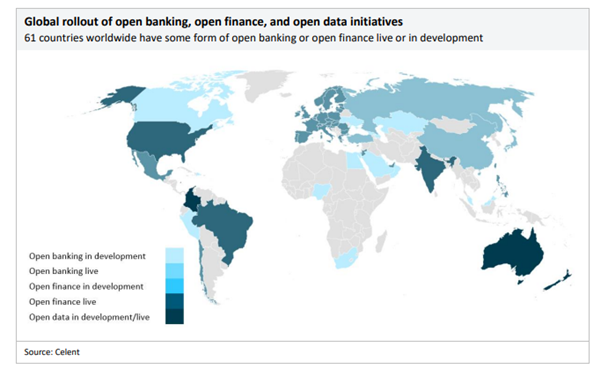

Open banking allows consumers and businesses to share financial data securely with third-party providers through application programming interfaces (APIs). This gives consumers and businesses more control over their financial information and encourages collaboration between FIs and fintechs, unlocking access to a greater range of financial products and services. While open banking is now available globally, regulations, products, providers and the extent of data and operations covered differ widely across markets, and adoption rates in many regions continue to be lacklustre.

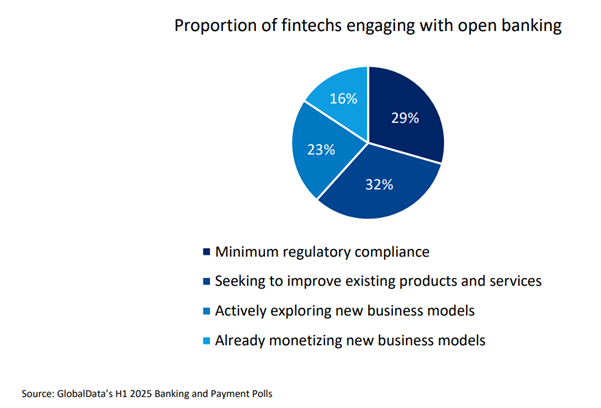

Key factors driving low adoption rates compared to traditional payment methods include consumer awareness, security concerns and a passive approach by Fis. According to GlobalData, the number of banks, payment service providers (PSPs) and fintechs actively developing open banking-powered products and services globally has underperformed relative to expectations when the first regulation was passed by the EU in 2015. A 2025 GlobalData survey found that 29% of financial services companies around the world are simply conforming to the regulatory minimum, reinforcing the importance of government and regulatory leadership in encouraging industry transformation[i].

Europe stands apart in terms of development because it was an early mover on regulation. The EU’s PSD2 and subsequent policy work created clearer rules and incentives, which in turn encouraged banks, fintechs and merchants to build real products on top of open‑banking APIs. Reflecting that regulatory head start, GlobalData reports higher commercial activity in Europe than the global average: 19% of European respondents say they are already monetising open‑banking models, and a further 41% are actively transforming products and services beyond the regulatory baseline.

This does not mean European regulation has single‑handedly driven global adoption, but it does show that a consistent regulatory framework helps accelerate commercial experimentation and scale. Where rules are clearer and standards more consistent, firms are likelier to invest in product development, partner ecosystems and customer experience.

Key barriers to wider adoption

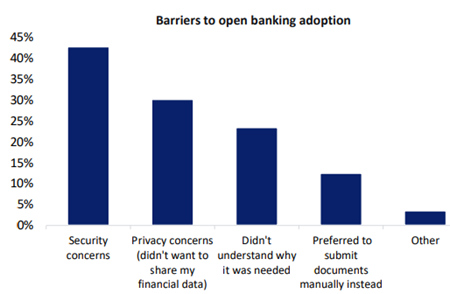

Many FIs still treat open banking primarily as a regulatory obligation rather than a strategic revenue opportunity. That limits investment in user experience, product development and commercialisation. In addition, many banks are hesitant to participate fully in open banking initiatives due to concerns about security and the implications of sharing customer data. According to GlobalData’s 2025 Financial Services Consumer Survey, more than a third of consumers remain hesitant to use open banking, largely due to concerns over privacy and security. With financial fraud on the rise, FIs face challenges in persuading these consumers to share their data.

On the technical side, legacy IT infrastructure and FIs with ageing systems face costly and time‑consuming upgrades, while inconsistent API standards across jurisdictions add to integration overheads and slow roll‑out, making it harder to deliver reliable, seamless experiences at scale. A related issue is the relative scarcity of compelling use cases beyond payments. Account‑to‑account (A2A) transfers, pay‑by‑bank and variable recurring payments (VRPs) are clear commercial winners because they solve immediate pain points. Other applications have yet to demonstrate such tangible benefits.

In addition, market fragmentation raises the cost and complexity of scaling successful propositions internationally. Differences in regulation, technical standards and market practices between jurisdictions mean that a product that works in one country often needs significant adaptation for another. For global FIs, that fragmentation increases development costs and slows the path from pilot to profitable scale. Addressing such barriers through clearer strategy, consumer trust-building, modular technology and targeted use cases will be essential if open banking is to move to full commercial reality.

Where open banking is winning today

Yet open banking has scored visible commercial successes, for example in the payments space. A2A transfers, pay-by-bank solutions and VRPs have matured more quickly than other use cases because they offer immediate, measurable benefits to both merchants and consumers, improving merchants’ cash flow and reducing working capital strain, while giving consumers a clearer, real‑time view of their balances and outgoings.

For lenders, enriched transaction data gives underwriters a far more granular picture of a borrower’s income and spending patterns than traditional credit bureau data alone. This improved visibility supports faster, more accurate affordability assessments, enables more dynamic pricing and opens up lending opportunities to customer segments that were previously hard to profile.

For customers, account aggregation provides a single, consolidated view of finances across multiple providers and allows highly tailored guidance, including personalised product recommendations, to boost engagement and loyalty.

What can financial institutions do to improve uptake of open banking?

To turn open banking from a regulatory obligation into a source of revenue, financial institutions must treat it as product-led change rather than a compliance checklist. This means reframing open banking as an enabler of revenue-generating propositions, with success measured by commercial metrics such as active users, transaction volumes, and revenue per user and retention, not just regulatory uptime.

Making pay-by-bank as seamless and familiar as card and wallet checkouts is central to adoption with user experience matching customer expectations of one‑click flows, instant confirmation and clear consumer-protection messaging. Merchant acquisition is equally important and FIs should demonstrate the commercial benefits of notably lower processing costs, faster settlement and fewer chargebacks.

When it comes to building consumer trust, consent flows should be transparent and privacy notices easy to understand, with data-sharing requests paired with tangible, immediate benefits such as lower rates, faster decisions or bespoke offers, so that consumers can see direct value in granting access.

How can financial institutions monetise open banking?

Using enriched transaction data to create smarter and higher‑value products, as well as more accurate credit scoring and personalised pricing, allows institutions to make better lending decisions and offer timely, relevant products to consumers, such as overdraft alerts or refinancing. Analytics can also examine spending trends, savings and personalised offers, increasing engagement and improving cross-sell.

Monetisation opportunities also arise through platform and partnership models. Banking-as-a-service and embedded finance enable FIs to partner via APIs and charge per API call, take a revenue share or levy subscription fees. Marketplace models, where fintechs and third parties sit on an institution’s platform, generate commission or referral income. With appropriate consent, data-enabled services such as premium cash‑management analytics can be offered to corporate clients for a fee.

However, practical implementation requires scalability. Modularising the open‑banking stack enables roll-out of components, such as payments and data access, market by market without rebuilding core infrastructure. Wherever possible, institutions should adopt or help shape common API standards to lower integration costs for partners and accelerate time to market.

By prioritising segments where open banking delivers clear and immediate value, such as small and medium enterprises that benefit from instant reconciliation and faster payments, underserved but creditworthy customers can be better assessed through transactional data. Testing different pricing models like free tiers, transaction fees and subscriptions can measure willingness to pay and identify sustainable monetisation approaches.

Finally, investment in go‑to‑market capability and change management will determine success. Partnering with fintechs can speed product development, but distribution and customer experience ownership should remain with the institution. Frontline staff and relationship managers must be trained to explain benefits, address concerns and convert cautious customers into active users. Institutions that combine product focus, technical modularity and clear commercial metrics will be best placed to transform open banking.

Using business intelligence

FIs can unlock significant value and position themselves to capitalise on opportunities within the open banking ecosystem. FIs can enhance customer experiences, develop new revenue streams and improve operational efficiencies. Furthermore, the integration of open banking into their business models can facilitate partnerships with fintech companies, enabling FIs to offer more personalised and diversified financial products and services.

As the global banking landscape continues to evolve, those institutions that proactively adapt to and embrace the open banking paradigm will likely emerge as leaders in the financial services industry, driving growth and delivering enhanced value to their stakeholders. Mastercard Business Intelligence offers powerful tools to help firms of all sizes stay competitive, make insight-driven decisions and thrive in a rapidly changing landscape. Log in with your Mastercard Connect credentials here to explore our full suite of business intelligence solutions. Or, if you don’t have access yet, request your credentials here today.

[i] GlobalData: Analyst Briefing: Open banking implementation remains low globally; highlighting the need for updated regulatory requirements, October 2025