Corporate governance has come to the fore as directors and executives recognise that they are responsible not just to shareholders, as in the past, but to a wide range of stakeholders, reports Douglas Blakey

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

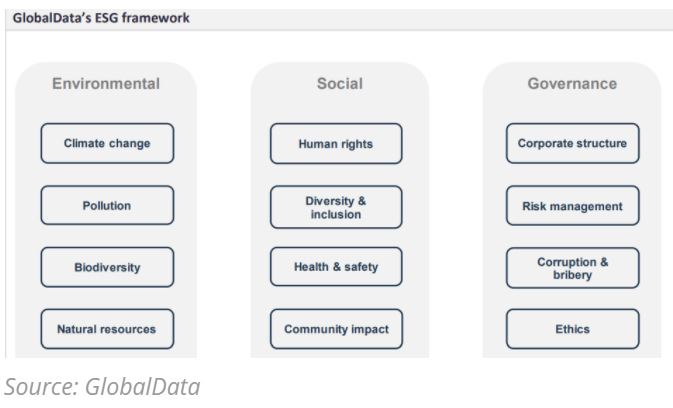

Governance is central to GlobalData’s ESG framework. GlobalData has developed a framework to help companies understand and address their responsibilities across the three main areas – environmental, social and governance (ESG) – once termed simply as sustainability.

Organising the topic in these three areas makes it much easier for companies to assess where they stand. GlobalData’s framework goes deeper and defines four key areas within each of the three main topics.

Within corporate governance, these are corporate structure, risk management, corruption and bribery, and ethics. Then, within each area, the framework identifies several contributing factors and mitigating actions to help companies identify where progress is needed and create action plans.

A holistic approach

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe chart below summarises GlobalData’s ESG framework. Companies can use it to assess their sustainability policies, performance, and progress. It will help them identify and mitigate factors that contribute to negative consequences and pursue actions to improve ESG performance.

It provides a checklist for CEOs to ensure hat their management policies and practices address all aspects of sustainability.

Environmental factors

Social factors

Social performance assesses a company’s engagement with its workers, customers, suppliers, and the local community. It covers human rights, diversity and inclusion, health and safety, and community impact.

Inattention to these factors can damage corporate brands and reputations and bring legal and regulatory penalties.

Governance factors

Governance assesses how a company uses policies and controls to inform business decisions, comply with the law, and meet obligations to stakeholders.

Governance failures – for example, aggressive tax avoidance, corruption, excessive executive pay, or relentless lobbying – cause reputational harm and loss of trust.

Even the Business Roundtable, the association of US CEOs founded in 1972 that long espoused Friedman’s view, has come around. In 2019, the organisation published a new Statement on the Purpose of a Corporation, signed by 181 CEOs who committed to “lead their companies for the benefit of all stakeholders – customers, employees, suppliers, communities and shareholders”. The statement acknowledged the importance of a healthy environment.

- Develop and adopt vision, mission, and values statements that define your corporation and establish accountability at all levels;

- Define ESG success for the company and recognise that it is entwined with financial success. Commit to integrated assessment and disclosure of ESG and financial performance;

- Establish a team to drive ESG performance, headed by a C-level executive;

- Incentivise ESG performance by tying it to a portion of executive compensation;

- Appoint more independent board members to widen the board’s vision and sense of responsibility;

- Increase board-level diversity to drive greater diversity throughout the organisation;

- Embrace transparency, understanding that secrecy tends to grow like mould and cause internal rot. Take the long view, recognising that stakeholder scrutiny will only increase.

BlackRock, which has more than $8.6trn under management, has significant power over its portfolio companies in how it manages its holdings and through support for activist board members to drive change within these companies.

Fink is arguably the most important man in private finance; his words signal changing winds in the investor world toward sustainability.