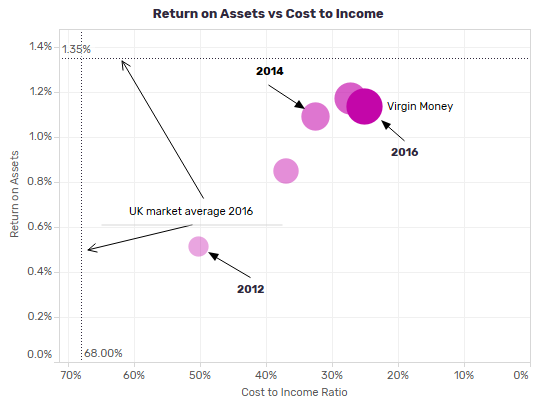

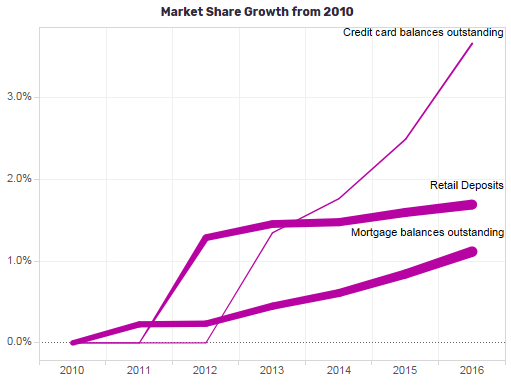

Since its acquisition of Northern Rock in 2012, challenger bank Virgin Money has pursued a successful growth strategy across all its product lines. With a decreasing cost to income ratio it has been able to offer very competitive rates on mortgages and deposits. Growth in its credit card business has been driven by acquisition, most notably purchases of assets from MBNA. Yet its card-linked rewards – which give customers exclusive discounts for the Virgin Group, including train tickets and holidays – remain a very attractive proposition.

Growth in lending has not been the result of relaxed credit standards, with its net impairment to loan ratio significantly below the market average. Virgin Money’s interest income to net income ratio was 96.3% in 2016. Plans outlined in its recent annual reports indicate it is seeking to expand into the wider personal current account market with the aim of increasing its non-interest income to net income ratio.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData