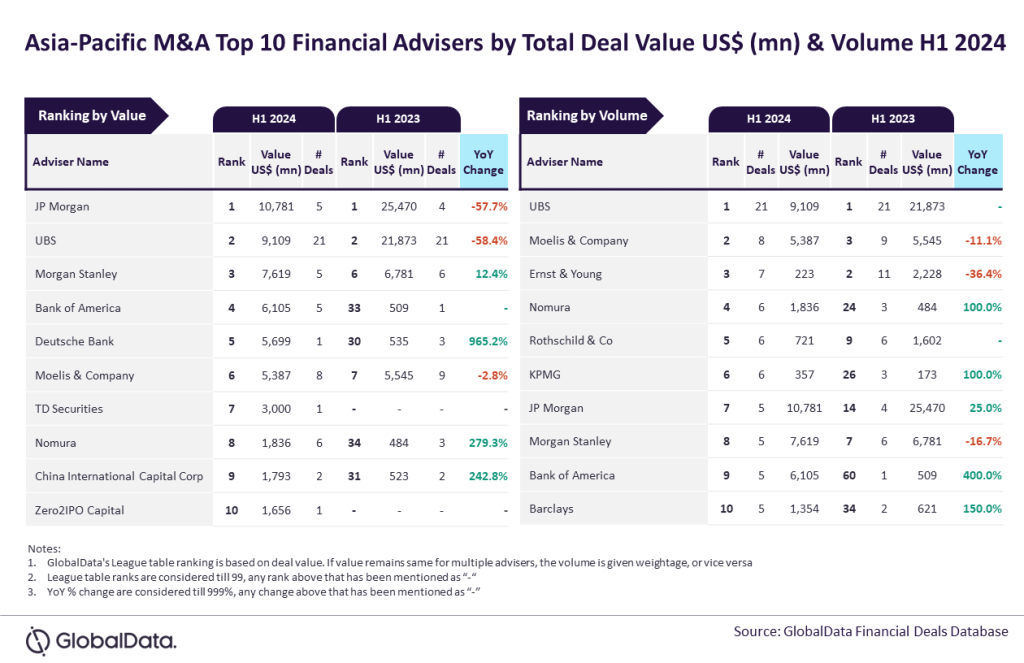

JP Morgan and UBS were the top mergers and acquisitions (M&A) financial advisers in the Asia-Pacific region during the first half (H1) of 2024 by value and volume, respectively, according to the latest financial advisers league table by GlobalData, publishers of RBI, which ranks financial advisers by the value and volume of M&A deals on which they advised.

An analysis of GlobalData’s Deals Database reveals that JP Morgan achieved the leading position in terms of value by advising on $10.8bn worth of deals. Meanwhile, UBS led in terms of volume by advising on a total of 21 deals.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “UBS was the clear winner by volume as it was the only adviser with double-digit deal volume during H1 2024. Apart from leading by volume, UBS also occupied the second position by value in H1 2024.

“Meanwhile, JP Morgan was the only adviser to touch the $10bn mark during the review period. Apart from leading by value, JP Morgan also held the seventh position by volume during H1 2024. Interestingly both UBS and JP Morgan occupied the top spot by volume and value, respectively, in H1 2023 as well.”

UBS occupied the second position in terms of value, by advising on $9.1bn worth of deals

This is then followed by Morgan Stanley with $7.6bn, Bank of America with $6.1bn and Deutsche Bank with $5.7bn.

Meanwhile, Moelis & Company occupied the second position in terms of volume with eight deals, followed by Ernst & Young with seven deals, Nomura with six deals and Rothschild & Co with six deals.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSimpson Thacher & Bartlett and TriLegal were the top mergers and acquisitions (M&A) legal advisers in the Asia-Pacific region during the first half (H1) of 2024 by value and volume, respectively, according to the latest legal advisers league table by GlobalData, which ranks legal advisers by the value and volume of M&A deals on which they advised.