ABN Amro’s tactical cost reduction measures and its efforts to adopt an open digital banking platform through new partnerships will enable the bank to reduce outgoings and remain profitable.

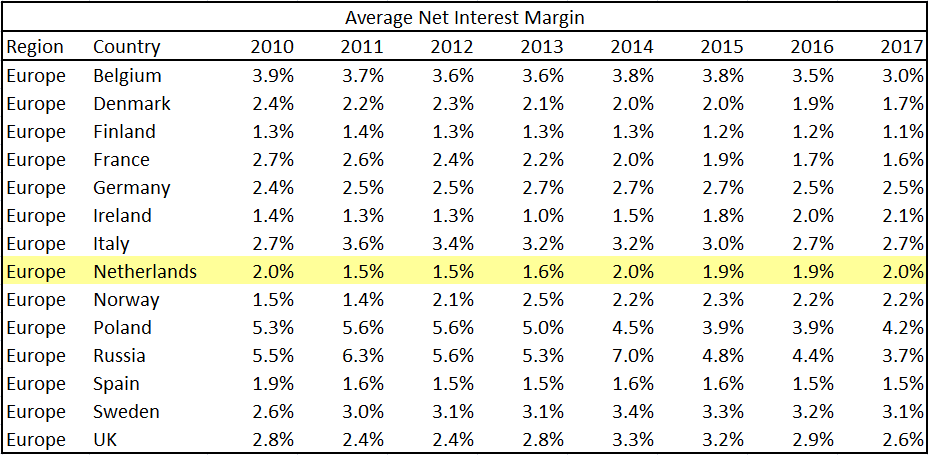

In today’s business environment, profitability is now the most important challenge facing banks globally. According to our Global Retail Banking Analytics, banks in Netherlands have comparatively low net interest margins in Europe, meaning they are not very profitable compared to their regional peers.

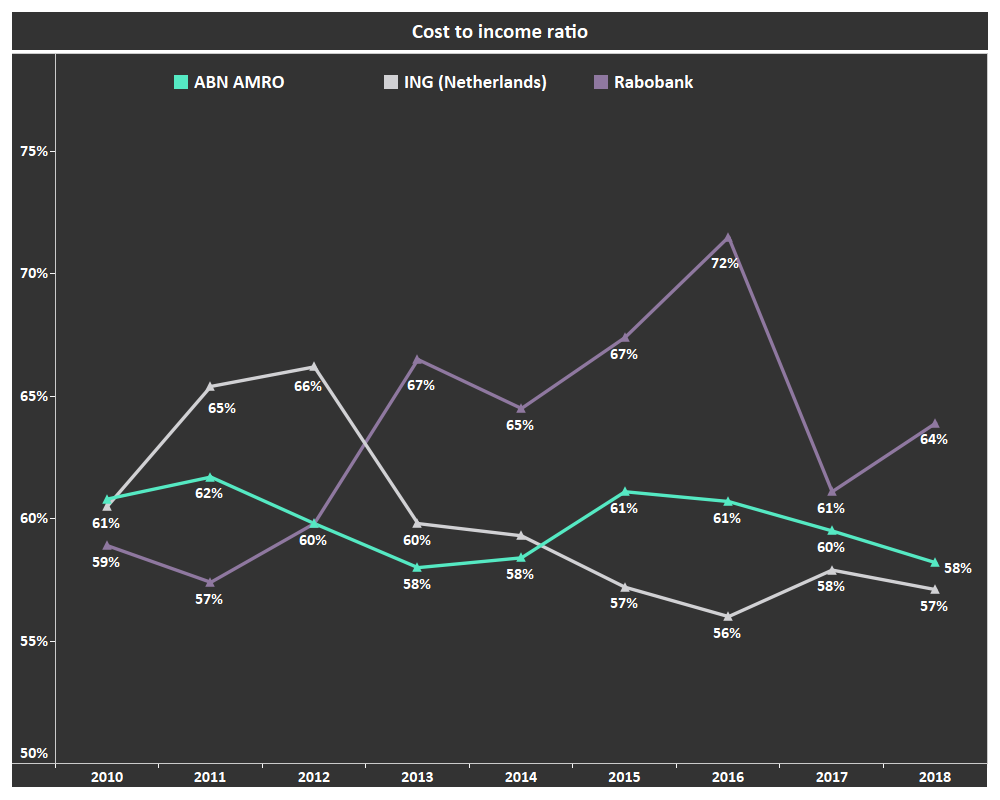

One factor affecting the efficiency in banking are higher cost/income ratios – the ratio of total operating costs to total income. Personnel and IT costs are the largest components of banks’ total costs and are important drivers of cost/income ratios.

IT plays a particularly key role in reducing the ratio. The big banks in Netherlands have renewed their focus on costs over the past few years in order to increase profits. The big three (ABN Amro, Rabobank, and ING) have each reported that their respective investments in digital technology and automation coupled with initiatives to make processes and products simpler and less confusing are improving their efficiency and productivity levels.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

At the forefront of these efforts have been investments in core banking upgrades, with ABN Amro leading the way. In its 2018 annual report, it states that its cost reduction initiatives, driven by technological developments, have proven successful. As shown above, ABN Amro achieved a cost/income ratio of 58% in 2018 by leveraging its new banking platform to drive down costs.

Recently, it has also partnered with banking software company Temenos. With this partnership, the bank is aiming to shift to a single shared digital banking platform, a move that will allow it to cut back on costs and strengthen its cost/ income ratio. All of these efforts ensure the bank is set to reach its 2020 cost/income ratio target of between 56% and 58%, with a goal of under 55% slated for 2022.

ABN Amro’s continuous efforts to reduce costs provide it with a competitive advantage over other players. As pressures on efficiencies continue, other providers in the Netherlands must follow strategic steps to drive similar competences in their banks to remain profitable.