Virtual technology has helped facilitate the lifestyle of modern society; today,

almost everything can be done through a mobile device. Briony Richter speaks

to Helen Kan, executive director & alternate chief executive officer group head of personal and business banking group at China Citic Bank, about inMotion, Hong Kong’s first virtual banking app

Convenience is touted as the major advantage of virtual banking, but it is not the only one. There are many reasons to bank online, from 24/7 service and a speedy process.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

In March 2018, China Citic Bank launched inMotion, opening up a completely new channel for its customers.

Speaking to EPI about the breakthrough, Helen Kan states: “In March 2018 we became the first bank in Hong Kong to offer a completely new way of opening a bank account without having to visit a branch. Opening the account is completely virtual, and we were the first and the only bank up until now in Hong Kong to do so.

“Anyone can download through the Apple App Store or Google Play store. It is available 24/7 for anyone who holds a Hong Kong identity card.”

She continues: “We want to position this app to be our virtual banking app, because as a commercial bank we want to offer our customers a service that is completely digital.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

As long as the person has a valid Hong Kong ID, they can enjoy all the functionalities of the app. The onboarding process is one of ease and speed. Once a customer has launched the app, it will ask for a mobile number.

inMotion uses a one-time password. Once that is completed, the app will ask the customer to scan their Hong Kong ID card.

The app has expanded its functionality beyond day-to-day banking to cover investment account opening. It also allows customers to make fixed deposits, and handles foreign exchange, mutual funds and stock trading, revealing the extent to which inMotion is making headway in the virtual banking space.

On its site, it boasts some of its latest offers, which include cash prizes up to HK$100 and 0.125% brokerage commission on trading securities.

Regulation and Security

Becoming the first bank in the region to achieve the launch was a milestone. The bank worked hard with the regulator to ensure security and open the door to enable a new way of banking.

The app harnesses OCR and facial recognition technology and e-KYC processes, and can complete the account-opening process in just 15 minutes. Facial recognition is carried out via a ‘selfie’, from which the app can confidently ensure that the user is the same person as pictured on their Hong Kong ID card.

Speaking about the onboarding process, Kan states: “We promise account opening in 15 minutes, and after putting in key information we achieve that. We use OCR technology to scan the Hong Kong ID card and conduct numerous tests to look for fraudulent or invalid ID cards.

“The other technology is the selfie. These are the two fintech technologies that enable us to securely authenticate, but we also had a breakthrough in terms of the regulatory requirements.”

Opening a bank account in Hong Kong used to be a much more rigorous process. Kan explains: “In the past, when opening a brand new bank account in Hong Kong, the customer needed to submit proof of address. So the way that traditional banks do it is to ask the customer to show a utility bill or another bank’s statement.

“In a virtual world, this is not feasible; the bank cannot guarantee the nature of a photo copy. We went through long discussions with the Hong Kong Monetary Authority (HKMA) to discuss and lobby its support. In turn, it had to go to the legislative council to relax the CML ordinance to allow banks to open a brand new banking account without needing proof of address.

“What we are really proud of is our ability to work with the regulator, with its support to have this breakthrough in terms of the constraint of opening a bank account,” she notes.

China Citic Bank was the first to propose the solution and gain approval, and Kan adds that she expects other banks to join the revolution. The regulation is now more relaxed, enabling other banks to adopt the same approach and expand their services. This is why the inMotion app added the capability to open an investment account, to enhance its competitive advantage.

The competition did not take long to attempt the new approval process. In August this year, HKMA announced that it had received 29 applications for the first batch of virtual bank licences. The applicants ranged from telecommunications operators and financial technology companies to global banks.

inMotion successfully met the criteria to open a virtual banking app; the other applicants will need to pay close attention to how it handles operational risk. Successful applicants will need to effectively demonstrate to HKMA an understanding of the risk exposure in the running of a virtual bank, and more importantly, how they plan to manage those risks.

Combining channels

Even in an increasingly digital arena, having a branch network can play a critical role in building a strong connection with customers.

Physical branches also provide comfort for those customers who are not willing to go fully digital, as they inspire trust in banks’ ability to safeguard both their money and data.

Speaking about balancing the digital and physical channels, Kan highlights: “In Hong Kong we have 32 retail branches. I think it’s a journey, and customer behaviour should drive the pace of the mix between virtual and branch channels. The customer experience on the inMotion app is critically important.

“On the other hand, there are still customers that come into our branches because we are very convenient and everything is nearby. Competition is high, but consumers are very used to visiting branches. I think it’s a generation trend. The age profile of inMotion customers is much younger than the customers we acquire through our branches.”

Kan adds that around 15-20% of all new customers have been acquired though the inMotion app, and that 100 accounts are opened every month. Even in the short time that inMotion has been live, it is clear there is scope for virtual banking on a daily basis.

HKMA has introduced a number of initiatives in a move to modernise Hong Kong’s banking and payments system. The country’s instant payment system, the Faster Payment System, is now live. It is open to all banks and payment service providers in the country; around 20 banks and eight payment service providers are already on board with the system.

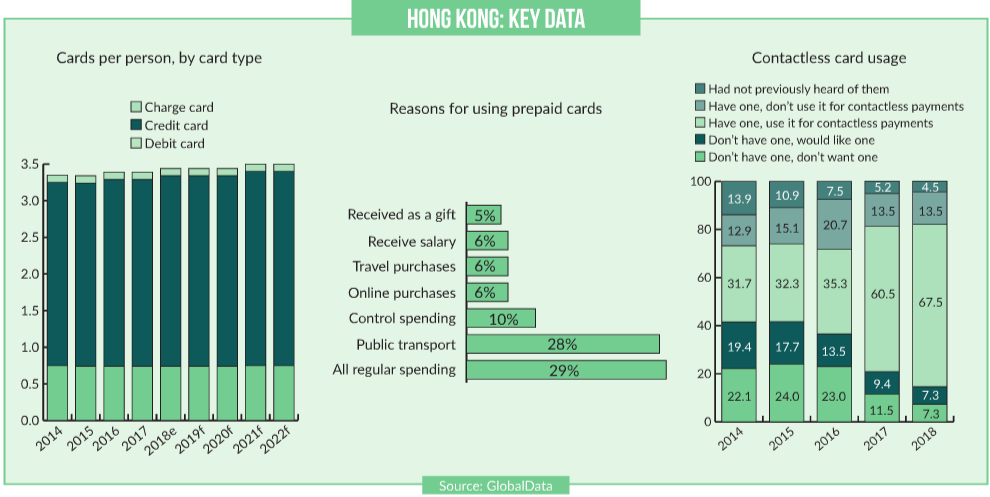

The breakthrough with inMotion marks the start of a long journey towards more digitally accepted payment methods in Hong Kong. According to GlobalData, debit cards account for only 32.9% of the total card payment value in 2018, largely as a result of consumer preference for pay-later cards.

However, debit card use is gradually rising – frequency of debit card payments rose at a marginal CAGR of 2.9%, from 20.6 per year in 2014 to 23.1 in 2018. Debit cards are mostly used for payments rather than cash withdrawals, highlighting a gradual shift from cash to card-based payments. Overall, debit card payments account for 68.6% of the total debit card transaction value in 2018.

Looking to the future, Kan concludes: “Our strategy going forward is to expand our local market share through fintech investments. We want to be able to increase our customer base and tap into the cross-border Chinese customer because we have the advantage and the collaboration with our mother bank, China Citic Bank.”