Collaboration between banks and government agencies in the UK is key to tackling and minimising cybercrime – along with improved consumer awareness.

Given the continued growth of digital channels, governments and financial institutions are under great pressure to strengthen cybersecurity. The UK’s Public Accounts Committee (PAC) said the National Cyber Security Centre has dealt with more than 1,100 incidents since it was established in October 2016. PAC chairwoman Meg Hillier stated that “with its world-leading digital economy, the UK is more vulnerable than ever before to cyberattacks. As the likelihood of these attacks continues to grow, the UK needs to protect itself against the risks created by more and more services going online.”

The government’s National Cyber Security Strategy 2016–2021 is designed to help address the growing threat of cybercrime. But the threat is becoming increasingly sophisticated, and large firms are prime targets for organised crime and cyberterrorists. A cyberattack on a financial institution not only results in the loss of vital data, but can have a devastating effect on a firm’s reputation, requiring significant amounts of time and money to restore lost trust. Moreover, the interconnectedness of financial institutions makes them even more susceptible to disruption, threatening both national security and the stability of the international financial system.

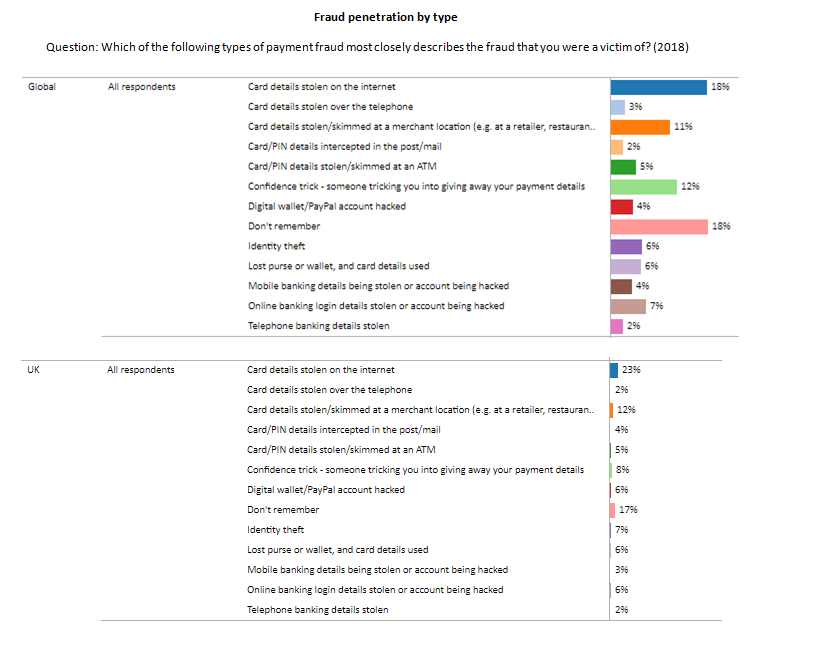

And that’s before considering the impact on consumers. According to GlobalData’s Payment Fraud Customer Analytics, the most prevalent form of cybercrime is online card details theft:

Consumers are looking for advice on how to protect themselves so they can have confidence as they increasingly live their lives online. This means there is an opportunity for businesses with the required expertise to provide customers with insight, protection, and support designed to combat cybercrime. Boosting consumer awareness of the dangers of cybercrime – and educating them about specific methods criminals use – would likely lead to a reduction in incidents.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn our view, there is no one size fits all solution to cybercrime. Both government agencies and banks should adopt a strategic approach involving wider communication and collaboration across the international financial community. Above all, there is a need for an industry-wide intelligence sharing hub, or at the very least a global body to facilitate information sharing, as well as greater cooperation across borders.