A key angle has been missing from much of the well-worn discussion about the ‘dollar dethroning’ canard reignited by last month’s BRICS Summit. This is what is arguably the most systemically significant use case for central bank digital currencies (CBDCs) – namely, as a cross-border payment instrument.

As can often happen with innovations, widespread adoption and impact looks like being triggered in this case by a hard constraint that outweighs business-as-usual inertia that might otherwise have kept CBDCs for international trade in a slow-burn holding pattern of pilot projects competing for policymakers’ attention and prioritisation with any number of other desirables. The constraint in question is US financial sanctions on Russia. Reflecting this, the enabling legislation for the e-ruble was passed by both houses of the Russian federal parliament in August and is due to be signed into law by President Putin next week.

The CBR has highlighted “facilitation of cross-border payments” as a major benefit of the e-ruble.

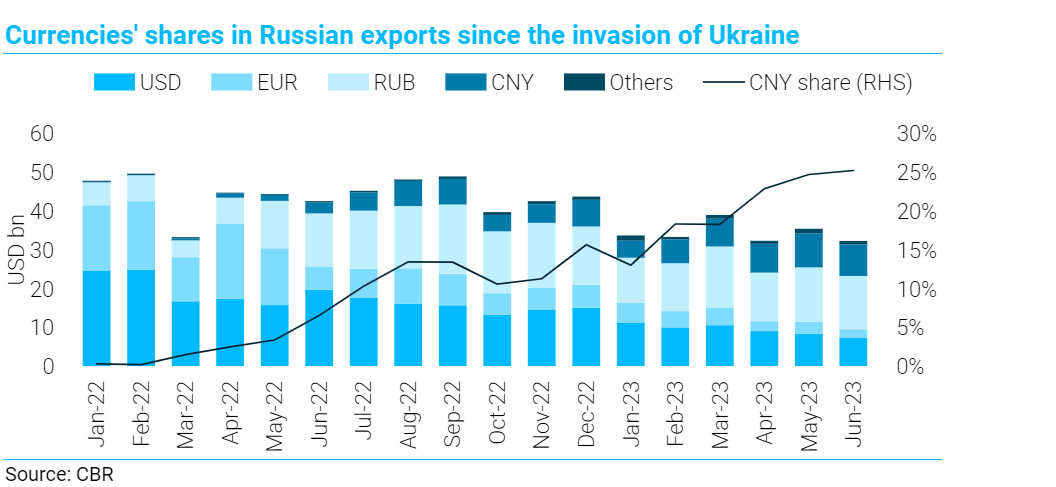

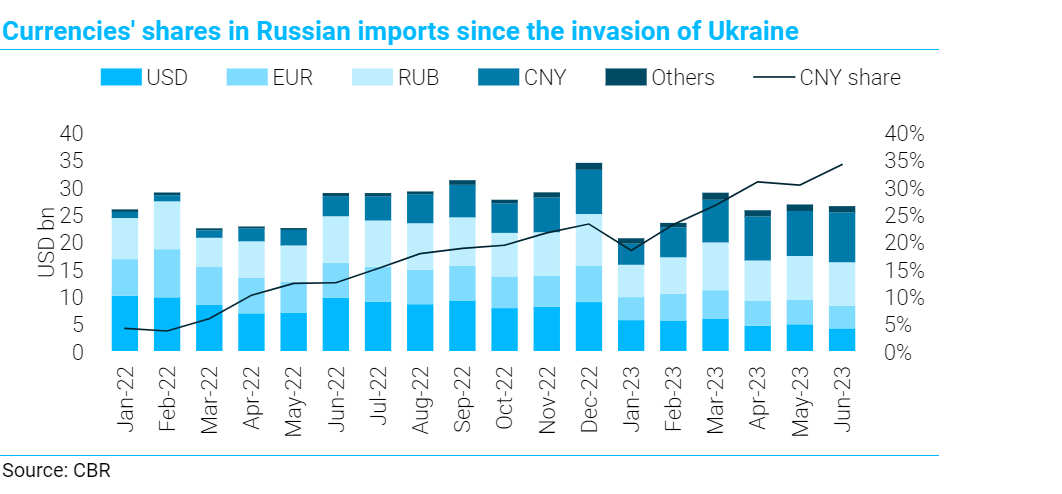

Having been cut out of the global US dollar system, Russia has no choice about finding alternative arrangements for its international trade. The readily available options are settlement in trading partners’ national currencies and the use of the RMB for payments with trading partners other than China itself. The RMB has thus become the settlement currency for a rapidly rising share of Russian exports (chart above) and – especially – imports (chart below).

But non-dollar settlement via correspondent banks using messaging systems other than SWIFT (both China and Russia have developed their own international payments systems) are relatively costly and inefficient.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis makes such payment methods an unnatural preference for trade between countries which have not (yet) been sanctioned by the US and which therefore – unlike Russia – retain other options. Political will might always outweigh commercial logic – as has been seen with the gradual shift towards national currency settlement of oil and gas sales from the Gulf to China. The political motives range from the strategic goal of countering US hegemony to pragmatic mitigation of the risk of being on the receiving end of the kind of US sanctions now imposed on Russia. The combination of this political impulse with the emergence of a cheap, quick and safe global payment system would win the day. CBDCs unlock the potential for such a system – the “safety” element just referred to being both operational and political (out of the range of the US Treasury enforcement).

The BIS – through its Hong Kong-based “innovation hub” – coordinated in October 2022 a live experiment involving the settlement of commercial invoices and FX trades on a single network with four CBDCs – those of the PBOC, the Hong Kong Monetary Authority, and the central banks of the UAE and Thailand. The BIS’ verdict on this real value experiment (if only to the modest tune of the equivalent of $22m) was that “direct participation in peer-to-peer payments in the safety of central bank money across multiple jurisdictions” is “a realistic and achievable goal”.

The mBridge ledger

Russia was not involved in that experiment or, for now, in the ongoing development of this BIS-coordinated platform based on a new blockchain – the mBridge ledger. Yet there is no doubt that this or a similar platform is part of the Russian plan. CBR governor Elvira Nabiullina said as much when presenting the e-ruble project to Putin on 19 August.

Her mention of a “common settlement centre that various countries’ CBDC platforms could plug in to” was echoed last week by Sergey Storchak, a former long-serving Deputy Finance Minister responsible for international financial relations who is now the Russian director in the New Development Bank (or ‘BRICS Bank’).

It is worth paying attention to Storchak rather than what the FT, picking up on remarks from an ignorant Russian parliamentarian, described on 31 August as “pitiful rambling from Moscow about a shaky dollar being challenged by a new BRICS currency”. Speaking at a conference in Moscow the very next day, Storchak said that talk of a BRICS currency was “utopian” and that the real focus was on setting up “not a bilateral but a multilateral clearing and settlement system in national currencies.”

The bottom line is that such a system based on CBDCs could become (in BIS terminology) “production ready” within 12-24 months – and that this is something worth monitoring. The Russian angle is of interest for two reasons. This is despite Russia joining the CBDC party somewhat later than China and some other EM countries, including various island nations in the Caribbean and Pacific. But Russia is still out of the starting gate with a fully built blockchain-based CBDC platform ahead of most DMs (Sweden being a possible exception). Relative DM reticence in this area stems from concerns about financial stability – or, more precisely, the possibly existential to commercial (especially retail) banks’ business models. DM country authorities might be interested in Russia’s balanced approach here.

In the Russian CBDC scheme, participants must have a bank account from which to transfer funds of up to Rb300,000 ($3,000) per month into their new digital wallets on the CBR’s platform, and the resulting e-rubles cannot be used for lending and deposit-taking but only for payments and transfers, which will be free of charge for retail users while businesses will pay a commission of 0.3% per transaction (very competitive with bank and payment card charges).

Returning to the two Russian angles on the use of CBDCs for global payments: first, Russia might catalyse the operational build-out and take-up of such a system; and second, Russian involvement will help make the expanding use of CBDCs in cross-border payments part of the wider global fragmentation theme surveyed in the round last week by Dario Perkins in his latest Macro Picture.

Both points stem from the combination of Russia’s own sanctions-driven incentive to use and promote CBDC payments and Russia’s importance as a trading partner – mainly for commodity importers, but also as a market now vacated by competing western suppliers and which a CBDC payments network would make it easier for other countries to sell into at lower risk of secondary US sanctions

The first scaled CBDC-based system for international payments is therefore likely to be firmly in China’s orbit. This prospect does not change the overall macro conclusion that global de-dollarisation will be a slow-moving process.

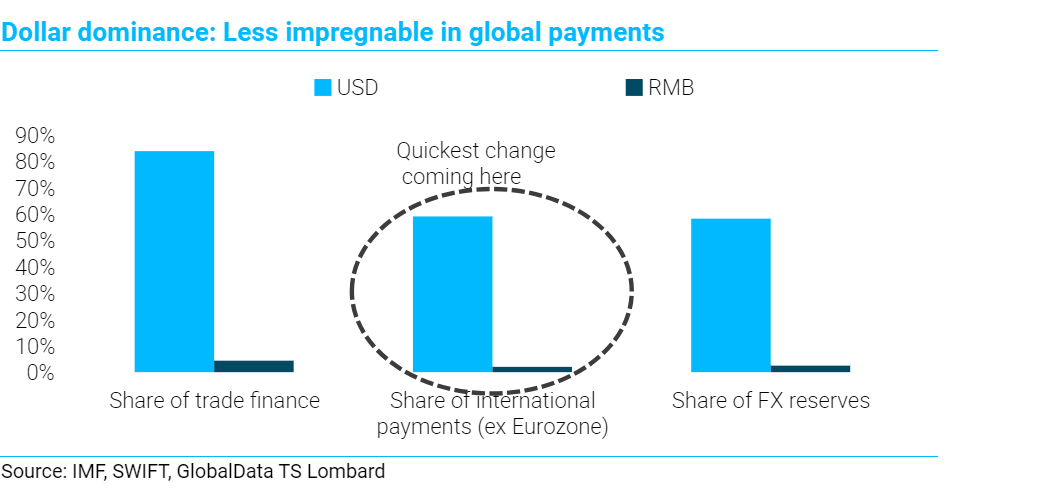

To the extent that this development accelerates the relative decline of dollar-denominated international payments, this will at most have only indirect effects on other, and more important, foundations of the US currency’s dominance – in foreign exchange reserves and international lending for trade and investment.

The central bars in the above chart could therefore shift faster than the lateral ones; and, while contributing to the long-run de-dollarisation trend, this CBDC-driven shift will be more relevant on most investment time horizons as a deglobalisation catalyst.

Christopher Granville is Managing Director, Global Political Research, TS Lombard

This article was initially released as a daily note by TS Lombard, the globally renowned independent economic and investment strategy research provider with a formidable 35-year track record of actionable ideas and since 2022, a division of GlobalData, publishers of RBI.

Related content:

Why would central banks want to issue digital currencies?