Mobile banking’s popularity is heavily skewed towards the younger segments in the UK. It is crucial for banks to invest in their mobile capability, as the channel is expected to play a significant role in the near future and empower older generations to convert.

As we are gradually moving towards a mobile-centric world, more consumers are now using their mobile phones to do their banking activities. Mobile as a channel has made inroads in the UK banking space, due to the government’s role in developing it and banks’ migration of routine transactions from human channels to digital channels. Legislation allowing banks to process cheque images via mobile and other technologies such as chatbots, biometric authentication, tailored expenditure monitoring, and analytics-based alerts have all contributed to increased consumer satisfaction levels.

New research from CACI suggests that older generations, in particular pre-retired and wealthier older families, are embracing mobile banking and the channel is set to overtake online and branch banking by 2021.

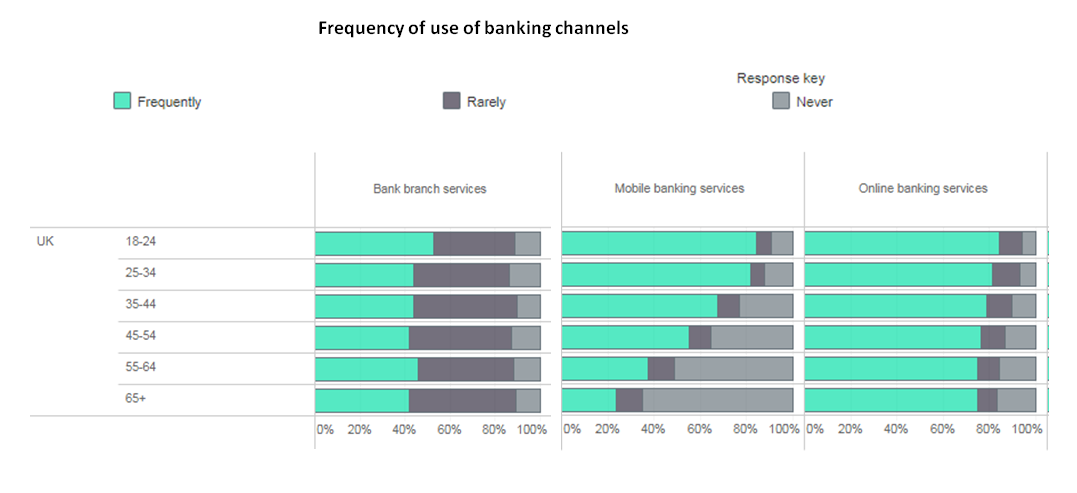

Perhaps contrary to the research done by CACI, mobile banking is still mostly preferred by younger consumers who are the most enthusiastic users of smartphone apps. According to GlobalData’s 2019 Channel Analytics, the frequency of use of mobile as a channel is still low among older consumers.

For instance, in the 65+ age group, only 24% of consumers use mobile banking while 75% use online banking. However, as mobile reaches maturity it will emulate the online channel, where usage is much more consistent across life stages and age groups.

Satisfaction with digital channels is much higher than for traditional channels but given that mobile banking is still relatively new compared to online, satisfaction with mobile is impressively high. This reflects the potential of the channel and the increasing breadth of functionality it can offer. This will improve further as banks continue to develop and enhance their mobile capabilities.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThere are big incentives for providers to move older customers over to this channel. Improved engagement with consumers, particularly older generations, through better interaction will encourage customer retention. Mobile, together with online, will also help to free up the branch and telephone channels to offer more value-added services. The mobile channel has emerged as a potentially key differentiator between offerings and may help providers attract new customers. Banks in the UK need to encourage older consumers to use mobile banking in order to realise these benefits.