Record full-year earnings for fiscal 2017, impressive market share gains, and a growing worldwide reputation for best-in-class customer service and digital banking combine to make for a very happy 50th birthday for DBS. The prospects for its golden jubilee year are equally positive, reports Douglas Blakey

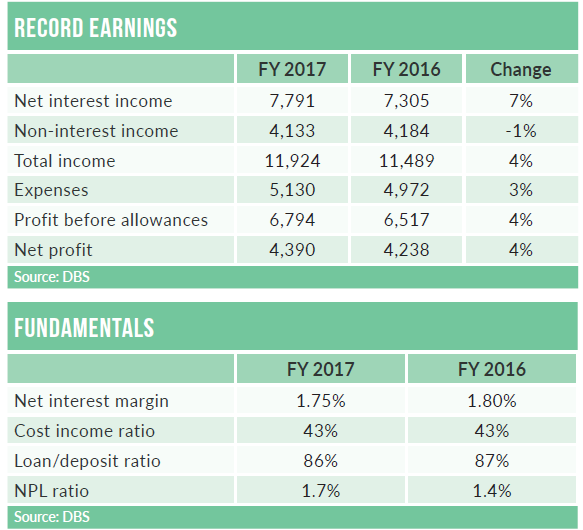

DBS is set for a very happy 50th – and with good reason. Its full-year earnings for fiscal 2017 rose by 4% to a record S$4.39bn ($3.34bn), boosted by a 4% rise in income to a record high of S$11.9bn.

Underlying loans rose by 9%; including loans from the consolidation of the ANZ acquisitions, the rise was 11%. Total deposits also rose by 11% for fiscal 2017, including ANZ consolidation, and by 8% on an underlying basis.

Fee income grew by 12% year on year, while productivity gains from digitisation and cost management initiatives contained expense growth to only 3%.

Market share gains included a 2.1-percentage-point rise in Singapore mortgage loans to 30.8%; around 120 basis points came from ANZ and almost one percentage point came from DBS’s organic business. As for deposits, DBS continued to have more than a 50% market share of Singapore-dollar savings deposits.

Cards growth was also strong, with DBS’s Singapore credit card receivables market share up from 20% to 25%; while around 3-3.5 percentage points came from ANZ, around 1.5 points of the rise arose from organic growth.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataANZ acquisition on schedule

DBS kicked off the migration of the wealth management and retail banking businesses acquired from ANZ in Singapore, Hong Kong, Mainland China, Taiwan and Indonesia in July 2017.

The aim was to complete the acquisition in all markets by early 2018, and the new year started well, with the completion of the migration of ANZ’s Indonesian lending book onto the DBS platform to wrap up what is a major banking M&A.

The ANZ deal was first announced back in October 2016 when DBS agreed to acquire the ANZ retail and wealth business units in the five markets – loans of around S$11bn and deposits of S$17bn – for around S$110m above book value.

Digital success

DBS’s digital highlights in 2017 included the launch of the world’s largest banking API platform to create ecosystem partnerships and offer differentiated customer experiences.

DBS was the first bank to develop methodology to measure digital value creation, driving traditional to digital conversion; by the end of 2017 two-thirds of its applications were cloud-ready, and that number will rise to 90% by the end of 2018.

In a call with analysts, DBS’s CEO Piyush Gupta said: “The digital part of the business is giving me a 27% ROE, compared to 19% for non-digital. Last year, we shifted 250,000 customers into digital; our goal is to try and shift another 250,000 this year.”

DBS’s digital success is no accident – it has invested more than S$5bn in recent years to develop its IT platform, and from re-engineering its technology infrastructure to transforming its front end, the aim is “to become digital to the core”.

Said Gupta: “In credit cards, wealth and SME, we make it simple and easy for customers to engage with us digitally. Coupled with a focus on agile methodology and journey thinking, we have been able to improve speed to market and the customer experience.

“This translates to more digitally engaged customers, as well as higher returns per customer. In particular, consumer banking and SME customers who engage with us digitally account for two times more revenue, on average, than other customers.”

DBS now has more than 3 million online and almost 2.5 million mobile banking customers, while in the SME sector, more than 60% of customers start their relationship with DBS digitally.

Looking ahead, DBS is continuing to invest heavily, especially as regards data optimisation. Gupta said: “We’re making a big effort this year on data. We’ve done a lot of work on digital but data is one area where I think we need to do even more. We’re making a massive effort to re-architect all our data. We’re almost complete with a project on big data – we have huge new data architectures.”

For fiscal 2018, DBS forecasts lending growth of around 7-8%, with low double-digit growth in income with its cost-income ratio remaining at around 43%.

New year, new look

In celebration of its 50th anniversary, DBS has a new look. Unveiled on 5 March, DBS employees are sporting new uniforms by celebrated Singaporean designer Phuay Li Ying of Ying the Label. The uniforms feature distinctive print patterns taken from an abstract watercolour art piece with red and black brushstrokes.

DBS’s 24,000 employees across its 18 markets are also receiving gold-plated cufflinks and necklaces, dubbed the DBS Sparks collection, as part of the birthday celebrations, modelled after the spark found at the heart of the DBS logo.

In a statement, DBS’s head of strategic marketing and communications, Karen Ngui, said that DBS’s staff embodies the DBS Spark, representing the “spirit of imagination, the sense of possibility and the courage to make things happen.”

A Digital Trailblazer

DBS enjoyed a successful evening at the ninth annual RBI Asia Trailblazers awards in Singapore on 1 March (see page 5), collecting eight awards, including the senior categories of Trailblazer of the Year, both for the individual and institutional awards.

While Neal Cross would the first to acknowledge that the bank’s digital success is very much a team effort, his role as MD and chief innovation officer at DBS cannot be underestimated. RBI editor Douglas Blakey sat down with Cross during the Trailblazer summit to discuss some of the reasons why DBS is widely regarded as among the most innovative banks in the world.

Douglas Blakey (DB): I heard you say recently that Singaporeans need a bigger risk appetite; can you expand on that?

Neal Cross (NC): Singaporeans can do better. It is all to do with the risk-taking appetite. Singapore is a lovely place, a safe place, but innovation tends to occur in places where there is some stress.

Life is too good in Singapore. You have to generalise, but if you look at places where there is the greatest innovation, it is places with stress, such as Israel – per capita the most innovative place on the planet. Taiwan and South Korea – there is some stress there, and the same in China and Japan.

We need to understand that Singapore needs greater impetus to be a nation of innovators, but there is increasing interest around transformational change. There are the accelerator programmes, and kids as young as age eight to 10 are being taught about innovation.

DB: Can I take you back to when you assumed your current role? You took a very different route to many major banks; a lot of your development has been in-house as opposed to the outsource route, for example.

NC: We actually do the complete opposite of everyone else. Sometimes if you just do the complete opposite of something it works better than doing it the normal way round.

For example, we never hire tech people. So we are one of the few innovation groups I know with no capital resources. We do not hire any experts. We do not hire bankers. Also, we never invent anything. My goal every year is to invent zero.

It is an easy metric to hit, but how do you overachieve on that?

DB: That is a deliberate strategy – to invent nothing?

NC: Yes, absolutely. Most innovation groups tend to last about two years and they fall into a number of traps. One is that they think that innovation has something to do with technology. For us, it is about cultural transformation. I started with three people and now have more than 30 across four locations across Asia. For us, our job is about making the whole bank the innovation group.

If I can inspire, educate and motivate 24,000 people to do their careers’ best work, that is a lot more powerful than 14 innovation experts playing with tech and delivering a new product or service.

DB: How do you about getting products to market?

NC: A lot of innovation groups work in a silo. The biggest problem in innovation I see is getting products to market. We do not actually have that problem. About 95% to 98% of everything we do goes into production.

That is because we are not going to the business saying ‘we have created this cool thing’, which is just like saying ‘hey business, we are better than you – look what we did better than you.’ That is what can happen, so you can get some pushback.

So we go to the business and ask ‘what are you trying to deliver this year? What is your KPI? What does success look like? How can we make this even better? And how can we help you?’

Over time, as you build relationships and get respect from a particular division, they start to want to be more ambitious. They ask for advice and look at some of the tech trends and ask ‘what do think about the relevance of branches? And what do you think about artificial intelligence?’

Then suddenly we are in partnership with the business and we are trying to help them achieve more than they have ever done before. That is what we find is a better way to operate an innovation group than some of the standard methods that we see in the market.

DB: I recall in a past interview you hammered home the message that banks should not be afraid to fail. How did you get that message across to your DBS colleagues?

NC: To be a chief innovation officer there are a few things you have to realise.

One is that you have no more career prospects. You are done. You are not going to move on to another job in the organisation. Your job is to get fired slowly while effecting change, and once you accept that fact then you can come out with bold statements. You have to build the culture of experimentation. I worked at major tech companies most of my working life.

There are three big differences I see between a tech company and a big corporate such as in finance. One is around collaboration. Banks are very hierarchical. You do what your boss tells you. You only work in your small team. You do not work with other teams or outside entities or startups when I first joined.

The second thing is around risk appetite. Banks are schizophrenic, they are very risk-averse – it is hilarious. In the investment arm, they will happily lose tens of millions of dollars on some bet to make hundreds of millions. At the same time, internally, heavens forbid we try something new or innovative!

Banks can price and monetise risk on the one hand, but on the other, when risk involves some kind of internal change, they are very risk-averse, whereas tech firms are experimental and will try things and occasionally fail.

The third big difference is around partnerships, ecosystems and ownership. The bank owns everything, such as its ATMs branches, products, and tech stack – even if outsourced, whereas a tech firm is more like a platform.

We do not have to own everything. The biggest companies in the world own very little because they have a partnership model.

DB: Why then did you choose to work with DBS?

NC: This is my first and last job at a bank, even though it pays very well. I never wanted to work for a bank; I would not do this again.

I have had offers from many banks, but I said they are too political and have an aggressive outlook. DBS was different, and so the first thing I created was my own culture bubble.

I brought in very different people to come and work with me: people from industrial design, sales people, advertising people, and once we created the bubble we tried to change the bank culture to be more like our culture. If I am going to live in a bank, I am going to bring my culture to work, like you bring your own laptop. Over time, slowly, the culture is changing to be more like a tech company.

Is it a tech culture yet? No, but is it a fully bank culture? Actually no – it is somewhere in between. It takes a long time but I am happy with the progress to date.

DB: Any threats? Anything keep you awake at night?

NC: It does not keep me awake at night but my personal belief is that banks may have lost the consumer payments battle – it is only a matter of time.

The people who will own finance in the future are Alibaba, Tencent, Google, Apple, Amazon, Facebook. We need to rethink our strategies where maybe we do not own the payments.

The tech giants do not want to make money from finance – they make money on the data, but it is not a level playing field. They have the best brains in the world, billions of dollars in the bank. It is hard to compete with business units of the tech giants that can afford to run at a loss.

DB: So, should leading banks look to partner with the tech giants?

NC: I can see a time when you are on Amazon and a drop-down list of a few major banks appears.

Put a 1 in front of your name, so you come top – maybe we should rebrand as 1DBS!