In today’s global scenario, significant attention has been focused on bank earnings and earning power. Many banks in the UK still struggle with profitability. Amidst ongoing economic uncertainty and costs associated with Brexit, it will be interesting to see how RBS manages its net interest margin (NIM) pressure.

In recent years, many European banks have struggled with low profitability, which has weakened their ability to finance the wider economy. In turn, this has further weakened the economy. One factor squeezing revenue is declining NIMs. NIM measures the difference between the interest income generated on average interest-earning margin financial assets (lending) and the amount of interest paid on average interest-bearing financial liabilities (borrowings) relative to the amount of interest-earning assets.

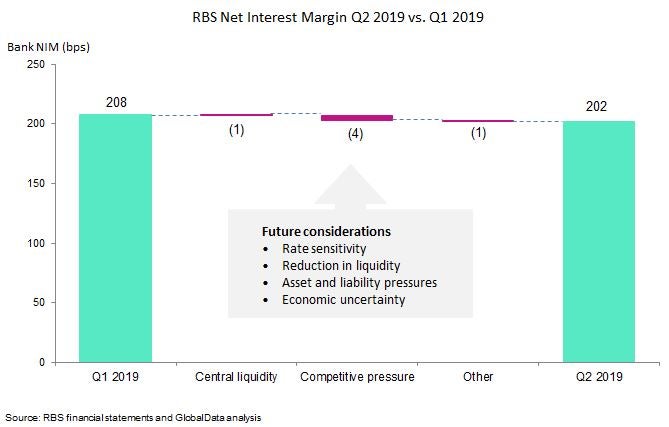

Royal Bank of Scotland’s (RBS) H1 2019 results flag that the group is under margin pressure. NIM is a key measure of profitability, highlighting how profitable a bank’s lending is. RBS’ NIM of 202 in Q2 2019 (which was 5 basis points lower than in Q1 2019) reflects the competitive pressures it is facing. Outside of a declining NIM, the bank’s overall results are generally sound.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGiven current market conditions, continued economic and political uncertainty, and the contraction of the yield curve, it is not easy for UK banks to achieve profitability improvements, not least at a time when NIMs are under increasing downward pressure from lower interest rates.

The current weak economic environment in the UK may lead to a higher rate of non-performing loans, an increase in banks’ funding costs, and competitive pressures from existing banks and new entrants. Additionally, the uncertainty created by Brexit is also likely to put a dent in the bank’s core operations.

As pressures on profitability persist, RBS and other UK incumbents will have to remain cautious and work hard to drive competencies in their retail banking divisions in order to remain profitable.