Credit card complaints rose by 2% in the second half of 2017 while current account complaints fell. Overall, a total of 3.76 million complaints were received in the six months to end-2017, up 13% year on year, as PPI continues to haunt UK banks, reports Douglas Blakey

First off: the positives. Take a bow, Nationwide. Of the major UK banks and building societies, Nationwide attracted the least complaints in the second half of 2017, with only 1.44 complaints per 100,000 accounts for banking and credit cards.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Skipton Building Society and Yorkshire also scored well with only 1.57 and 1.92 complaints per 100,000 accounts respectively.

At the other end of the scale, HSBC is the most complained-about major retail banking brand with 6.88 complaints per 100,000 banking and credit card accounts, just ahead of RBS with 6.69 and Barclays with 6.51.

Of the other major brands, Santander (5.26) and Lloyds (5.23) continue to attract more complaints per 100,000 accounts than challenger brands such as TSB (4.35) and Metro Bank (4.18). Co-operative Bank and Virgin Money, on only 3.09 and 2.68 respectively, performed strongly.

RBS’s private banking brand, Coutts, is among the worst overall performers (10.22); sister RBS brands NatWest and Ulster Bank, on 5.48 and 4.25 respectively, fared better.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData Claims handling

Claims handling

The latest FCA complaints data suggests that banks’ internal complaints-handling processes remain a work in progress.

A whopping seven in ten (70.1%) of banking and card customer complaints against Lloyds were upheld by the FCA. Sister brand Bank of Scotland (60.2%) also scored poorly by this measure. By contrast, less than one-half of all complaints against Bank of Ireland UK (43.0%), Allied Irish Banks UK (43.4%), Santander (43.5%), Tesco (49.0%) and Metro Bank (49.3%) were upheld.

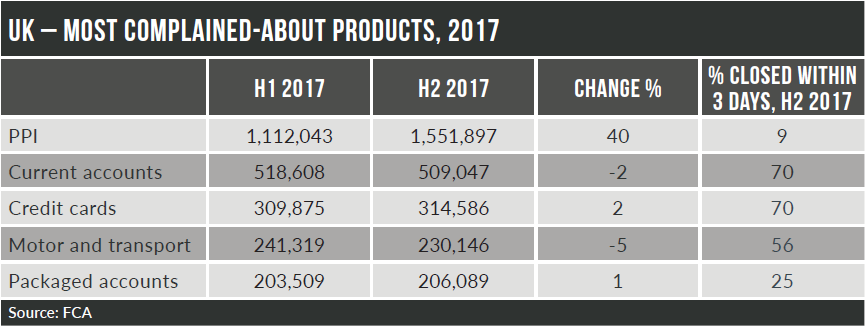

Complaints about PPI rose by 40% to 1.55 million in the second half of 2017, the highest level of complaints about PPI for more than four years. In January, firms paid out £416m ($581m) in PPI compensation, the highest figure since March 2016. The total for compensation payments since January 2011 is now £30bn.

Banks continue to add to their PPI provisions, with Clydesdale Bank setting aside a further £350m for PPI claims in April. Clydesdale said it received 59,000 claims in the six months to the end of March, and expected to receive another 110,000 by the complaints deadline set for August 2019.

Excluding PPI, the number of complaints received by firms was 2.21 million – around 13,000 fewer than the previous six months.

After PPI, the next most complained-about products are current accounts with 509,047 complaints, and credit cards with 314,586 complaints. These products have a higher proportion of complaints closed within three days (see table).

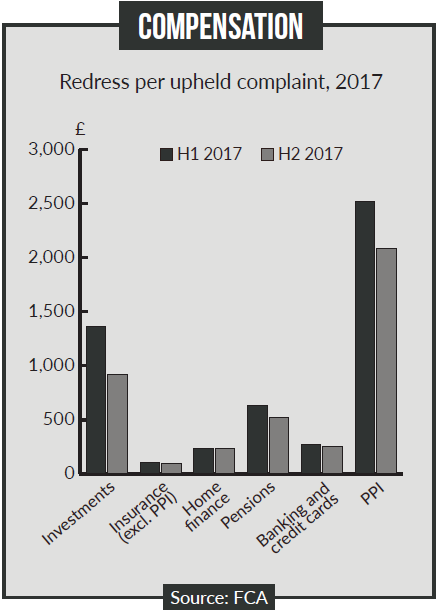

The amount of redress paid out in total during the second half of 2017 was £2.36bn, up 19% year on year. This was driven by an increase in redress payments for PPI complaints, which rose by 26% to £2.05bn. Redress per upheld complaint fell in the second half of 2017 for all product groups (see chart), with the average banking and credit card payment falling from £270 to £253.

Christopher Woolard, executive director of strategy and competition at the FCA, said: “Having set a deadline for PPI complaints, we are encouraging consumers to decide whether they want to claim, and if they do, to make their complaint as soon as possible, as many already have.

“We are continuing to monitor and challenge all firms to ensure they maintain the expected standards and are delivering on their commitments to make it easy for people to complain about PPI,” Woolard added.

“When PPI is taken out of the mix, the numbers of complaints firms are receiving has remained stable. Firms should be doing all they can to reduce complaints and ensure they are treating customers fairly.”