Despite the economic turbulence if the past three years, the GCC’s banking sector is enjoying a broadly stable outlook that reflects the strong fundamentals of the larger financial systems in the region, which lend it resilience to the challenges arising from slower economies and weaker profitability, writes John Bambridge

Heading into 2018, concerns over the impact on balance sheets of the implementation of International Financial Reporting Standards 9 and the introduction of 5% VAT in Saudi Arabia and the UAE have meanwhile been somewhat mitigated by the rise in oil prices.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Income growth

As head of research at U-Capital Hettish Karmani notes: “We expect the GCC banking sector to witness a sizeable growth in income this year as a result of increasing oil prices, which will hand them more deposits, along with continued improvement in spreads in the wake of rising interest rate environment – as signalled by the US Federal Reserve and generally followed by central banks in GCC.”

Whether banks benefit from the rise in interest rates remains highly dependent on their positioning with respect to their assets and liabilities.

Profitability

Regardless, profitability remains an issue that is expected to weigh on the banking segment throughout 2018 and into 2019.

With rising overheads and limited means by which to further raise lending and earnings, banks must find ways to cut costs.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOne focus for the banks is the development of financial technology and other service-based technologies as potential sources of cost savings.

M&A activity

Another route forward for banks lies in mergers and acquisitions (M&A), which could allow for considerable cost-cutting at a local level, or offer lenders the opportunity to expand.

In 2018 alone, the mere frequency of M&A discussions in the Gulf is indicative of the seriousness with which the option is being considered by regional banks.

Karmani adds: “Macroeconomics trends, changing regulations, consumer behaviour and the widening gap between big and small players are having an impact on the GCC banking sector at both the operational and strategic level. With such challenges, many banks are expected to pursue the M&A route.”

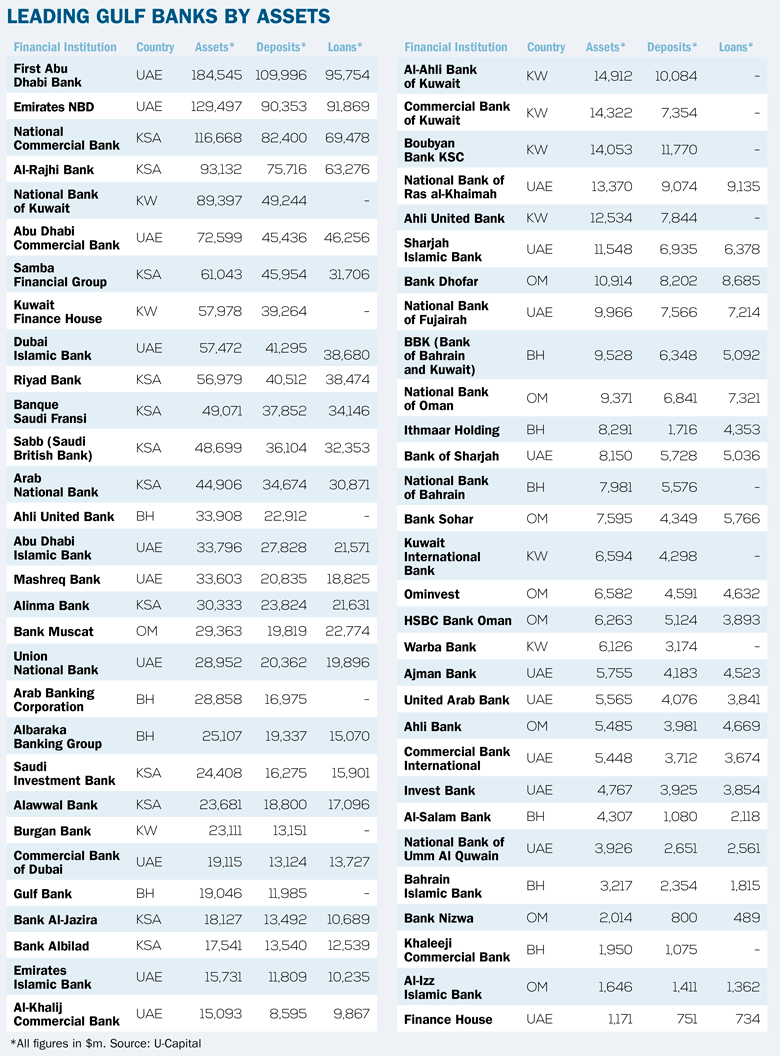

Gulf banks by assets

John Bambridge is features & analysis editor at www.meed.com. MEED is sister publication of Retail Banker International and is a leading source of high-value business intelligence and economic analysis about the Middle East and North Africa. To access more MEED content register for the 30-day Free Guest User Programme.

https://www.meed.com/registration/