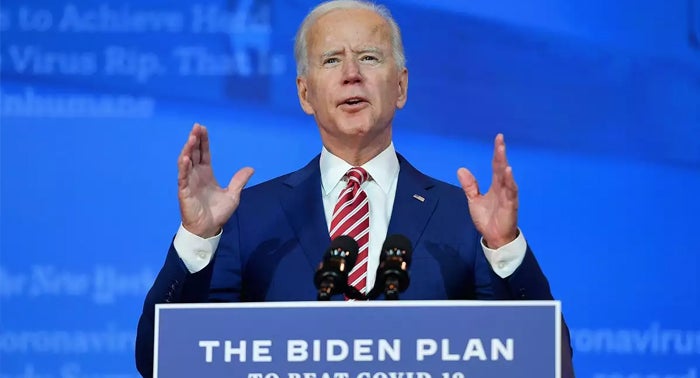

US President Joe Biden signed an Executive Order to promote competition in the economy. The move will push the Federal Reserve and the Department of Justice to strengthen scrutiny of proposed bank mergers, which will likely reduce deal activity in the banking sector.

The order will also encourage the Consumer Financial Protection Bureau (CFPB) to enable customers download banking data. This will help the consumers to switch banks more easily, fuelling competition.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

According to the White House, the US lost 70% of the banks it once had in the last four decades.

More than 10,000 banks closed, a majority of which due to mergers and acquisitions.

Furthermore, federal agencies have not formally denied a bank merger application in more than 15 years.

However, such mergers and related closures disproportionately affected certain communities.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Excessive consolidation raises costs for consumers, restricts credit for small businesses, and harms low-income communities. Branch closures can reduce the amount of small business lending by about 10% and leads to higher interest rates.

“Even where a customer has multiple options, it is hard to switch banks partly because customers cannot easily take their financial transaction history data to a new bank. That increases the cost of the new bank extending you credit,” a statement read.

During the previous US administration, the number of bank deals surged due to friendly regulatory policy, reported Reuters.

Around $47bn worth of deals were announced this year alone, according to a Bloomberg report.