Between 1 July 2017 and 30 June 2018, 965,317 UK customers switched current account, up 6% on the previous 12 months. The welcome uptick follows a decline in switches during 2017, but as Douglas Blakey reports, switch rates remain a work in progress with no room for complacency

The positive statistics first: almost 0.5 million (499,801) current account switches were completed in the first half of 2018, up 7% compared to the same period in 2017.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

And for the 12-month period to end-June 2018, 965,317 switches were completed, up 6% on the previous 12 months.

More than 98.7% of current account switches were completed in the seven-working-day timescale in the second quarter this year; not for the first time, the switching service merits a gold star for the mechanics of the service functioning admirably.

There is, however, no room for complacency, and there will be disappointment on the part of regulators and government that switching rates overall remain low.

Total current account switches in calendar year 2017 amounted to 931,956, down 8% from 1,010,423 in 2016. Over 4.9 million successful switches have taken place since seven-day switching launched in 2013.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThere is, however, a caveat: present switching rates are no better than they were in 2012 before the service launched, when 1.12 million switches took place. With around 47 million adults holding a current account, a one-in-47 switch rate – or little more than a 2% annual rate – is not the figure envisaged when the switching service was established.

Incentives pay off

Proving that golden hellos result in market share gains is highlighted by the experience of the Clydesdale. The £250 ($323) current account switching offer from Clydesdale Bank was the most generous switching offer available in 2017 – and it paid off handsomely.

The £250 Clydesdale Bank offer for current account switchers ran from October 2017 until the end of the year.

Figures released by the Current Account Switching Service for the fourth quarter of 2017 reveal that the offer helped Clydesdale

to gain a net 22,000 switchers in the fourth quarter of 2017.

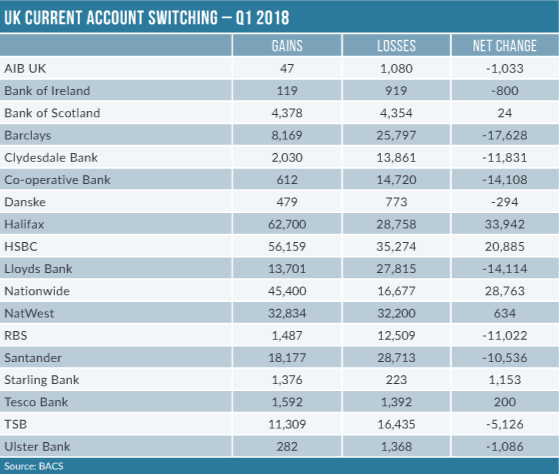

Come 2018, and with no such offer in place, Clydesdale lost almost a net 12,000 switchers in the first quarter. Other account-switching incentives helped HSBC and Halifax to post net gains.

In the fourth quarter of 2017, HSBC offered switchers £150, plus a further £50 if customers remained with the bank for a year.

Halifax’s offer comprised a £125 bonus, plus a £3 reward for each month customers made a credit of at least £750, made two direct debits and remained in credit. Halifax and HSBC both enjoyed net gains in switchers in the fourth quarter of last year and in the first quarter of 2018.

Current account switches: Net losers

In the six-month period to end-March, Barclays was the biggest loser, down a net 33,000 customers.

Other losers included Cooperative Bank and Royal Bank of Scotland, down by 22,000 and 20,000 respectively over the same period.

Santander has suffered a net loss of account switchers since it raised the price of its 123 product. For the six-month period to end- March, Santander was down a net 18,000.

By contrast with sister brand Halifax, Lloyds consistently posts a net loss of switchers, quarter on quarter. Lloyds was down by 13,000 and 14,000 in the past two quarters respectively.

Another perennial loser tends to be RBS’s England and Wales retail subsidiary, NatWest, but that tide may be about to turn: it posted a net gain in the first quarter of 2018.