Open banking developments have aimed to reform how banks handle customer financial data and primarily aim to allow users to share their financial data with third-party providers of their choice. This enables them to access innovative new services and analytics that offer more comprehensive, secure, and personalised elements of service.

As a relatively new development, progress in open banking has been somewhat limited, though markets such as the UK, Singapore, and the Nordic economies have all made substantial progress in implementing open banking policies as well as communicating what these reforms mean to users in a short period of time.

The partnership announced between Resurs and Nordic API Gateway will allow Resurs to access financial data and account-to-account payments for any of its 6.2 million customers in the Nordic region who choose to opt in and make use of the service.

Resurs intends to use such data to offer tailor-made loan products to customers, which will be based on a real-time understanding of customer financial behaviour. The increased data-driven approach is thought to yield better outcomes for all parties, simplify the loan application process, and develop a more accurate and fair credit assessment of customers, as opposed to the backward-looking, historically centered data currently employed.

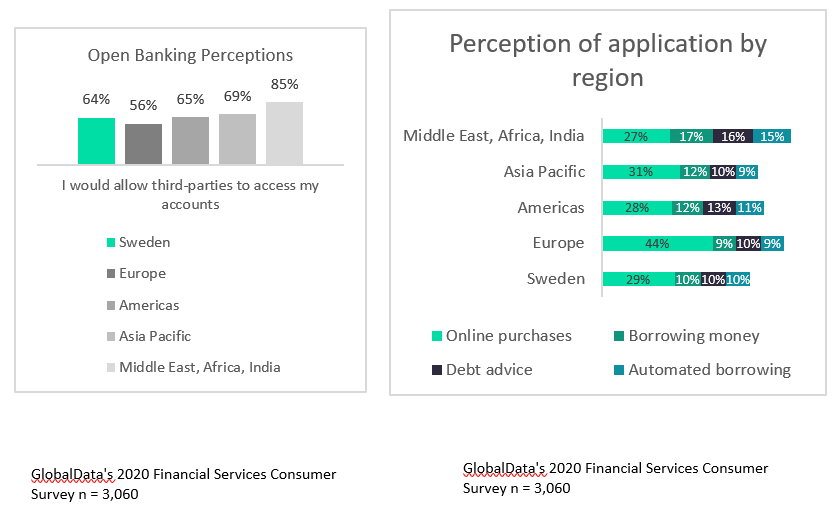

The partnership makes sense for Resurs, as the GlobalData 2020 Financial Services Consumer Survey shows that the Swedish market is one of the most receptive to open banking reforms in the world, trailing the likes of Singapore and Malaysia but leading London, despite it being the fintech hub of Europe.

The impact of Covid-19 is also likely to amplify the application of open banking in Sweden and other markets, as customers in financial distress, or those facing redundancy or delinquencies, are likely to make use of third-party budgeting and analytics apps that offer deep insights into which providers and products to use, as well as how best to plan their finances and pay off debt.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSimilarly, more efficient access to credit and better chances of acceptance will be pivotal in increasing the usage of open banking platforms given the deadlines and uncertainty that customers face.

Overall, open banking adoption and understanding can be expected to increase significantly over the next year as the consequences of Covid-19 shape behaviours and lives long term. Increased social distancing and preference for online methods of shopping and purchasing will see a rise in customers who use open banking platforms due to them being able to complete transactions online without divulging sensitive payment information, reducing the risk of fraud. These give the likes of Resurs a new-found competitive advantage that can be leveraged to increase its customer base and more dynamically challenge incumbent banks.