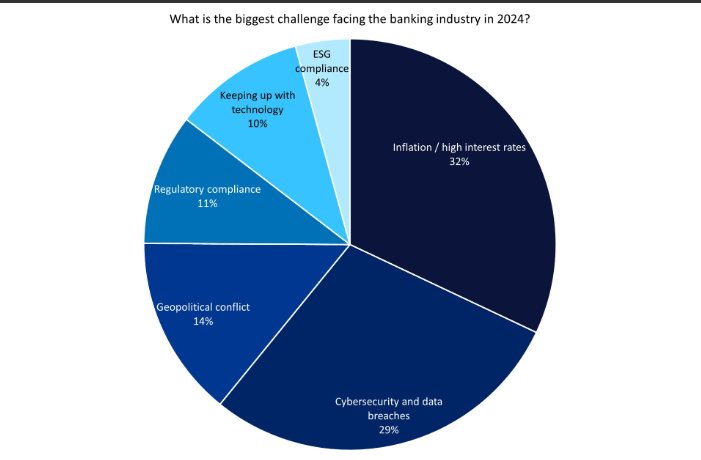

GlobalData polling of banking industry insiders suggests that only economic challenges surpass cybersecurity as the sector’s most important issue in 2024. Recent cyberattacks, including on UK government institutions and JPMorgan Chase (JPM), illustrate the severity of the challenge in combatting cyberattacks and bad actors.

Of the many key issues facing the banking industry in 2024, GlobalData finds that insiders believe inflation/high interest rates and cybersecurity are the two most prevalent. More than 60% of respondents selected these two options. While inflation remains sticky and central banks hold off on rate cuts, the economic situation presents challenges to banks’ operating, funding, and employment costs. However, these issues should subside over time as economies adapt to the ‘new normal’ of the post-Covid landscape.

For cybersecurity, challenges are (and will remain) systemic. JPM leaders Mary Erdoes and Jamie Dimon have spoken regularly about the significance and rapid evolution of the threat of cyberattacks. In January 2024, they revealed the bank employs 62,000 technologists—with many focused on cybersecurity—to combat these threats.

JPM data breach extends to 450,000+ customers

Yet despite the measures taken by JPM to mitigate cyber perils, the firm finds itself subject to a lawsuit following a data breach that was uncovered in February 2024, having exposed more than 450,000 retirement plan participants’ personal information.

This incident could ultimately prove financially costly to the bank; it will certainly be an embarrassment, given JPM’s positioning as a technological pioneer and one of the leading US banks. The case illustrates that, despite the best intentions and exorbitantly high cybersecurity budgets, cyber threats are relentless and can catch out even the top players in the banking sector.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe evolution of digital (and open) banking, growing geopolitical tensions, and the rapid growth of artificial intelligence have coalesced to present banks with a threat landscape of unprecedented scale. Players of all shapes and sizes within the banking space must be prepared for cyberattacks and be willing to continually innovate to stay ahead of the evolving threat landscape.

The financial and reputational damage caused by a data breach can be catastrophic for financial services institutions. We are entering the Code War era, where every digital device—no matter how small—can be weaponised. The potential consequences are dire, and if JPM can fall foul of stringent cybersecurity measures, then the warning to other players should be loud and clear.

Benjamin Hatton is an analyst, financial services, GlobalData