The property market in Australia is set for a boost as both major parties offer support to first homebuyers. Past experience with such buyer grants in Australia suggests this will increase first homebuyer lending volume, but will also bring forward lending into the early months of the year. Lenders will need to ensure they are quickly and efficiently processing loan applications so as to take advantage of the limited government support.

Instead of being forced to stump up a 20% deposit, eligible borrowers will be able to obtain a mortgage loan with a deposit of just 5%. First homebuyers will still be borrowing up to 95% of the value of the property and so taking on a larger loan, but the government will provide a loan guarantee on up to 15% so as to bridge the gap between the deposit and the typical 20% threshold. This will prevent the borrower from needing lender’s mortgage insurance (a substantial cost borne by the borrower) and will encourage lenders to take on borrowers with lower deposits, as the government will bear the added risk.

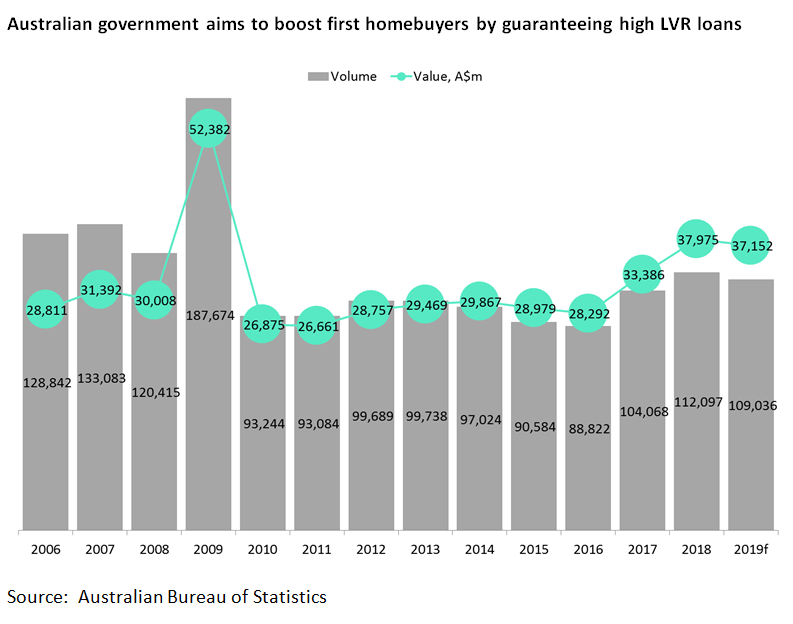

Crucially, the loan guarantee that is being proposed will be limited to 10,000 per year and rationed on a first come, first serve basis, starting in January 2020. As 10,000 mortgages represented just 8.9% of the volume of first homebuyers in 2018 according to the Australian Bureau of Statistics (and is estimated by GlobalData to be closer to 10% in 2019) the impact will be limited. It will certainly increase the average size of first homebuyer loans, which were already rising. The increase in lending volume is also certain as stories of lenders turning away potential borrowers has been a main feature of the Australian mortgage market recently due to the previous tightening of lending standards.

The move will also lead to increased mortgage activity in January, particularly in January 2020. January has been the slowest month for first homebuyer lending commitments in each of the last five years in Australia, as the Christmas break in December and summer holidays in January conspire to ensure only minimal business is conducted. Past experience with the First Home Owner Grant and First Home Owner Boost at the national level suggest buyers will alter their plans to take advantage of the scheme. As demand for the scheme is likely to be substantial while its availability is limited to 10,000 applicants, GlobalData expects prospective buyers to bring forward their buying, boosting January and February mortgage applications.

This will provide support to the property market, boosting demand in the short term as consumers who were marginal risks become eligible borrowers and thus buyers, while some first homebuyers stretch for a more expensive property. The immediate macro-prudential risks to the financial system will be minimal as this risk will sit with the government. Responsible lending guidelines on the suitability and borrowing capacity of loan applicants will still apply. However, longer term it will ensure more high LVR loans are in the system. And if a first homebuyer borrower who had used the scheme wants to remortgage, they will have to ensure they have managed to acquire 20% equity in the property or be ignored by mainstream lenders. This could result in an increase in so-called “mortgage prisoners.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe limited number of grants is one of the most salient points for lenders. The guarantee can help them write more business with no impact on their risk profile, but they need to ensure their borrowers are among the lucky 10,000. With digital lenders in the market like Tic:Toc able to give loan approvals in 22 minutes, speed could make a difference if the scheme is oversubscribed. Lenders with lengthy, inefficient processes for income and expenses verification or approval risk losing out to those lenders that can give assurances of a quick turnaround. This means it is time to invest in slick digital processes now, before the scheme is launched.