The highly popular Saudi digital wallet stc pay has launched a new digital banking platform in beta, available to join for selected customers, as the first step of transitioning into the first fully digital bank in the Kingdom.

The move aligns with Saudi Arabia’s Vision 2030 ambitions of levelling up the financial services sector through technology. GlobalData’s Current Account Customer Analytics shows that Saudi consumers’ interest in traditional banks has fallen by a half since 2020, when the central bank, SAMA, began the regulating and licensing of non-bank financial institutions in a push to enhance competition in the industry. 36% of Saudis would have chosen a traditional bank for a new account in 2020, gradually declining to just 18% in 2023 as alternative options expand.

GlobalData’s Mobile Wallet Analytics 2023

Saudi Digital Payments Company, founded in 2018 as a subsidiary of Saudi Telecommunication Company, was the first fintech to receive an electronic wallet license from the SAMA in 2020. Since then, stc pay has become the single-most popular mobile wallet after Apple Pay with an 18% share of the Saudi wallet market, according to GlobalData’s Mobile Wallet Analytics 2023. Stc pay is now looking to leverage its first-mover advantage for transitioning into a full-fledged digital bank in a banking market yet to be disrupted.

From the three Saudi providers that so far have obtained digital banking licenses in previous years, stc is the first to offer bank accounts, initially by tapping into its existing wallet user base of approximately 12 million. At its public launch planned for late 2024, STC Bank is well positioned to acquire customers in a market landscape overwhelmingly comprised of traditional banks without sufficiently differentiated offers.

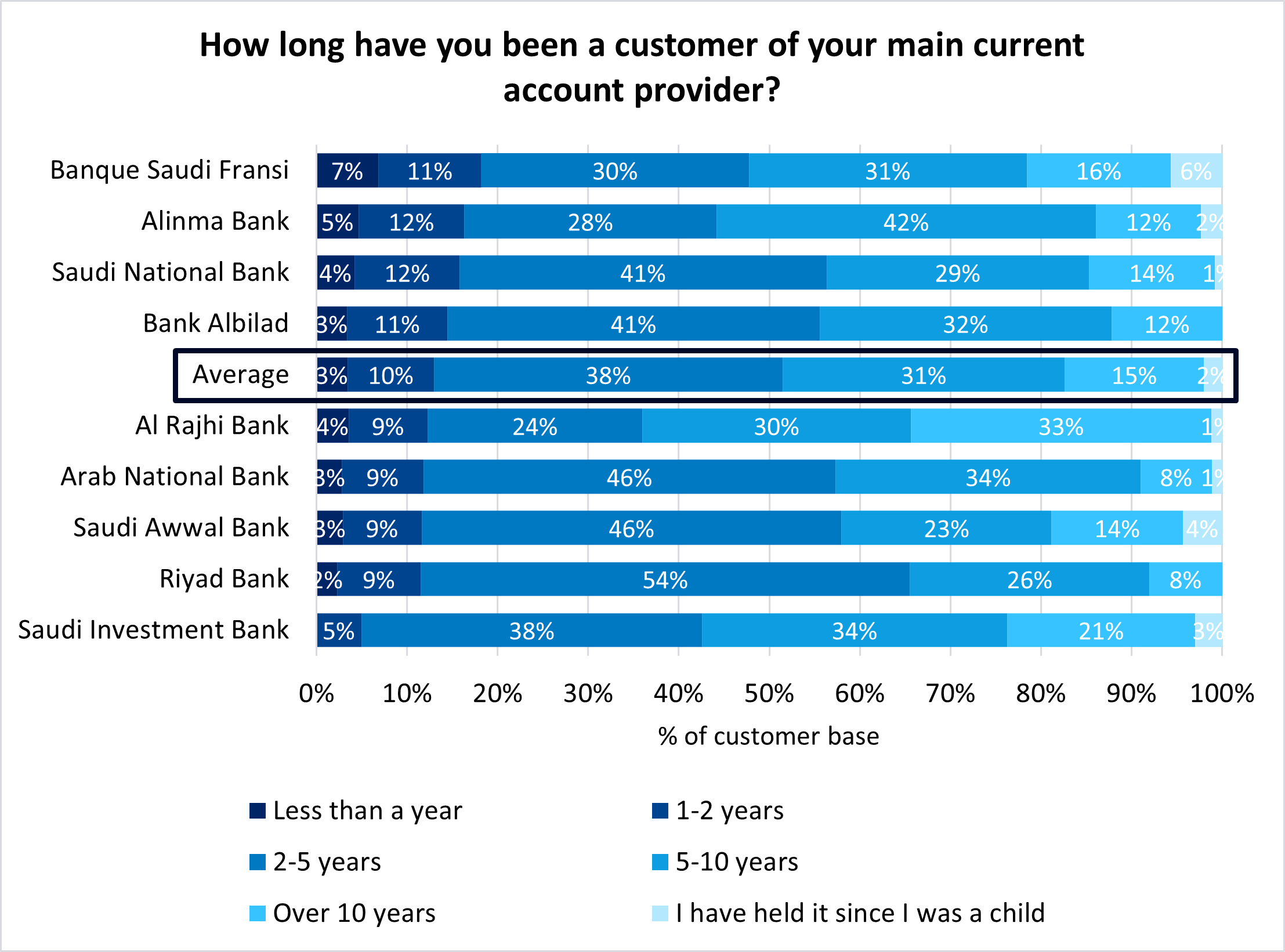

GlobalData 2023 Financial Services Consumer Survey

This lack of differentiation contributed to the high level of willingness to switch providers among Saudi traditional bank account holders. Nonetheless, only 13% of customers on average have opened accounts with incumbent banks within the last two years, according to GlobalData’s 2023 Financial Services Consumer Survey, pointing to a gap in the market for STC Bank to tap into.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSTC Bank aims to compete through superior user experience and is planning to offer a range of Sharia-compliant financial products and services later on. The bank is advised to plan for the strategic rollout of additional products, as successful cross-selling will create valuable long-term banking relationships that will be crucial to determining its position in the Saudi retail banking market.

Blandina Hanna Szalay is an analyst in Banking & Payments at GlobalData