In banking, the uses of artificial intelligence are endless. From enhancing customer interactions to improving fraud compliance, AI can help traditional incumbents survive in a digital world. Evie Rusman reports

With threats due to Covid-19, now is the perfect time for banks to invest in up and coming technologies like AI, especially since the pandemic has accelerated the shift to online banking.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Meanwhile, digitally-native challengers and fintechs are threatening to steal traditional banking customers. This means that pressure on banks to invest in digital capabilities is at an all-time high.

According to GlobalData’s recent thematic report, AI in Banking, banks must be “proactive in adapting their strategies and processes to remain competitive and desirable to consumers”.

It notes that fintechs have changed consumer expectations, resulting in increased pressure on banks to offer a more seamless and personalised customer experience.

Investing in AI

Is AI the solution? GlobalData argues that AI has been a key catalyst in helping banks transform digitally and highlights that it is a technology that has many different use cases.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor instance, AI can drive efficiency, and be used to enhance customer engagement and loan provisioning, as well as automate laborious back-end tasks.

GlobalData predicts that banks will invest a huge $4.9bn on AI platforms worldwide by 2024. This is up from $1.8bn in 2019, representing a compound annual growth rate (CAGR) of 21.8%.

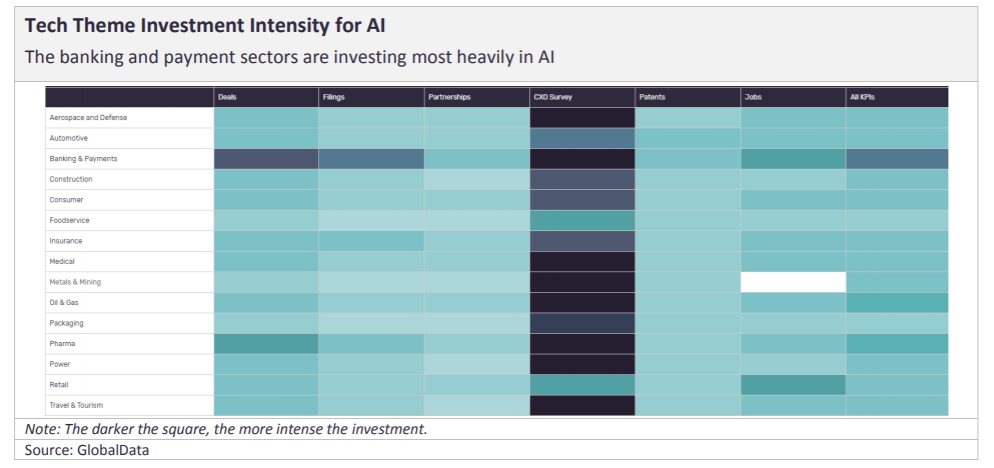

The graphic below shows the level of investment in AI from each sector, based on data drawn from GlobalData’s deals, patents, and jobs databases; company filings, and GlobalData’s CXO survey. Banking scores the highest of any sector for AI adoption.

Utilising AI

The report recommends that when investing in AI banks should focus their time and resources on certain aspects. It outlines machine learning, data science and conversational platforms as the three most import things to focus on.

“We recommend that banks invest in both machine learning (ML) and data science across the entire banking value chain,” notes the report. “Both technologies have large and diverse potential to improve the banking stack. This includes using data analytics to conduct more comprehensive risk assessments for loans, whilst reducing the time taken.

“Big data can be used to better target offers to clients and help identify areas where banks may be able to provide services to customers that they otherwise would not be able to.”

It also says that ML can help banks better detect fraud and cybersecurity risks, while data science can improve automation.

Furthermore, conversational platforms enable banks to offer round-the-clock support through tools such as virtual assistants, rather than relying on staff.

The report suggests that banks should invest time into improving their conversational platform technology to create smarter chatbots, which will ultimately improve the customer experience.

Cyber security

Banks hold important and sensitive data. Therefore, it is necessary for banks to ensure that their security measures are up to scratch.

GlobalData argues that AI is necessary to protect against ever-evolving cybercriminals. It says: “ML and data science tools are being used to combat cyber threats. ML can identify the normal pattern of behaviour for customers and raise the alarm if there is a deviation from this norm. This may prompt manual intervention, or the threats may be automatically countered.”

Banks can also add an extra layer of protection using identity tools such as facial recognition.

DBS Bank has incorporated a machine learning filter model within its existing case management system called CRUISE.

Digital competition

Another key challenge for traditional incumbents is rising digital competition from challengers and fintechs.

Through AI, banks can offer more personalised, digital services to their customers as data science tools enable them to gain insight to a customer’s banking habits. This is increasingly important since consumers are becoming less patient and demanding quicker, more convenient services.

GlobalData’s report highlights that AI is particularly effective in improving processes such as loan applications by reducing the time it takes for loans to be approved.

An example of this being used in practice is Ant Group’s MyBank ‘3-1-0 model’, a business loan that takes less than three minutes to apply for, less than one second to approve, and requires zero human intervention.

Regulation

Banking remains one of the most heavily regulated industries in the world, and as new technologies are adopted, this is only set to increase. The EU’s GDPR threatens fines of up to €20m or 4% turnover, whichever is greater, for data breaches.

Regulation and cyber security tend to go hand in hand – GlobalData says that AI’s ability to counter cyber threats will aide banks in solving issues surrounding regulation.

“AI will help to both prevent data breaches and to deal with data losses in a much faster and more effective manner than through manual tools alone,” the report notes. “The fact that ML can instantly detect a breach means that banks will be able to report data losses faster, avoiding the most serious punishments.”

For example, Santander has rolled out ThetaRay’s AI-based big data analytics platform to detect AML incidents.

Big data

Big data gives banks the opportunity to offer more personalised services to their customers. The report cites that through ML and data science, this data can be better visualised and will allow banks to tailor products to the requirements of specific customers.

For instance, this could mean offering a credit card or overdraft facility to a client who did not think they would qualify and did not even apply.

The type of loans being offered would be more tailored, meaning that people who do not qualify for loans, may be able to access higher loans. In addition, people with good credit scores, backed up by this data, may have access to better rates than expected.

This can work the other way round too – banks would be able to deny loans to people who seem like good candidates on paper, but big data shows previously unflagged risks.

Covid-19

Due to country lockdowns, Covid-19 accelerated the move to online banking as bank branches were shut. This meant that banks had to find alternative ways to help their customers.

GlobalData’s report shows that in response many banks rolled out AI-based chatbots. Natural language processing (NLP) incorporated into chatbots allows these automated channels to deal with most customer queries without the need to escalate such cases to humans.

The chatbots are also available 24/7, making it convenient for customers.

Bank of America’s virtual assistant Erica now has over 13 million active users, and in April 2020 alone, it handled 15 million requests from clients.

Adding to this, in 2020 BBVA rolled out a new voice assistant called Blue, which responds to over 100 customer requests. The assistant provides a range of services, including details on the location of the closest ATM, information about financial products, and details about the user’s account balances and savings in the current month.