Both incumbent and challenger banks are expected to receive higher deposit growth from worried retail investors, with retail equity deposits set to fall significantly in 2020.

As coronavirus raged across the world in early 2020, one of the first casualties was global commodity and stock markets. The sheer disruption that COVID-19 was expected to bring left the majority of investors worse off very quickly.

The FTSE All-Share Index fell drastically in February, recovering in recent weeks but still down 24%. The value of UK pensions, too, according to XPS Pensions, is down 8.4% in one quarter and expected to fall further, a reminder of how exposed pension funds are to the stock market.

However, rather than prove a short-term phenomenon, the disruption has reversed the recent trend of retail investors looking for higher-yielding assets, instead seeking to bolster their safety net in deposits.

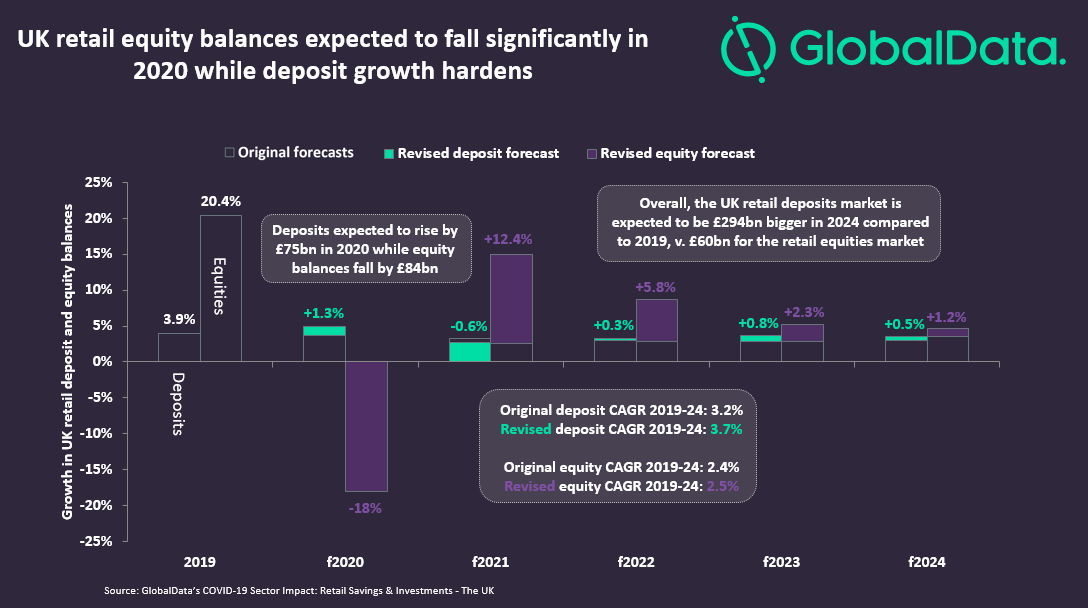

Insight from GlobalData’s Coronavirus (COVID-19) Sector Impact: Retail Savings & Investments – the UK report shows revised forecasts for 2020–24 that anticipate retail investors to gravitate towards deposits.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataEquity balances are expected to fall by 18% in 2020 alone while retail deposit balances grow by 5%. And while the decline for equities is made up for in the following years, the higher growth and large initial size of the retail deposits market shows the extent to which investors are set to turn towards safer assets.

Higher deposit growth is also likely to benefit both incumbent and challenger banks. Already, retail savings platforms Raisin and Hargreaves Lansdown reported a surge in activity in March with savers looking for short-term, fixed-rate deposits. Their offers of deposit protection potentially above the usual £85,000 limit, as well as interest rates of up to 2%, make them a tempting case for consumers who are still nervous to invest.

Additionally, with base rates lowered to just 0.1%, banks will be able to take advantage of consumer nervousness by simply offering a safe place for customers to store their money.