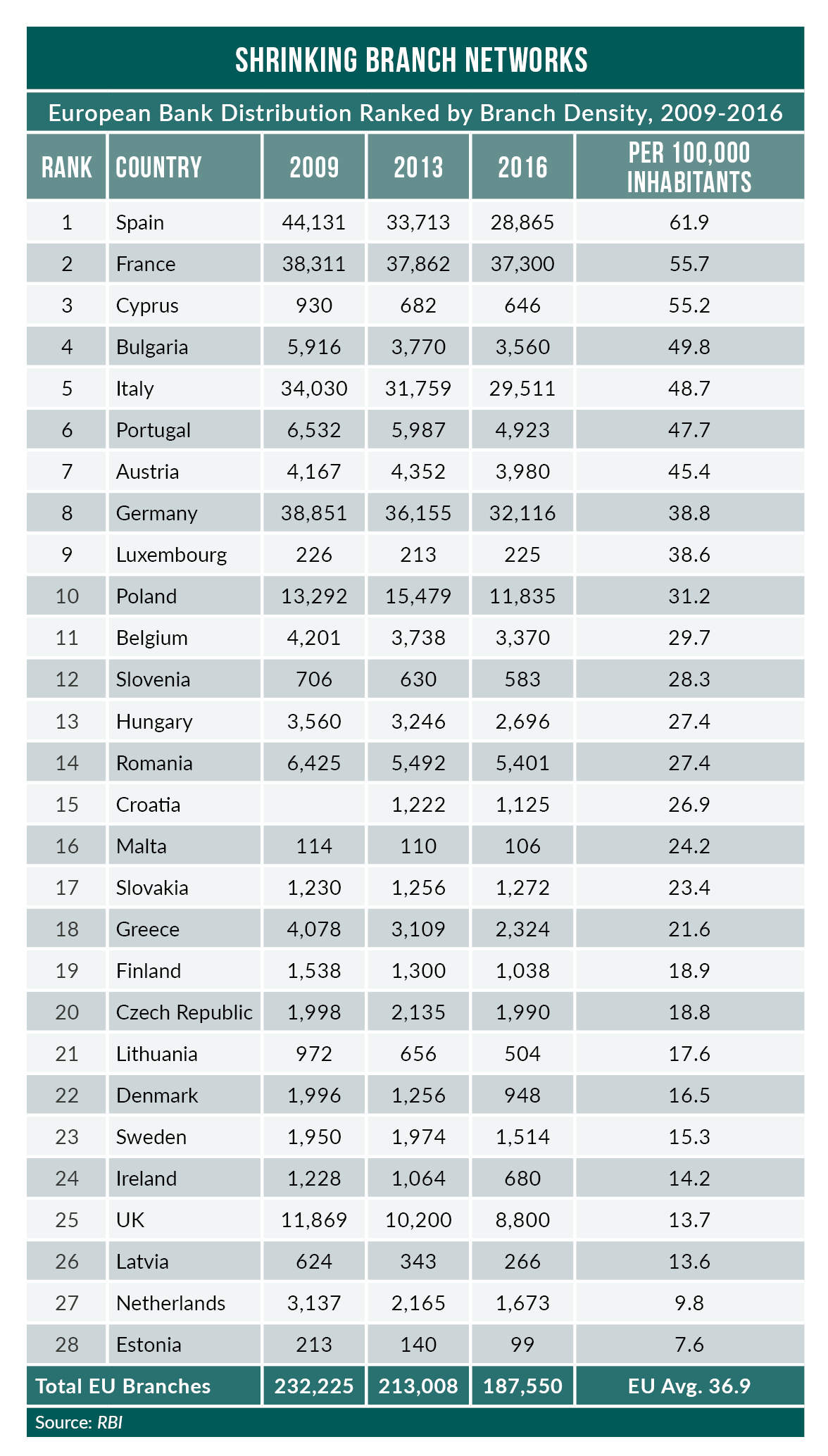

Across the EU, more than 25,000 bank branches have closed since 2013. Compared with 2009, more than one in five branches have closed. If UK or Netherlands branch density levels were to become the norm across Europe, another 100,000 branches will close Douglas Blakey reports

With more than 1,000 branch closures announced during 2017, the UK kicks off 2018 with a total branch network of around 7,500 outlets to serve a population of 66 million.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

For the UK that equates to a branch density of about 11.4 branches per 100,000 inhabitants – the third lowest in the EU’s 28 markets; only the Netherlands and Estonia have fewer branches per person.

Branch closures across a number of European markets have been gathering pace in the past three years 4,848 outlets closing in Spain in the period 2012-2016, about 15% of all branches.

Despite these closures, Spain remains the most over-branched European country, ahead of France.

In this particular bank race, France is playing catch-up with its international peers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn late November, Société Générale announced it would axe 15% of its branch network by 2020; that may sound like a significant rightsizing and for the 900 SocGen employees affected it is worse than significant but it only works out at 300 branches to be cut from a 2,000 network.

Expect further such announcements.

Rival BNP Paribas has been particularly reluctant to shrink its network; a mere 10% of its domestic branches have closed in the past five years and retains a French network in excess of 2,000 outlets.

Compared to France, branch closures are gathering pace in Italy. Intesa SanPaolo plans to shutter at least 600 outlets while UniCredit is aiming to close 944 branches by 2019.

Portugal is often advanced as an example of an over-branched market but here, one in four branches have already closed since 2009.

Elsewhere, almost one-half of branches in Greece have closed since 2009; in another market troubled by the financial crisis, Ireland, a similar percentage have closed in the same period.

If a prize was to be awarded to the market most enthusiastically grasping branchless banking: step forward Denmark: more than one-half of its branches have closed in the past seven years.