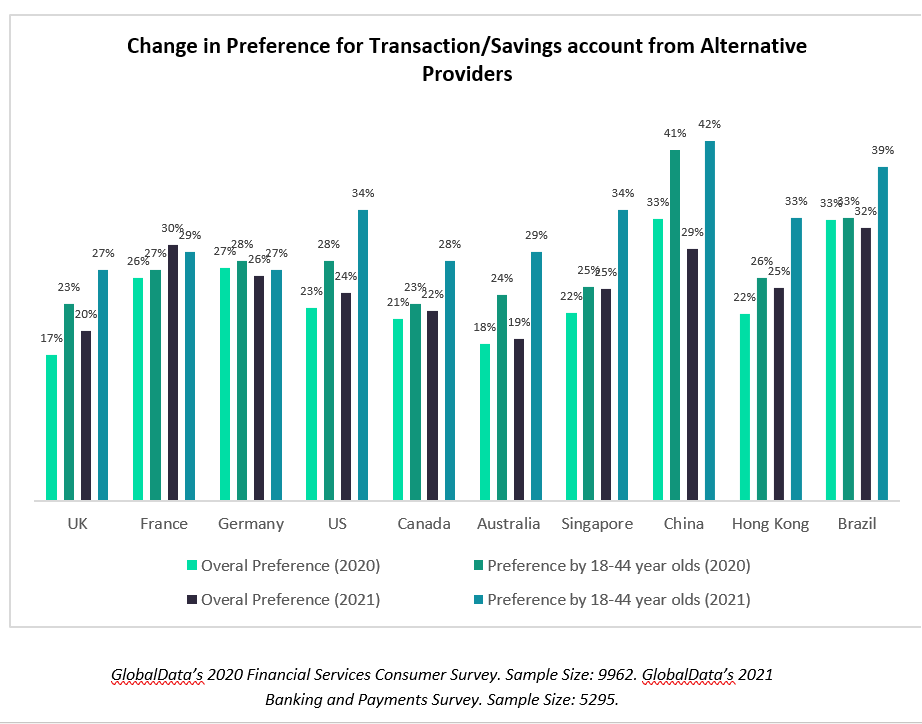

The growing preference for banking services from alternative providers (such as big tech, digital banks, fintechs and digital wallet providers) is slowly beginning to impact the market share of incumbent banks.

Whilst the primary reason for this trend emerging has been the superior levels of service alternative providers offer as standard, they are also benefitting from a technological landscape that is becoming increasingly consolidated and centered on the use of a narrow range of apps that offer a wide range of services – so-called “super apps.”

The next five years are likely to see this trend continue and accelerate as fintechs and particularly big tech platforms incorporate a greater number of financial services into their offerings. This will spell the end for some of the smaller “single issue” providers that have flooded the market over the last five years.

This is part of a trend in financial services that technology companies and even incumbents have recognized: a future based on “platformification.” This involves customers turning to a small number of platforms that offer a diverse range of services, from social media to financial services to ecommerce.

The emergence of big tech companies moving into financial services is perhaps the most telling sign that this process is underway. The likes of Google, Facebook, and Amazon are platforms in the very definition of the sense, and are clearly seeking to monopolize even more of users’ leisure time, attention, and wallet.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThey are achieving this by launching checking accounts, developing increasingly sophisticated payments and credit infrastructure, and offering services outside the scope of financial services entirely. This allows them to form deeper relationships with customers and encourage greater engagement with their entire product suite.

Super apps

PayPal has been the most explicit Western technology company to express its intent to become a super app in the image of Asia’s WeChat, Alipay, and Grab. Most recently this included the acquisitions of Honey Sciences Corporation and Happy Returns.

Honey is a deal-finding browser extension that enables PayPal to become a more visible payment option at checkout, as well as offering greater value in the form of discount codes and offers. Meanwhile, Happy Returns is a logistics company with reach across the US, enabling PayPal to reduce the pain points associated with returning goods purchased online.

Besides such acquisitions, PayPal has also expanded its financial services offering to include flexible credit plans, including buy now pay later (BNPL) options that will compete with incumbents’ ordinary personal loan products as well as fintechs offering BNPL.

The launch of such services coupled with simple account setup and its widespread acceptance at practically all online retailers has positioned PayPal to make something of comeback and increase its market share of the millennial and Generation Z demographics who are most likely to engage in ecommerce.

Forward-thinking banks such as ING, DBS, and BBVA all appear to have seen the writing on the wall. In recent annual reports they have made clear their intent to expand the range of services they offer beyond the typical banking standard. This includes ING launching the DealWise shopping platform to place its financial services offerings front and center at checkout and engage more on the ecommerce side with customers.

This will prove especially valuable given the growth in ecommerce since the start of the COVID-19 pandemic. DBS has launched the lifestyle app PayLah!, marketplaces allowing users to purchases cars and homes, as well as a digital tokenization exchange in partnership with Singaporean authorities.

Long term it is likely that the preference for financial services from alternative providers (particularly big tech companies) will increase given the complementary ways they can be integrated to improve the customer experience, specifically with regard to the other digital products customers use from them.

Whether regulatory hurdles block these developments remains to be seen, and expansion into financial services may prove to be the straw that breaks the camel’s back causing government to act on the growing calls to ‘break them up’.

However, at present alternative providers appear to be operating under the assumption that nothing can stand in their way as they continue to explore innovative plans such as new currency regimes that could turn all of financial services on its head.

This was written by GlobalData banking analyst Mohamed Hasan.