VASCO specialises in developing and providing security solutions for the financial sector, businesses and governmental agencies.

More than 10,000 customers worldwide implement the company’s software and services in a wide range of applications. These include identity management, access security, document signing, transaction verification and high-value asset protection.

High-performance transaction, document and data security solutions

VASCO offers transaction data signing and two-factor authentication tools, and also documents e-signature and identity management solutions.

The company also provides secure access to Cloud-based applications and data, as well as a robust toolset for software developers to easily integrate security functions into their web-based and mobile applications.

Software development kits for mobile applications

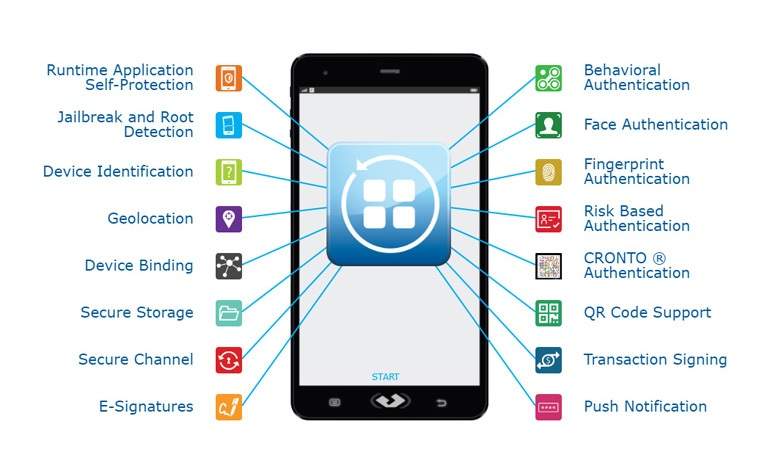

Vasco’s DIGIPASS for Apps is a complete software development kit (SDK) that integrates application security, electronic signing and two-factor authentication functions into mobile applications.

Through a complete library of APIs, clients can extend and enhance application security, deliver increased convenience to users, and simplify application deployment and lifecycle management processes.

Behavioural authentication tools

Vasco’s DIGIPASS® for Apps Behavioral Authentication solution enables continuous and transparent authentication in order to minimise fraud and increase customer loyalty.

The tool provides an invisible layer of security that consistently authenticates end users by using the unique ways they interact with their computer or mobile device.

Software to impede malware and fraudulent activity

Hackers and their targeted malware are an increasing threat to the mobile revolution. With an increasing demand for flexible access to mobile services, app developers are challenged to keep up with security, which increases exposure to malicious attacks.

VASCO’s Runtime Application Self-Protection (RASP) solution proactively manages the threat of high-tech malware by effectively detecting and preventing fraudulent activities before they can occur.

Fraud detection solutions

VASCO’s IDENTIKEY® Risk Manager is a comprehensive fraud solution designed to help clients improve how organisations detect fraud across multiple channels.

This enables a more proactive approach to fraud prevention while facilitating the user experience.

IDENTIKEY® Risk Manager collects and measures activities and operations based on state-of-the-art analysis of behavioural contextual and other significant data elements.

By using this data, the system can challenge unusual patterns and enhance security when required to create a secure barrier against cybercriminals.