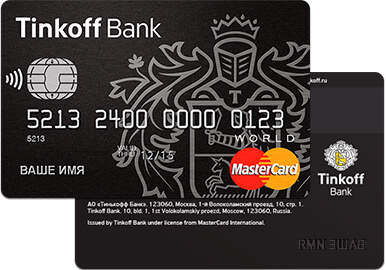

Tinkoff Black-card customers can now open multiple accounts in up to 30 currencies at a time.

Moreover, Tinkoff Black customers can instantaneously exchange money between currencies at attractive rates.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The currency mark-up for Tinkoff Black customers is rarely above forex market rate plus 0.5%.

Russia’s Tinkoff Bank is adding 26 currencies to the already available Russian rouble, US dollar, UK pound and Euro.

New currency accounts can now be opened via the Tinkoff mobile app for iOS. The service will be available later this year across the Android platform.

Tinkoff Black: links to Apple, Samsung and Google Pay

Tinkoff customers can also link their multi-currency cards to Apple Pay, Samsung Pay and Google Pay.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAnatoly Makeshin, Head of Payment Systems and Vice President of Tinkoff Bank, said: “Tinkoff Bank customers are active travellers. They use Tinkoff Black multi-currency cards on their international journeys.

“With 30 currencies now on the list, we give our clients a long-awaited opportunity to use Tinkoff Black more often, no matter where they choose to go.

“Holders of this easy-to-use multi-currency card do not have to worry how to best exchange their money while travelling. This option is now available in their smartphone. You first transfer money to the right currency account at an attractive rate. Customers can then link it to the card and continue using Tinkoff Black as usual.”

Tinkoff is Russia’s first and largest direct bank with around 7 million customers.

Tinkoff Bank is the second largest player in the Russian credit card market, with a market share of 11.7%.

In June, Tinkoff Bank CEO Oliver Hughes, told RBI: “We are opening over 400,000 accounts per month across all products. In consumer current accounts, we are opening 120,000 new accounts per month.”

Tinkoff is successfully disrupting the existing market, while its current account net promoter score of +57 is sector-leading.

Tinkoff is on track to report net income growth per year in the 20- 40% range to the end of fiscal 2019.