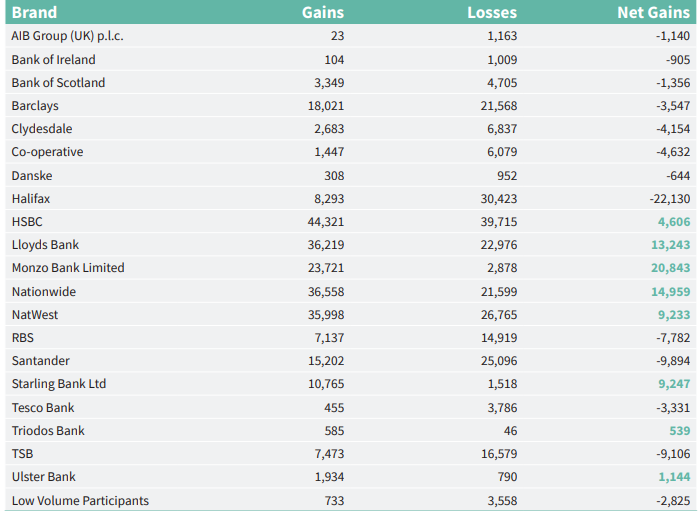

UK current account switches for the year to end March 2020 total 1,017,354, up 10% year-over-year. Notably, Monzo has the highest net switching gains for the first time, followed by Nationwide and Lloyds. Starling Bank and NatWest are in fourth

and fifth respectively for net switching gains.

On the other hand, Santander, TSB and Halifax are the three biggest losers.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

February saw the highest monthly total of business account switches on record. Business switching volume totals between January 2020 and March 2020

is up 52% compared to the previous quarter.

The Current Account Switch Service has now completed 6.6 million switches since launch. Over 113,000 switches took place in March 2020 alone. That is the highest monthly total since March 2016 and the third highest ever recorded.

Awareness and satisfaction levels for the switch service remain above the regulatory targets at 79% and 92% respectively.

UK current account switches: age is the key difference

The key difference in switching behaviour continues to be the age of the consumer. In the past three years, of those who switched over the age of 45, 70% used the Current Account Switch Service. This figure drops to 45% for those aged 34 and under and 36% of those under the age of 25.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData