Just over 13,000 UK bank and building society branches have closed since the first issue of RBI went to press on 18 May 1981. As RBI looks ahead to celebrate the publication next month of issue number 750, Douglas Blakey looks at the changing face of the UK branch network since RBI was launched

It seems like another world. In 1981, the then big four UK retail banks – NatWest, Barclays, Midland and Lloyds – operated a combined UK branch network of 11,400 outlets.

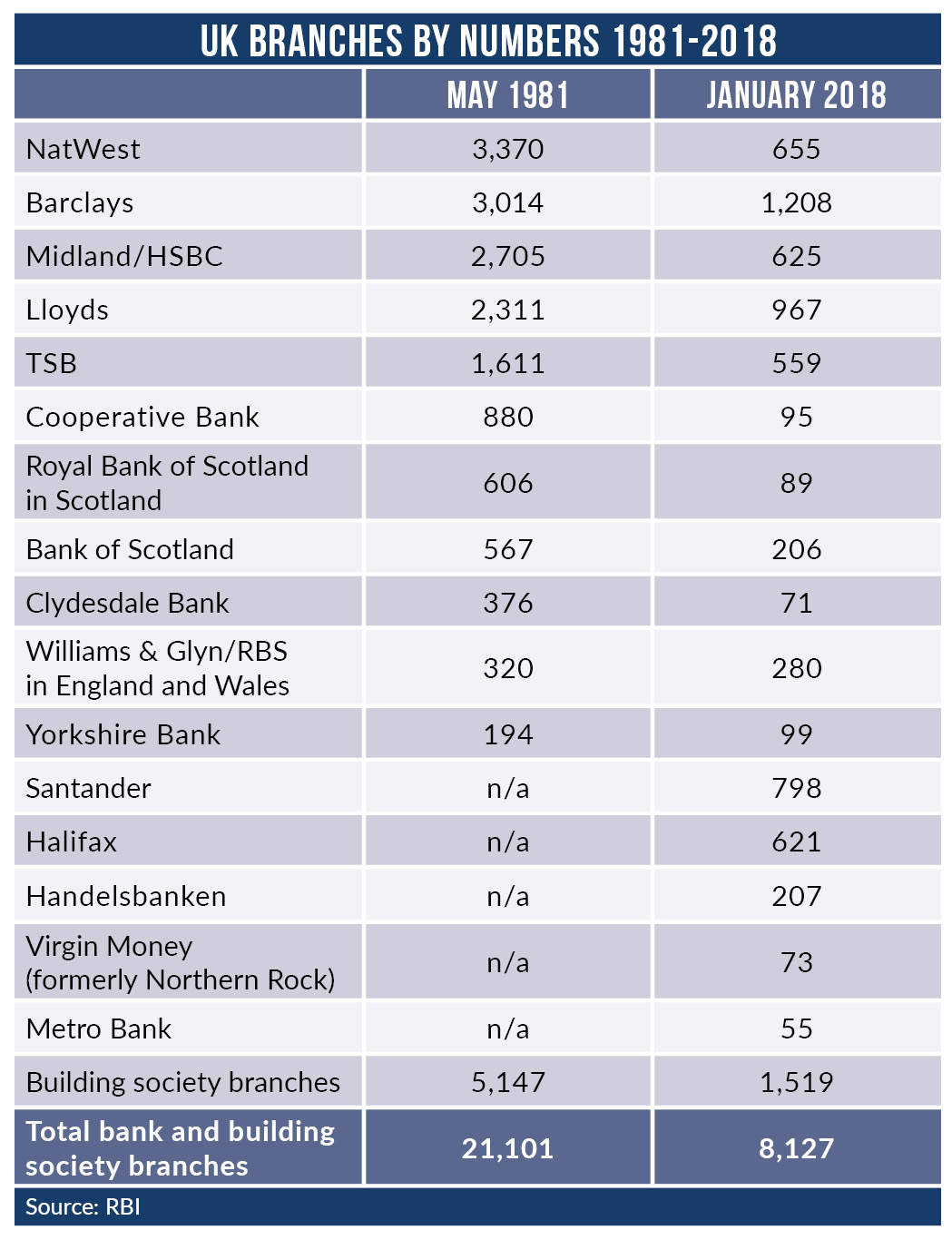

NatWest was some 19 years away from being acquired by Royal Bank of Scotland and boasted a network of 3,370 branches ahead of Barclays with 3,014. Midland, destined to become part of HSBC in 1992, rebranded under its parent moniker in 1999 and ranked third in 1981 with 2,705 ahead of Lloyds with 2,311.

Jump forward to the start of 2018 and Barclays ranks first by brand with 1,208 branches. NatWest has closed 4 in 5 of its branches, shrinking from 3,370 to 655 outlets. Midland/HSBC has closed over 2,000 branches or 3 out of every 4 outlets, reducing to 625 branches.

Lloyds has closed a relatively modest 60% of its branches, reducing from 2,311 then to 967 now.

The ownership structure of the traditional big four has undergone a radical change. Back in 1981, Barclays owned a 35% stake in Bank of Scotland, Midland owned the Clydesdale Bank while Lloyds held a 16% stake in Royal Bank of Scotland.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe three Scottish brands – RBS, Bank of Scotland and Clydesdale – have between them closed more than three-quarters of their Scotland based branches since 1981, almost 1,200 branches in total.

In Scotland, RBS is down from 606 to 89 with Bank of Scotland shrinking from 567 to 206. Meantime, Clydesdale has closed more than 80% of its branches, reducing to 71 from 376.

TSB

In 1981, the TSB was in the process of bringing together around 20 regional savings institutions and developing a nationwide branch network capable of competing with the Big Four. TSB operated 1,661 branches in 1981, against 559 today.

The Cooperative Bank has closed nine in ten of its branches since 1981 with a network today of 95 branches against 880 in 1981.

By contrast, Clydesdale Bank’s sister brand Yorkshire Bank has closed a mere 50% of its branches in the past 37 years, down from 194 in 1981 to 99 today.

The Building Societies

In 1981 there were around 250 building societies in the UK against 44 today. Building society branch numbers in the UK in 1981 totalled 5,147 against 1,519 today.

Legislation in 1986 enabled building societies to offer current accounts and SME loans and to demutualise. The second-largest society at the time, Abbey National converted to a bank in July 1989 and was subsequently acquired by Santander in 2004, re-branding to its parent group in January 2010.

Other significant demutualisation’s included: Cheltenham & Gloucester, acquired by Lloyds in 1995; Alliance & Leicester in 1997, later acquired by Santander in 2008; Woolwich converted to a bank in 1997 and was acquired by Barclays in 2000; Northern Rock and Bristol & West also converted to banks in 1997, the latter being acquired by Bank of Ireland.

Santander today has 798 branches, the branches comprising former Abbey, Alliance & Leicester and Bradford & Bingley outlets; the latter converted to a bank in 2000 and was acquired by Santander during the crisis in 2008.

The biggest demutualisation was the country’s biggest society, Halifax. It converted to a bank in 1997, merged with Bank of Scotland in 2001 to form the ultimately ill-fated HBOS and was acquired by Lloyds in 2009.

The country’s largest society today, Nationwide, accounts for almost one half of all society branches with a network of 680 units; other notable society branch networks include Coventry (87), Yorkshire (70), Skipton (62), Nottingham (60) and Leeds with 53.

Williams & Glyn – RBS England and Wales

The branch network least affected by closures since RBI first published is the one most likely to attract press attention in the coming years: Royal Bank of Scotland’s branch network in England and Wales. Branded as Williams & Glyn, the network comprised 320 outlets in 1981; today the branches are branded as RBS and total around 280 units.

Following the crisis, RBS tried and very publicly and humiliatingly failed to spin off the branches under a plan that would have resurrected the Williams and Glyn (W&G) brand.

As recently as 2016, RBS planned to list W&G on the London Stock Exchange with a then 307 strong branch network serving about 1.4 million retail customers and more than 200,000 SME customers.

It is difficult to envisage RBS wanting to re-brand the existing branch network, around 280 Royal Bank branded branches in England and Wales as NatWest.