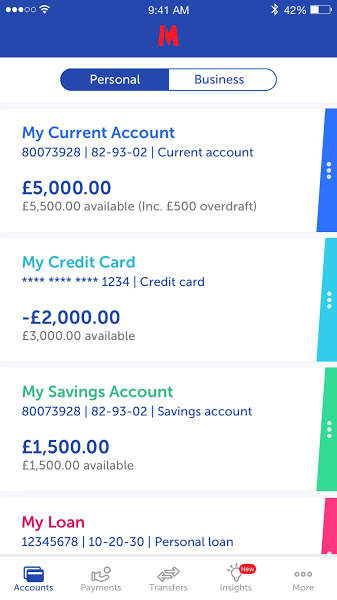

Metro Bank Insights is now live. Using AI to generate bespoke tips and alerts, the in-app tool enables personal mobile customers to manage their money more effectively.

Developed with Personetics, Insights is an opt-in tool. It applies predictive analytics to users’ spending patterns, which is then translated into tailored prompts. As well as alerts that anticipate customers’ spending, users will be able to see a breakdown of where their money goes each month, delve into individual spending categories, and receive bespoke tips about how to manage their finances, based on their specific circumstances.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Metro Bank Insights alerts include informing customers when there is not enough money in their account to cover likely spend. Other Insights include alerts when there is a change in the amount of money paid to a regular supplier. It also flags up to customers when they have been charged twice for the same item.

Metro Bank Insights: making money management straightforward

Paul Riseborough, Chief Commercial Officer at Metro Bank said: “Life is busy at the best of times. Insights is all about using technology to make customers’ lives easier. It saves them time and provides a helpful nudge when they need it the most. Whether your account needs a top up to avoid you straying into an overdraft, you’re looking for a breakdown of how much you spent on a recent holiday or you simply want to know when you got that refund, Insights makes managing your finances straightforward.”

Metro Bank’s Insights delivers immediate value to customers. It provides an important step towards a future of self-driving finance that positions the bank as a trusted advisor.”

The tool is launching with more than 20 individual insights.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOther lenders to use Personetics AI tools include UOB, Israel Discount Bank, Societe Generale and Royal Bank of Canada.