Japanese firm Line has launched a digital banking platform in Indonesia to further expand its fintech footprint.

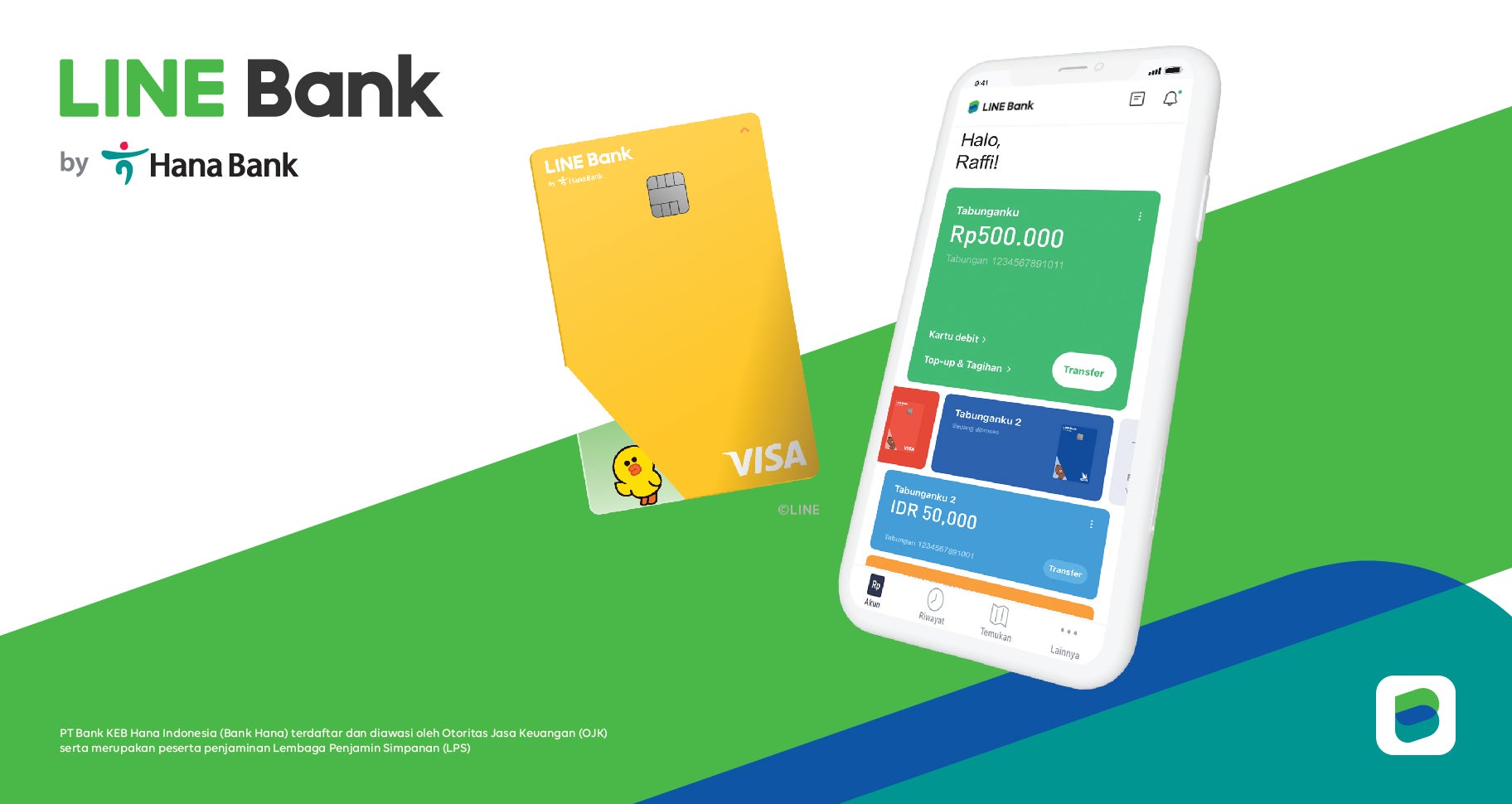

The banking platform, Line Bank by Hana Bank, was rolled out by a collaboration between PT Bank KEB Hana Indonesia, a subsidiary of South Korea’s Hana Bank, and Line Financial Asia.

The newly launched lender will offer deposit, debit cards, fund transfer and bill payment services among others.

Line Financial Asia COO Young Eun Kim said: “The demand for digital transformation in the banking industry is growing rapidly all around the world. In Indonesia in particular, due to this market’s unique geographical characteristics, we believe bringing banking services to people’s mobile phones will greatly increase their availability and convenience.

“Through Line and Hana Bank working together, we will do our best so the Indonesian people can use Line Bank to enjoy a more convenient financial life.”

Line Bank Services:

Customers can open savings accounts by completing eKYC. The accounts will offer no-fee transfers and withdrawals, and will have no monthly admin fee. Additionally, the customers can conduct cardless cash withdrawals from Hana Bank’s ATMs.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe lender will also offer time deposits starting from IDR1m ($70).

Line Bank plans to expand its product portfolio to include loans, partnership loans and QR payments.

Indonesia is the third market after Thailand and Taiwan where Line Bank commenced services.

Recently, Indonesian digital challenger Bank Jago tapped Mambu’s cloud platform to power banking services.