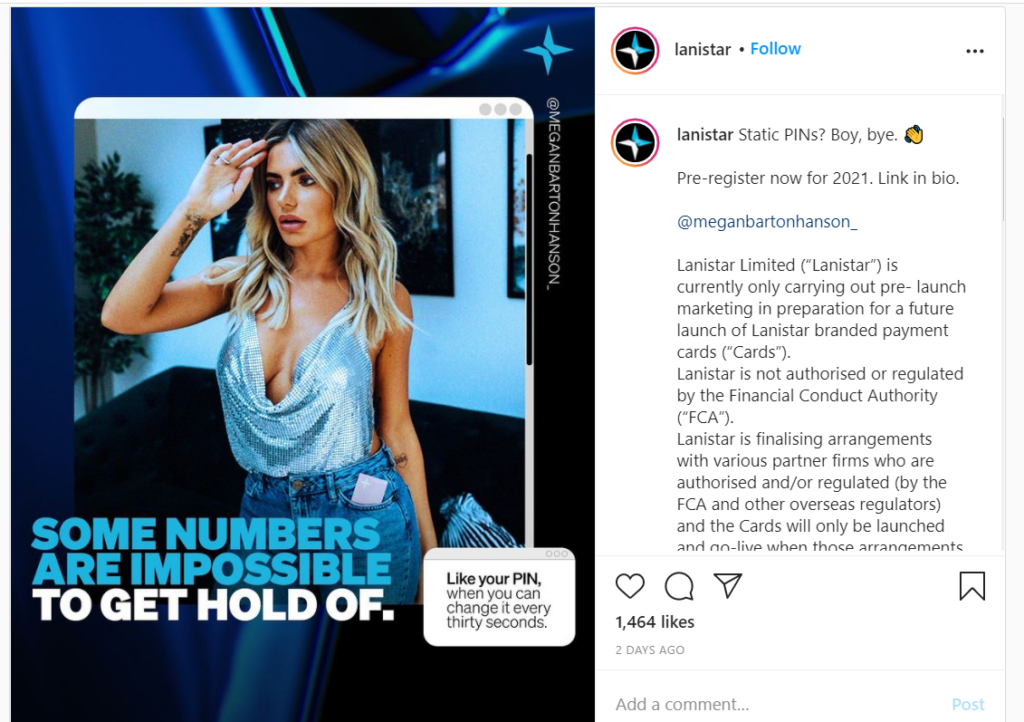

The latest fintech to undergo this kind of brand promotion is debit-card startup Lanistar, who so far has paid over 3,000 influencers including Premier League footballers and Love Island stars to promote its debit card.

FCA involvement

Lanistar claims that the card is “one of the world’s most secure” and as a result has attracted unwanted attention from Britain’s financial regulator the FCA. The FCA has accused the fintech of peddling its products without authorisation.

The accusation stems from a series of Instagram posts in late November from a range of influencers with the caption: “The most secure card in the world has arrived. Pre-register before anyone else @lanistar”.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFollowing the campaign, the FCA issued a warning saying Lanistar’s polymorphic bank card was not authorised by the regulator.

Lanistar hit back at the FCA saying it had asked the FCA to take down the warning notice and that it would be “partnering with firms that are authorised by the FCA to provide financial services or products” when its new card actually launched in January 2021.

Lanistar’s debit card

The fintech launched last year and currently users can only download the Lanistar app and register their interest. In January 2021, the company hopes to launch its polymorphic debit card, which will be available for free as well as offering £3.99 and £14.99 a month options.

Customers will be able to generate one-time PINS (OTPs) and security codes for purchases or ATM withdrawals – the reason the company claims it is so secure.

Speaking on the product, Lanistar founder, Gurhan Kiziloz, says: “I’m thrilled to be releasing Lanistar to the world to change the fintech landscape and give consumers a secure and superior customer experience.

“This is the first step in our goal to reach a £1billion valuation and break records in our space, and we look forward to growing our user base ahead of our card launch in early 2021.”