Since March 2019 the Hong Kong Monetary Authority has awarded eight virtual banking licenses to new fintechs looking to start virtual banks. These licences allow banks to offer a fully digital banking service without having to have bank branches in Hong Kong.

Although none of these banks are currently operational, the incumbents have already responded. Eight of the country’s key players have dropped fees for customers who fail to maintain a minimum monthly balance. This is clearly a response to the new virtual banks not being allowed to impose any minimum account balance requirements or charge customers low-balance fees as part of their banking licenses.

Tech in Asia, which provide news on banking technology in the region, states that these charges can add up to HK$1,200 ($153.60) a year if balances fall below HK$10,000 ($1,236.60) each month. HSBC was the first bank to announce it was stopping these fees.

This move was quickly followed by Standard Chartered, Bank of China (Hong Kong), Hang Seng Bank, Bank of East Asia, Dah Sing Bank, ICAC Asia, and Citibank. However, this may not be enough to help incumbent banks.

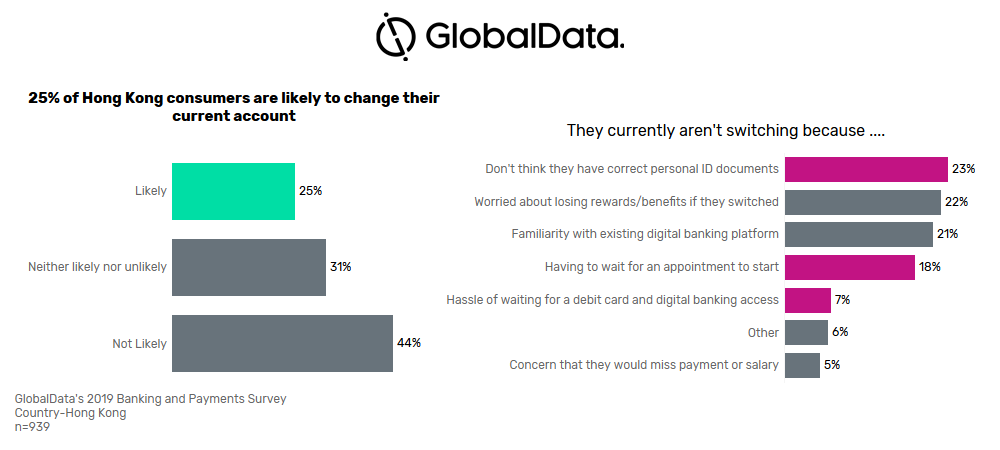

According to GlobalData’s 2019 Banking and Payments Survey, a quarter of Hong Kong consumers state that they are likely to switch their main banking provider in the next 12 months.

What is more worrying for incumbents is the fact that some of the obstacles for switching banks are easier to overcome for the new digital entrants. Approximately half of those who are likely to switch banks in the next 12 months previously did not do so due to onboarding issues. These include everything from not knowing what documents they need, having to wait for an appointment, or having to wait for a new bank card to arrive. This is an area where the new virtual banks will have a clear advantage over their incumbent rivals. Digital challengers can onboard customers through their mobile phone and give them instant access to mobile banking and their bank card via mobile wallets once their ID has been successfully verified.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIncumbents have made a small move in trying to appease their customers. Yet the sizable proportion willing to switch and the arrival of new entrants making that process significantly easier means traditional banks will have work harder to retain their customers. It will no longer be sufficient to simply rely on lack of choice and consumer apathy as a defence.