A growing number of North American consumers are favouring Buy Now Pay Later (BNPL) instalment loans from specialist providers over revolving credit card debt. Banks are responding with their own account- and credit card-based instalment loans. Robin Arnfield reports

BNPL is increasingly attractive to younger consumers who lack or don’t want to use credit cards and prefer a fixed number of instalments – typically four low-value payments over six weeks. And in a number of markets, BNPL is growing apace, albeit from a low base

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

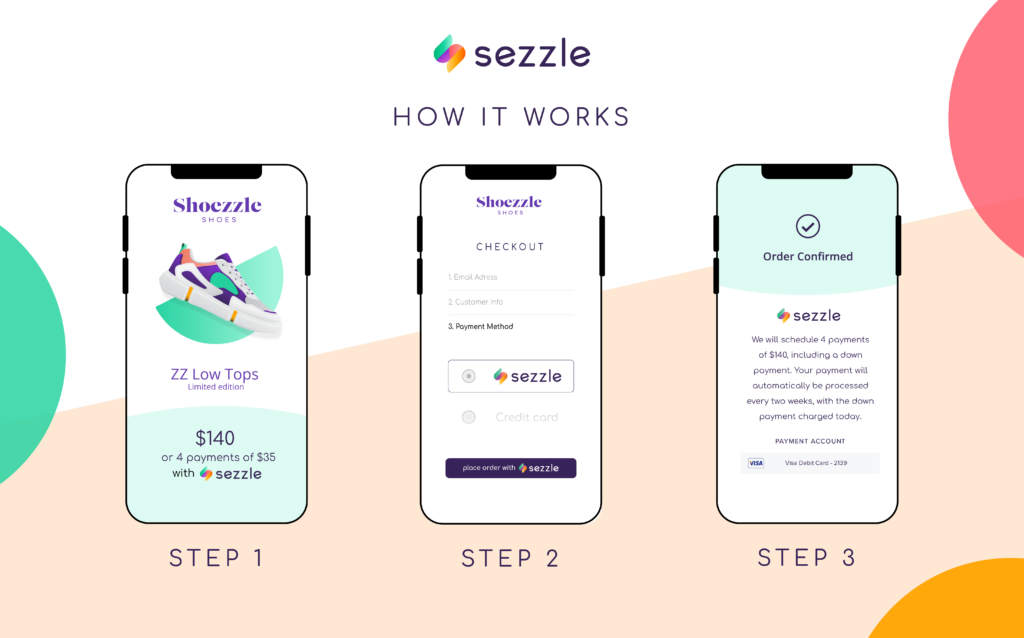

BNPL loans are either free of charges to consumers or there may be a small fixed monthly fee, provided that borrowers don’t incur late fees, For example, QuadPay, which offers loans payable in four instalments, charges users of its app $1 per instalment payment. By contrast, consumers revolving credit card debt, may face uncertainty and a lack of transparency about the long-term cost of their loans.

“Covid-19 accelerated an existing shift from a credit to a debit-led economy,” says Ben Pressley, EVP of sales, operations and strategy at BNPL provider Afterpay. “Gen Z and millennial shoppers show strong preferences to pay with debit cards and spend their own money over time, instead of using expensive credit cards and loans which often lead down a rabbit hole of revolving debt and fees. As this generation matures and their spending power grows, so will the use of BNPL as a primary payment method.”

The standard US BNPL charging model is to offer interest-free loans to shoppers, with merchants paying a percentage of the purchase price, which is higher than credit card acceptance fees.

BNPL: boosting merchants, expanding consumers’ spending power

BNPL providers claim their services enable merchants to increase their sales and average order sizes by expanding customers’ spending power. For example, PayPal’s Pay in 4 offering promises to drive conversion and create revenue and customer loyalty for US merchants accepting the BNPL method. Merchants receive payment upfront for Pay in 4 purchases and pay PayPal 2.9% plus $0.30.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThere is a trend for e-commerce merchants to offer multiple BNPL options at checkout in the same way that they accept different card types. “They want to be able to serve customers who use different BNPL providers,” says Aite Group senior analyst Ginger Schmeltzer.

The major players

The US BNPL market is dominated by US-based Affirm, Australia’s Afterpay, Sweden’s Klarna, QuadPay, which was bought by Australia’s Zip Co. in 2020, and PayPal. Other players include US-based Sezzle, Splitit, Amex and banks such as Barclays US, Chase, Citi, Commerce Bank, and Citizens Bank.

According to US consultancy Cornerstone Advisors in 2020 Klarna had 7.9 million US users, while Afterpay and Affirm had 5.6 million users each.

Canada’s BNPL market is dominated by PayBright, which was acquired by Affirm in January for C$340m, and Afterpay, which said in February 2021 that its Canadian annualised underlying sales run rate was A$90 million. BNPL providers use the term ‘underlying sales’ for transactions processed through their platforms.

According to a February 2021 Citi Research report, Afterpay is used by 31% of Canadian BNPL users and PayBright by 30%. Sezzle, which entered the Canadian market in 2019, has experienced rapid growth, according to Patrick Chan, Sezzle’s Canadian general manager.

BNPL growth in the US

BNPL is still embryonic in the US. In 2020, BNPL represented 1.6% of US e-commerce purchases, according to FIS Worldpay, which predicts BNPL will account for 4.5% of US e-commerce payments in 2024.

Cornerstone Advisors estimates that US consumers spent $24bn on purchases using BNPL in 2020.

However, US BNPL purchases are growing rapidly and moving from e-commerce to the physical world. BNPL platforms issue their users with virtual cards that can be used with Google Pay and Apple Pay for BNPL purchases in online and bricks-and-mortar stores.

In addition, Affirm plans to issue a plastic debit card which will offer pay-over-time functionality as well as the ability to pay upfront in full for purchases in-store and online.

“Consumers who have got used to paying for e-commerce purchases by instalment, want to be able to pay for physical world shopping such as their groceries by instalment.” Schmeltzer adds.

Profitability and investment

Although BNPL providers have yet to become profitable, they have attracted significant investment funds due to their growth prospects.

“BNPL providers are at an early stage and are more focused on top-line growth right now than on driving bottom-line profits,” says Sezzle’s Chan. “Sezzle is reinvesting everything back into the company.”

Sezzle, which is listed on the Australian Stock Exchange (ASX), has announced plans for an IPO in the US. ASX-listed Afterpay said in April 2021 that it is also considering a US IPO.

In January 2021, Affirm listed on Nasdaq, raising $1.2bn, having received $500m in Series G funding in September 2020. In February 2021, ASX-listed Splitit announced a $150m receivables funding facility with Goldman Sachs to support the expansion of its business.

Partnerships

A key trend in the US BNPL market is the development of ecosystems and partnerships. Affirm exclusively provides the Shop Pay instalment loans for e-commerce platform Shopify’s US merchants, while Sezzle provides BNPL loans for Discover’s US merchants.

Affirm agreed in April 2021 to buy US-based Returnly, which enables consumers to return e-commerce purchases and receive instant credit for replacement items when they initiate returns, instead of waiting until returns are fully processed.

In December 2020, Klarna signed a partnership with POS technology vendor Verifone to provide its BNPL service to Verifone devices in the US and Europe. In Canada, small retailers that use Fiserv’s Clover POS platform can offer BNPL plans from PayBright at checkout.

Bank and credit card issuers

BNPL providers challenge credit cards’ long-term domination of e-commerce and interchange revenue.

Consumers’ BNPL accounts tend to be linked to their debit cards, which have lower interchange than credit cards, as the underlying loan repayment method. Around 85-90% of payments to US BNPL providers are through debit cards, Aite Group’s Schmeltzer estimates.

“Credit card issuers want to capture some of the spending that is going to BNPL providers,” she says. “Banks don’t want to be disintermediated by Afterpay and other BNPL providers. They want to keep the relationship with their cardholders and ensure they are the go-to brand for loans.”

Several North American banks offer BNPL loans on their credit cards, including Canada’s CIBC with its Pace It product; Plan It from Amex, whose US cardmembers created 6 million instalment loans and over $5bn in receivables between the service’s launch in August 2017 and May 2021; Chase with My Chase Plan, and Citi with Citi Flex Pay.

Canadian fintech Brim Financial offers instalment loans on its credit cards and provides a payment-as-a-service platform to banks so they can provide white-labelled credit cards with BNPL features.

New York-based Splitit provides a service enabling consumers to obtain instalment loans from participating merchants on their credit and debit cards without applying for a separate line of credit.

Visa, Mastercard develop APIs

In addition, Visa and Mastercard have developed APIs enabling banks to offer BNPL services to their cardholders and merchants by transforming cardholders’ already approved credit lines into installment payment options at checkout.

“Most US banks don’t offer downloadable BNPL APIs for retailers, making it difficult for banks to enter the market,” says Grant Halverson, CEO and managing director of Melbourne-based consultancy McLean Roche.

Visa’s partners include ChargeAfter, Splitit and TSYS, which is rolling out the card network’s Visa Installments technology to US banks such as Commerce Bank.

Mastercard is partnering with TSYS, Jifiti, QuadPay and Splitit to enable US Mastercard users to split purchases into instalments at checkout.

Several banks have partnered with fintechs to provide non-card BNPL services at the point of sale. Royal Bank of Canada launched its PayPlan BNPL product for high-value purchases in Canada in January 2021, using technology from Alliance Data subsidiary Bread. Consumers pay for PayPlan loans from their bank accounts.

In April 2021, Barclays US, which issues co-branded credit cards with companies such as American Airlines, partnered with digital financial technology vendor Amount. Barclays plans to use Amount’s platform to offer POS instalment financing options that carry the merchant’s own brand.

BNPL Regulation in the US

Currently, the US BNPL market is unregulated, but the Consumer Financial Protection Bureau (CFPB) has been examining the industry with a view to introducing responsible and transparent regulations for BNPL lenders.

US BNPL providers don’t conduct hard credit checks with credit bureaux before agreeing loans under $500, making it easier for people with poor credit histories to borrow from them.

“As BNPL lenders only conduct soft credit checks which don’t affect borrowers’ credit ratings and don’t report to credit bureaux, it’s easy for consumers to obtain credit lines from multiple lenders and get into financial difficulty,” says Schmeltzer.

“Up to 20-30% of US customers have missed at least one BNPL payment, so there is a high missed payment rate,” she said. “If you miss a repayment, the BNPL lender will shut off your credit line.”

McLean Roche’s Halverson says that late fees for BNPL loans can amount to an APR of 35-68%. “Globally, the BNPL industry has very high bad debts averaging 30% of revenues,” he estimated.

Schmeltzer predicts that in the next few years, the CFPB will introduce consumer protection regulations for US BNPL providers.

“As BNPL providers don’t currently report to credit bureaux, borrowers can’t use their BNPL repayments to improve their credit history and apply for mortgages or other types of loans,” she said.

The major US BNPL players

Afterpay

In Afterpay’s third quarter ending 31 March 2021, North America contributed A$2.6bn, up 167% year-on-year from A$1bn, to its A$5.2bn in global underlying merchant sales.

As of 31 March 2021, Afterpay had 9.3 million active North American customers compared to 4.4 million a year earlier, and 3.5 million US customers had set up the Afterpay Card to shop in person in physical stores.

In April 2021, 18,700 new North American customers a day joined Afterpay’s service, pushing monthly North American sales to A$1bn.

“Our North American retailers are taking us into new verticals outside fashion and beauty, including kitchen and home, home furnishings, athletic equipment, pets, travel, tickets and big box ‘everyday’ spend retailers,” says Afterpay’s Pressley.

Klarna

“We saw incredible US momentum in 2020, fuelled by widespread merchant integration of our Pay in 4 offerings and adoption by millions of customers nationwide,” says David Sykes, Klarna’s head of US and Canada.

In April 2021, Klarna had 17 million US customers, up 120% from April 2020. Klarna’s customers can use Pay in 4 on the websites of 8,000 US merchants who have partnered with Klarna. They can also use Klarna’s one-time virtual card-based in-store payments service at 60,000 physical store locations in the US.

In addition, consumers can use the Klarna app, which creates a one-time virtual card for each purchase, to shop at any online store. As of April 2021, there were 3.6 million monthly active US Klarna app users.

PayPal

In a Q1 2021 earnings call, PayPal CEO Dan Schulman said that PayPal saw over $1bn in total payments volume (TPV) in the US for Pay in 4 between the service’s launch in August 2020 and 31 March. Commenting on PayPal’s Q4 2020 results, Schulman said Pay in 4 had experienced the fastest adoption of any new PayPal product.

Pay in 4 enables US consumers to pay for purchases of $30-$600 in four instalments over six weeks; consumers pay no interest or origination fees, although late fees are applied if payments aren’t received on time.

“Pay in 4’s early results show a 15% engagement lift in transactions and TPV,” says Schulman. “Nearly 30,000 merchants have implemented our BNPL capabilities upstream on their product pages with a corresponding lift in our overall share of checkout.”

PayPal also offers PayPal Credit, a reusable credit line offering 0% promotional financing for six months for purchases of over $99. PayPal Credit, which had 34.6 million users in 2020 according to Cornerstone Advisors, can be used online and in physical stores through PayPal’s QR code payment method.

QuadPay

QuadPay’s US transaction volumes rise by 293% year-on-year and 14% quarter-on-quarter to US$589.0m (A$762.0m) in its parent company Zip Co.’s third quarter ending 31 March 2021. Its March 2021 US transaction volumes exceeded December 2020 by over 10%.

In Q3 2021, QuadPay saw its US customer base grow 153% year-on-year to 3.8 million.

While some BNPL providers’ virtual cards can only be used in bricks-and-mortar retailers that partner with them, QuadPay’s virtual Visa card can be used at any Visa-accepting merchant in-store and online.

Sezzle

Sezzle’s core BNPL product provides financing for purchases up to $1,000 with four repayments over six weeks.

In May 2021, Sezzle partnered with US digital bank Ally Financial to provide financing for e-commerce purchases up to $40,000 with monthly fixed-rate repayments for up to 60 months.

“Our mission is to financially empower the next generation,” says Sezzle’s Chan. “Many young people at the beginning of their credit journey aren’t using credit cards as much as young people used to. So, they may find it harder later on to get mortgages, car loans or other traditional loan products.”

“We asked our customers how we could help them with their credit journey, and they said they wanted help with building credit. So we introduced the Sezzle Up credit-building service. If a customer shows good repayment behaviour and gives us permission to report this to the credit bureaux, Sezzle Up will enable them to build a credit history. We’re unique in the BNPL industry in offering this.”

Sezzle doesn’t charge any fees other than late fees to borrowers, and if a customer misses a repayment, they can’t borrow any more money until they have paid off their instalment loan. Merchants pay Sezzle a percentage of the purchase amount and receive full payment for the purchase upfront from Sezzle. “We make about 15% of our revenue from consumer fees and 85% from merchant fees,” says Chan.

In Q1 2021, Sezzle’s Canadian and US underlying merchant sales rose by 214% year-on-year to $375.1m, while its active consumers rose by 126.6% to 2.6 million and its merchants by 167.5% to 34,000.

“We’re growing very rapidly,” says Chan. “Sezzle is reinvesting heavily in the company in terms of R&D as well as in people and expanding our markets. Our team has more than doubled in the last year.”

Splitit

Splitit enables merchants to provide BNPL loans to customers using their existing credit lines on their cards. As merchants pay for accepting Splitit, consumers don’t pay Splitit any fees or interest.

“Splitit provides merchants and issuing banks with an agnostic solution, enabling instalment payments for transactions made on all payment gateways and cards when offered via Splitit,” says Brad Paterson, Splitit’s CEO.

According to Peterson, North America is Splitit’s largest market. Globally, in Q1 2021, Splitit’s merchant sales volume rose by nearly 250% year-on-year to $82m, and total shoppers rose by 111% over the same period to 500,000.