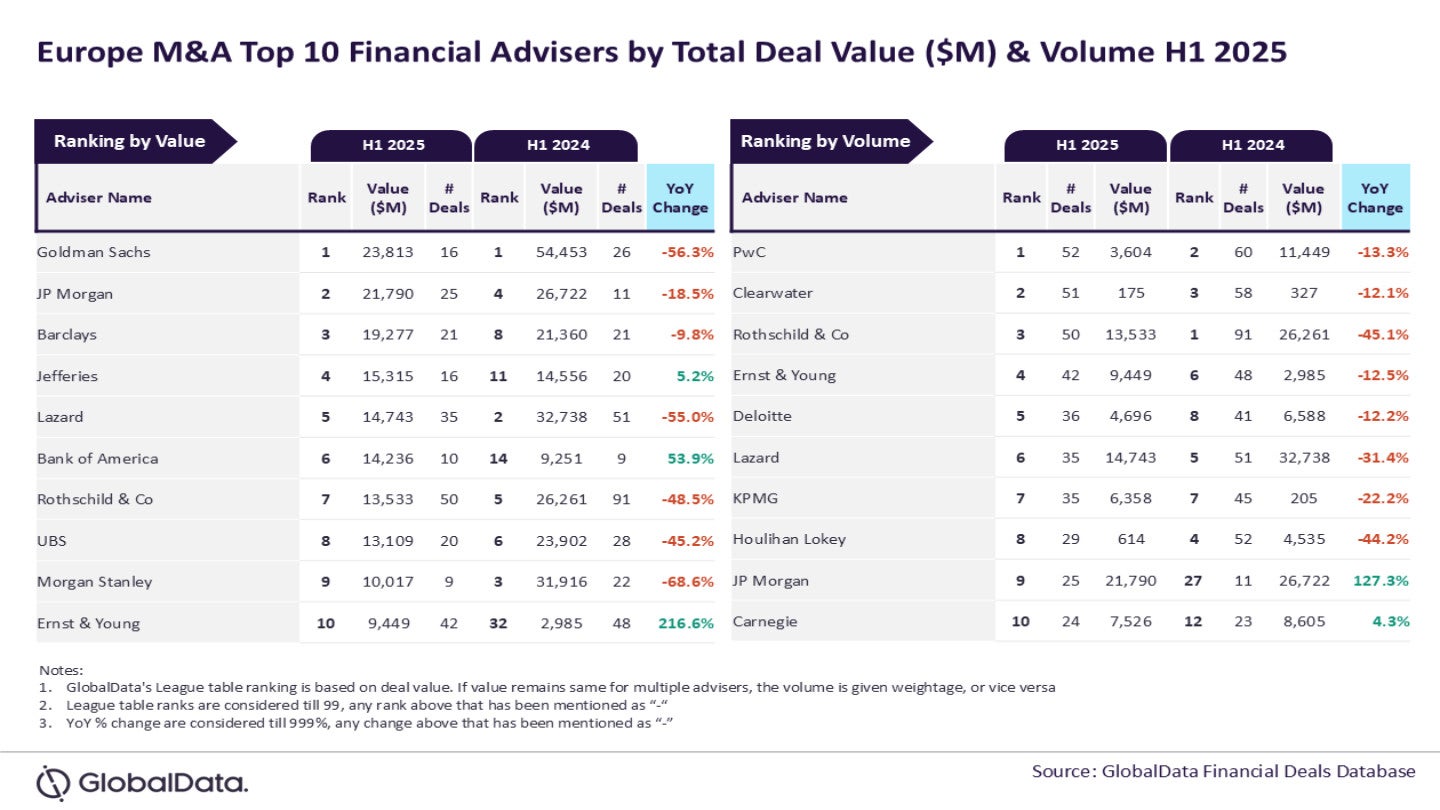

Goldman Sachs and PwC have emerged as the leading financial advisers in the mergers and acquisitions (M&A) sector in Europe for the first half (H1) of 2025, according to data and analytics company GlobalData.

The financial advisers league table, which assesses firms based on the value and volume of M&A transactions, indicates that Goldman Sachs topped the rankings by deal value, while PwC led in deal volume.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Goldman Sachs advised on transactions amounting to $23.8bn and PwC facilitated a total of 52 deals.

GlobalData lead analyst Aurojyoti Bose said: “Goldman Sachs was the top adviser by value in H1 2024, and despite registering a year-on-year drop in terms of value, it managed to retain its leadership position by this metric in H1 2025 as well. It is noteworthy that seven of the top ten advisers by value registered a decrease in the total value of deals advised by them during H1 2025 compared to H1 2024.

“Similarly, eight of the top ten advisers by volume registered a decline in the total number of deals advised by them during H1 2025 compared to H1 2024. In fact, PwC also registered a decline; however, despite that, its ranking by volume improved from the second position in H1 2024 to the top position in H1 2025.”

In terms of value ranking, JP Morgan followed closely behind Goldman Sachs, advising on $21.8bn worth of deals. Barclays ranked third with $19.3bn, while Jefferies and Lazard secured fourth and fifth positions, advising on $15.3bn and $14.7bn, respectively.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn terms of ranking by volume, Clearwater ranked second with 51 deals, while Rothschild & Co came in third with 50 deals. Ernst & Young and Deloitte followed, advising on 42 and 36 deals, respectively.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.