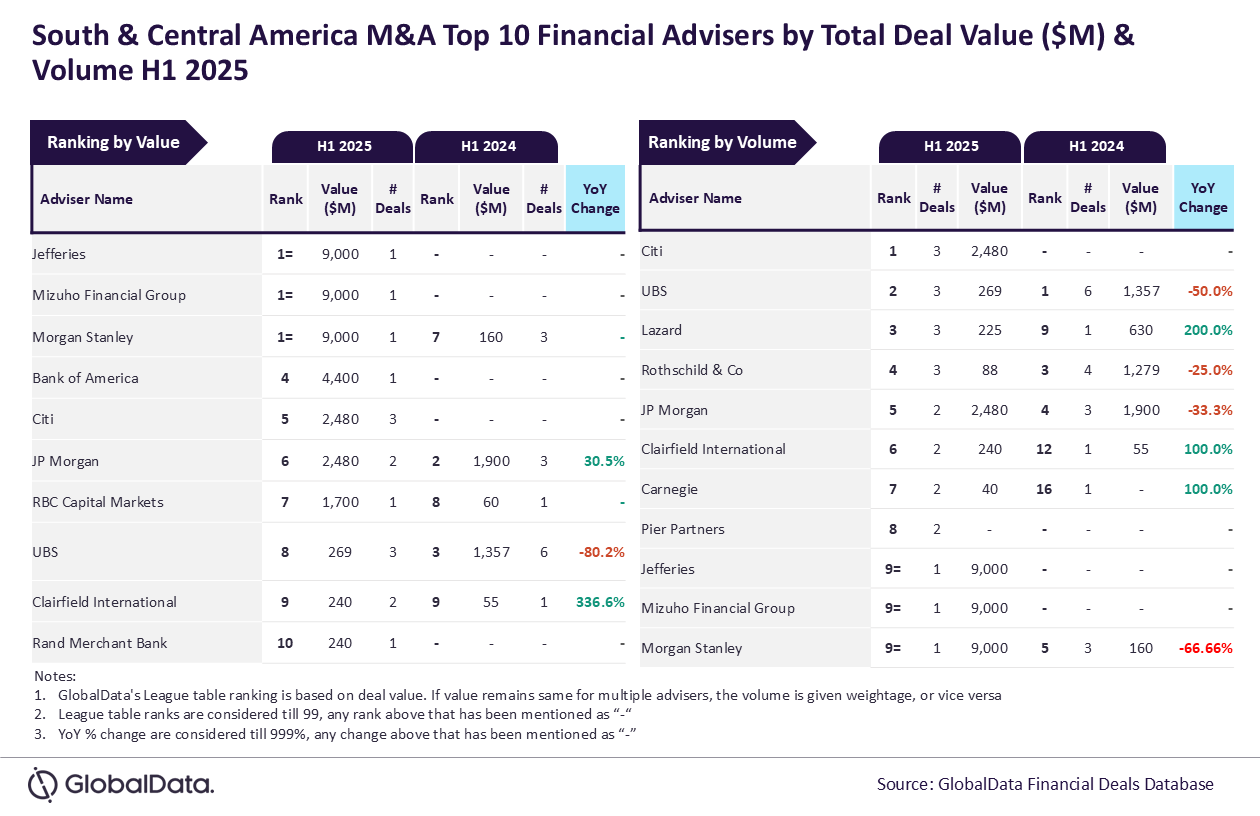

Jefferies, Mizuho Financial Group, and Morgan Stanley have emerged as the leading mergers and acquisitions (M&A) financial advisers by value in the South & Central America region for the first half of 2025, according to GlobalData’s latest league table.

The analysis of GlobalData’s deals database shows that Jefferies, Mizuho Financial Group, and Morgan Stanley each advised on a deal worth $9bn, securing the top position by value.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Meanwhile, Citi led in terms of deal volume, by advising on a total of three deals.

GlobalData lead analyst Aurojyoti Bose said: “Jefferies, Mizuho and Morgan Stanley advised on only one deal but still were significantly ahead of their peers in terms of value during H1 2025. Involvement in the $9bn Brookfield-Colonial Enterprises deal helped them secure the top spot by value. Apart from leading by value, these three firms also occupied the ninth position by volume during H1 2025.

“Similarly, Citi, apart from leading by volume, also occupied the fifth position by value during H1 2025.”

The UK-based GlobalData’s deals database further reveals that Bank of America ranked fourth in terms of value, advising on a $4bn deal.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCiti followed closely with $2.5bn worth of deals, demonstrating its presence in both value and volume metrics.

In terms of volume, UBS secured the second spot by advising on three deals, alongside Lazard and Rothschild & Co, which also advised on three deals each.

JP Morgan completed the top-five list with two deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.