AdviceRobo is an international credit scoring company applying psychometrics and artificial intelligence (AI) to support lending to millennials and small, medium enterprises (SMEs).

We provide a scalable psychometric credit score solution powered by a machine learning platform, which combines deep scientific knowledge and experience with psychographics applied in scoring models.

Global financial inclusion

The UN Secretary-General’s Special Advocate for Inclusive Finance for Development states that around two billion people don’t use formal financial services, accounting for 40% of the world’s adults. The World Bank says more than 50% of adults in the poorest households don’t have a bank account.

These people do not have access to appropriate or affordable financial services. It’s not only households but also businesses still struggle to obtain financing that meets their needs, especially SMEs. Financial inclusion is key to empowering people to build and live their lives.

Poor credit information

Part of this issue is the lack of reliable credit information. Only 30% of adults worldwide and 52% in the Euro area are listed in a private credit registry with information on repayment history, unpaid debts or credit outstanding.

This makes it hard for a bank to assess the risk and creditworthiness of a new customer, and therefore often results in rejecting the application for credit.

New financial digital technologies

New digital technologies are making it cheaper and easier to extend access to financial services to the two billion citizens without bank accounts.

Technology such as data, AI and machine learning help to achieve financial inclusion, improving a customer’s financial health and empower them.

To achieve this, AdviceRobo brings a new credit score and risk-approach, driven by big data and artificial intelligence. This approach consists of modelling of risk models for predictions of default, churn and collections and comes with a data scan, preventive risk treatments and future-proof data strategies.

Psychometric credit scores

Based on motivational insights, AdviceRobo offers an academically proven psychometric credit test to measure creditworthiness of ‘thin-file’ customer segments where no or little credit information is available.

Psychographic credit scoring assesses a ‘thin-file’ people’s creditworthiness by:

• Universal risk profiling based on behaviour, attitudes and personality traits

• Granular individual prescriptive score due to machine learning-based scoring model

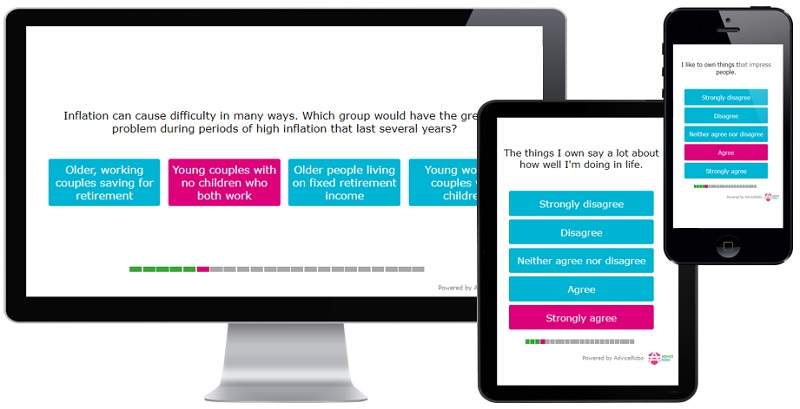

In the regular onboarding process for a loan, mortgage or credit card, applicants participate in an online interview.

AdviceRobo offers an integratable white label plug-in for a seamless customer experience. Within seconds, the lender gets the applicant’s credit score and a short profile via an application programming interface (API). Based on this, the lender can instantly either approve or reject the applicant.

This technology has been proven to increase acceptance (+18%) at same or better risk levels (up to 38% lower than average default rate).

Benefits of psychometric scoring

Psychometric scoring offers an unprecedented opportunity for lenders to help customers build and strengthen their financial health.

At the same time, it enables lenders to learn deeply about their customers, understand their needs, and intelligently include them financially and empower them.

Creditworthiness measurement tests

A simple ‘personality’ test measures the creditworthiness of the applicant, the AdviceRobo test gives insights into their ability to mitigate risks, their understanding of financial concepts such as pension and inflation, and their capacity to manage such as repayments.

Benefits of the AdviceRobo test include:

• Improve screening of new applicants

• Increase acceptance at same or better risk levels, and at a reduced cost

• Enable lenders to learn deeply about their customers, understand their needs and access to credit

• Easy to integrate into the consumer journey

Alongside the innovative psychographic credit score, AdviceRobo enables lenders to properly predict and prevent credit risks during the customer lifetime.

We developed a machine learning platform that accurately predicts consumers’ risk behaviour by combining structured and unstructured client data.

About AdviceRobo

Founded in 2013, AdviceRobo has a client base comprising next-generation banks, credit card providers, mortgage independent financial advisers (IFAs), and microfinance and crowdfunding platforms.

The AdviceRobo technology has been implemented by a wide partnership base that includes Microsoft, KPMG, Mambu and Endava, to support credit scoring and predictions of financial risks.

With offices in Amsterdam and London, the company has operations across Europe.