Nubank has entered the next stage of its growth strategy in Colombia. After receiving approval to operate as a financing company in the country in early January 2024, the neobank quickly launched the waitlist for its Cuenta Nu savings account product. This move signals its aim to become the main banking provider of customers—the same successful blueprint Nubank deployed in its domestic market, Brazil.

GlobalData’s upcoming report, Digital Challengers: The Era of Profitability, highlights Nubank’s unprecedented success in disrupting the traditional banking scene in Brazil following its launch in 2013. The neobank achieved this by addressing the complexities and inefficiencies of the local financial system. As a result, Nubank accounts for 17% of Brazil’s main current accounts as per GlobalData’s Current Account Customer Analytics 2023—just 1 percentage point behind market leader Banco do Brasil.

Given its strong domestic position, it is unsurprising Nubank is aiming to capitalise on gaps in other regional markets with large unbanked or underbanked populations. It launched in Mexico in 2019 and Colombia in 2020, initially offering credit cards. Nubank is now in the process of expanding its offering in both nations in a bid to secure main bank relationships.

Cuenta Nu account: 1 million customers within first month of launch in Mexico

As part of this strategy, the high-yield Cuenta Nu savings account was launched in Mexico in May 2023, reaching 1 million customers within one month.

Following on from this success, Nubank is set to introduce the Cuenta Nu account in Colombia, with consumers currently able to sign up to the waitlist. The annual equivalent rate of 13% will instantly make it one of the highest-yielding savings accounts available in the market, which will prove particularly attractive to Colombian consumers.

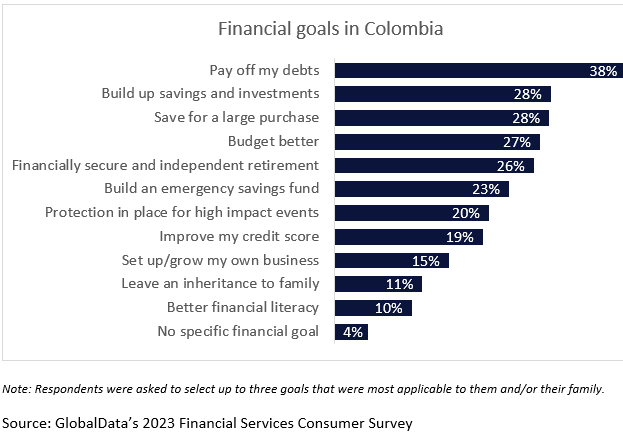

GlobalData’s 2023 Financial Services Consumer Survey found that building up savings and saving for a large purchase are key financial goals of Colombians, behind only debt repayments. As a result, the bank’s aggressive growth strategy that directly meets these goals is likely to prove successful in Colombia.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWith the second-largest population in the region, Colombia is the bank’s fastest-growing market. Nubank reached 800,000 credit card customers in Q3 2023, following 400% growth in 2022, and now covers all areas of Colombia—including locations where such financial services were previously unavailable.

Nubank targets remittances sector in Mexico

Nubank’s ambitions extend beyond bank accounts. In January 2024, the company shifted its attention to the remittances market in Mexico, enabling customers to receive payments from the US via a WhatsApp link. These transfers arrive directly to their Cuenta Nu savings account in Mexican pesos for a fixed fee of $2.99.

If the rollout of Cuenta Nu is successful in Colombia, Nubank may extend WhatsApp remittances to the market in the future, besides an additional deposit account planned to launch next. By expanding the scope of its services in this manner, Nubank is on the right path to becoming a one-stop shop in its new markets—thus securing the crucial main banking provider relationship.

Blandina Hanna Szalay is an analyst in banking & payments at GlobalData