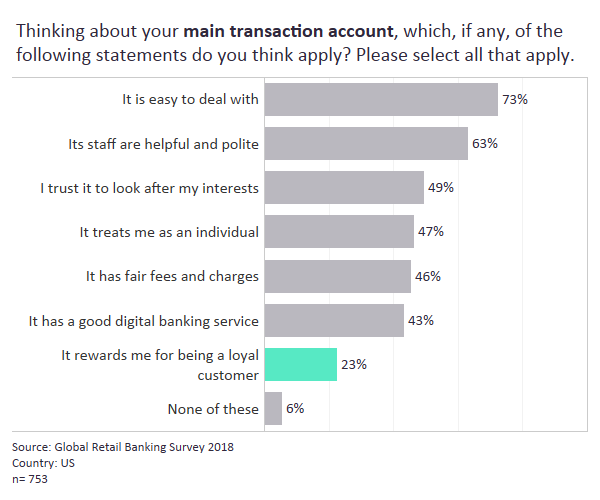

In GlobalData’s 2018 Global Retail Banking survey, consumers’ sentiments towards their main checking account provider reflect the priorities of US banks. Over the past decade, efforts to increase migration onto digital channels have been motivated by cost savings, and a concern that consumer expectations were growing due to interactions with other industries.

The reputational damage suffered by banks following the financial crisis has also encouraged them to be more transparent about the fees they were charging and become more customer-centric. Our survey shows that US banks have succeeded in simplifying customer journeys, acting in more honest and transparent ways while upgrading their digital banking platforms – although there is still room for improvement.

However, as a customer acquisition strategy, the concept of showing appreciation to loyal customers who bring business to the bank has clearly fallen out of favour. This has likely been exacerbated by banks offering better deals to newer customers instead.

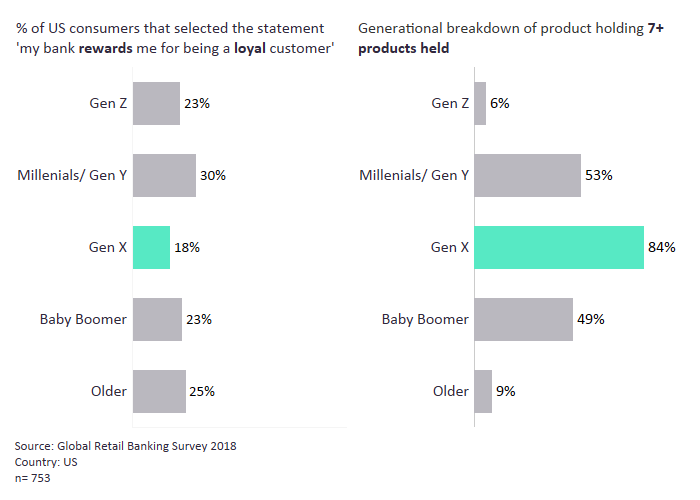

On average, only 23% of US consumers felt they were rewarded for being a loyal customer. This drops to as low as 18% for Generation X consumers, which is surprising given the high product ownership of consumers in this demographic.

While US banks have rightly focused on a strategy that reduces their operational costs and brings their digital platforms in line with other industries, they appear to have done so at the expense of higher value customers. This has created an opportunity for banks that do not have the best digital banking platforms or smoothest customer journeys.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBanks looking to differentiate themselves should re-orientate their acquisition strategies to target Generation X consumers, offering them rewards for transferring their products across.