Consumers who use multiple channels to interact with their bank are at greater risk of defection or to switch , according to research by GlobalData.

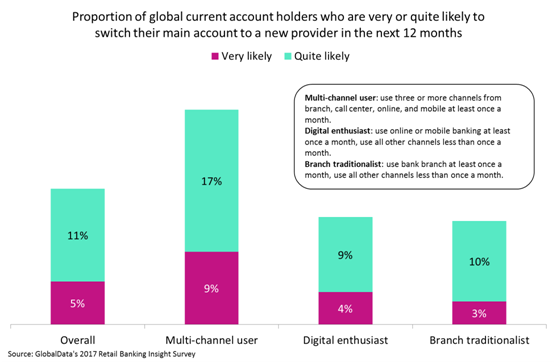

GlobalData’s 2017 Retail Banking Insight Survey found that while only 5% of global bank account holders stated that they were very likely to switch banks in the next 12 months, this rose to 9% among multi-channel users (those who use three or more channels at least once a month).

Conversely, consumers who use fewer channels display higher levels of loyalty, with smaller proportions of both digital enthusiasts and branch traditionalists claiming to be likely to switch providers. This is noteworthy, as multi-channel users are more profitable, holding on average two more products than branch traditionalists and one more than digital enthusiasts.

Further analysis reveals that multi-channel users have the highest net promoter scores, which suggests that these consumers are the most satisfied with their bank. This seems to run counter to their relative lack of loyalty, but examination of attitudinal data offers an explanation.

Multi-channel users are more likely than the other segments to agree that they are the first to try new products, and that they are excited by the future. These consumers are forward-looking and attracted by novelty, and are therefore more open to the idea of changing banks in order to obtain a better customer experience, even when they may have no complaints against their existing provider.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn order to retain these consumers, therefore, banks have to engage in a policy of continuous improvement to their products and services. Digital channels offer the greater opportunity for differentiation, and banks should exploit the latest AI-driven technologies to provide advanced financial analysis tools to their customers.