It’s no longer a question of whether banks should embrace chatbots, it’s about who is already there and racing ahead. Digital savvy entrants have already been challenging traditional banks and now it is bots that can help our age-old banks survive the digital storm. It is exciting times for banks, as bots promise to make use of AI, predictive analytics and cognitive messaging that will help customers make payments, check their balances and even offer advice on saving money. Time to gear up for world-class digital banking!

Tech-savvy new entrants are offering user-friendly financial products that are aligned with the changing digital world, forcing traditional banks to buckle up and innovate digitally. Gartner estimates that by 2020, customers will manage 85% of their association with a business with no human interaction. The biggest challenge for banks now is the competition from tech-savvy companies like Google, Facebook, Amazon and Apple. A well-executed chatbot can, however, change the future of a bank and bring about a new meaning for automation and user experience.

User experience

Banking customers are not known to have the most gratifying of experiences. As such banking applications are complex, call centres overburdened and customers frustrated. Gone are the days when banks only had to reach to a customer’s needs, now they also need to predict their needs. This is where artificial intelligence (AI) and machine learning (ML) step in; they allow chatbots to gather valuable user data with each interaction so that banks can provide personalised experiences.

‘Avenir Banking Bot’ launched this year by Avenir Business Solutions in London can be branded and customised to reflect the bank’s personality. As the bot is linked to an organisation’s back-end system when a customer interacts with a bot, he is immediately recognised, addressed, and engaged.

Here’s a recent case of Shawn G, a store manager who had to repeatedly explain his situation with customer care reps.

“Last month there were a few fraudulent transactions on my credit card. I had to make multiple calls to my bank to raise this issue. On every call, I had to repeat the entire story. It was exhausting,” lamented Shawn.

Such situations can be averted easily as the bot preps the human agent with contextual data and conversation history that it inherently stores in the back-end. As we talk about fraud prevention, note that a bot allows customers to block their cards within seconds over text. Additionally, Avenir Banking Bot can also send out fraud alerts. We know fraud prevention is an important component within a bank’s operational strategy, a banking bot can help save billions.

Conversational banking

In a recent research, customers rated their preference for live chat at 80% versus 20% for telephone. Chatbots such as Avenir Banking Bot are the future of customer service because they can streamline customer interaction, pro-actively boost customer engagement, and give customer the power to communicate through their preferred channels like Skype, SMS, Slack, Facebook, e-mails and more.

An Accenture report indicated that within the next three years, banks will deploy AI as their primary method to interact with customers. Banks can use this power of conversation to establish better relationships with customers, understand and serve them better.

It’s true that conversational banking is at an early stage, but it will only become more widespread with time as natural language processing (NLP), AI and ML become a way of life. Don’t expect chatbots to come right away with the ability to understand the human language. Just like we humans need to be trained before we start conversing, the bots too need to be trained. The earlier you teach the bot to interpret and respond to your customers the faster you are prepared for tomorrows banking. Typically, it can take ML at least a thousand examples to reach an accurate state. Teaching the bot through ample data is the only way we can achieve positive user experiences.

Customer service in the true sense, 24/7

Leading MNC senior manager Brian S said: “My bank kept me waiting for twenty minutes when I rang them to change the registered address for my savings account. That’s pathetic customer service. Time to change my bank!”

His post on social media received hundreds of comments from customers who are fed up with the customer care system of banks. Negative feedback can cause huge damages and any correction exercise can also be expensive.

With AI and ML growing at a tremendous pace, Avenir Banking Bot promises to tackle 90% of customer queries through text. Chatbots are ideal because they allow the banks to program the bot to handle repeatedly asked questions and provide user satisfaction with prompt answers, thus freeing up the expensive customer care executives to handle more complex issues.

With time, bots will get smarter and customers will trust it to answer queries and get their tasks done. For instance, you could change your password within 10s versus a 10min phone call or you could block your lost card within seconds saving you the plight of calling the call centre. It is convenience redefined for the customer and the bank.

Capturing the millennials

Millennials like their interaction with brands, banks and their own work places to be seamless and an almost invisible part of their daily life. Recent studies by Gallup reveal that only 23% of millennials are actively engaged with their bank, making millennials the least engaged generation. Millennials communicate differently than previous generations; they prefer texting over talking and emojis over words.

The Millennial Disruption Survey reveals that nearly half of the millennials surveyed are counting on tech start-ups to overhaul how banks work and nearly 73% millennials are excited about new financial services offered by Google, Amazon, Apple, PayPal or Square than from their nationwide bank.

If banks don’t gear up now, they will be missing out on tremendous opportunity, millennials are estimated to have over £200bn in collective buying power and are predicted to have more than any other generation by the year 2018.

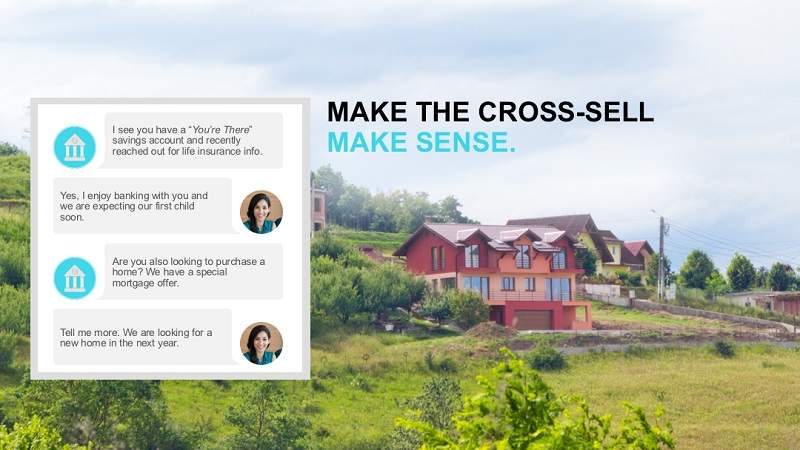

Cross selling

Banks can promote other financial products via bots. If this practise is not as frequent as to annoy the customer, they can remind existing customers of the banking products’ benefits.

Savings galore for banks

Poor customer service by call centres is costing organisations billions, not to mention decreasing loyalty. Avenir Banking Bot can help save more than 75% customer support costs by shifting support conversations from telephone to the chatbot.

Costs of hiring, employee retention and workforce productivity can be reduced drastically with bots stepping in to aid the customer care centre. Avenir Banking Bot is designed to free-up the customer care representative by handling frequently asked questions, handling ticket routeing and so on.

While we are not indicating that a chatbot will replace call centres altogether, it will prevent a call centre from being the only customer service solution. Banks can integrate chatbots with their existing systems as a complementary or alternative solution to personalise and automate their customer service efficiently and cost effectively.

Banks need to gear up, now!

Google CEO Sunder Pichai said: “We are moving from a mobile first world to an AI first world!”

Banks now have just two choices, either to build a chatbot or watch others build a chatbot. What’s your choice?

Avenir Business Solutions, headquartered in the UK is a Technology company serving Enterprises globally and is a Kore.ai Messaging & Bots solution partner. We excel in building NLP and AI enabled chatbots. Recently built Avenir Banking Bot – smarter than the average chatbot, it can be customized to any bank’s workflows and launched within eight weeks.

You can request for a complimentary demo of Avenir Banking Bot here. Reach us at info@avenirdigital.co.uk or +44 (0) 203 7357262.