More than 60% of 18-30-year olds are considering changing banks in 2021, has revealed an annual survey on banking fees and expectations in France.

The survey by Neobank Vaultia questioned more than 15,000 participants and compared the results with the previous year. The answers indicate notable changes of opinion in just one year, especially among the young.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Young people are paying more and more attention to banking fees.

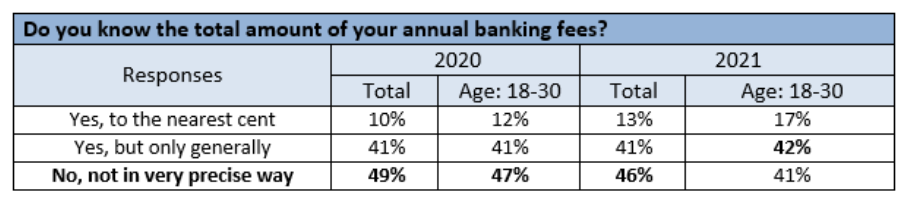

Nearly 46% of French people don’t know the exact amount of their bank charges compared to 49% from the previous year.

However, young people (18-30) seem a lot more attentive to their bank statements, with 42% having a vague idea of their annual fees (41% in 2020) and 17% knowing exactly how much they are paying (against 12% in 2019).

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMore customers are willing to talk to their banks

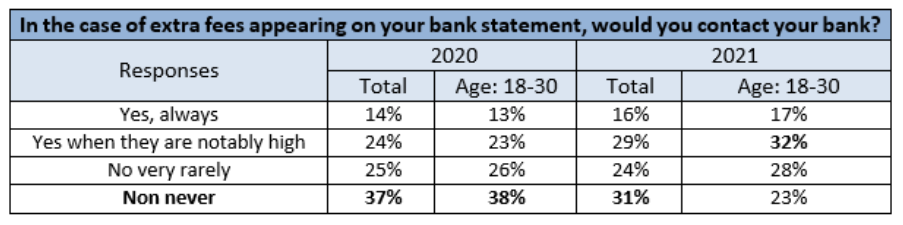

In the case of unexpected bank fees, 55% of French people wouldn’t dare contact their banker. This percentage keeps going down with 62% saying the same last year.

However, young people are showing a real interest in more contact when it comes to questionable fees, with 49% saying they would contact their bank, up from 36% the previous year.

Bank fees remain “too high”

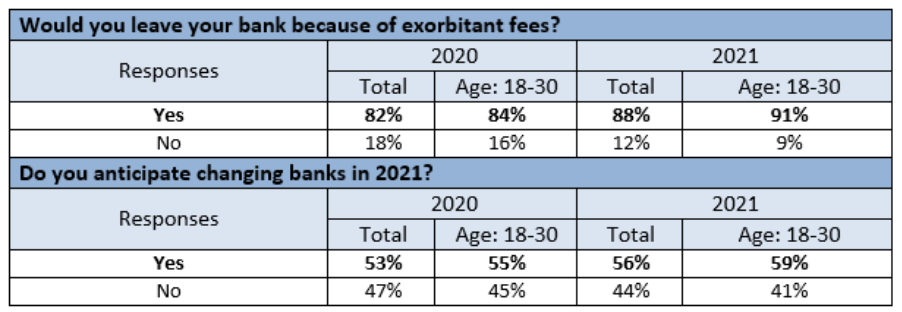

If they become too large, more than 88% of French people admit that they would be likely to change their bank.

There is an even stronger reaction among the 18-30 age bracket with 91% likely to leave their bank.

Moreover, exorbitant bank fees or not, 56% of respondents are considering changing banks in 2021. (59 % of 18-30 years old bracket).

There is growing dissatisfaction with banks

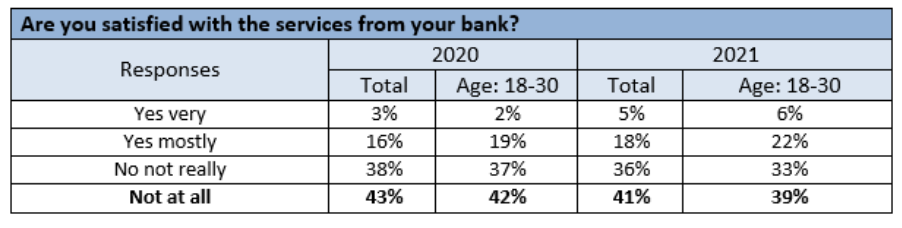

Last year, only 19% of French people said they were satisfied with their banking services. This year, that number reached 23%.

A nice increase but still remains for below the 77% who are dissatisfied. One thing to note: The 18-30 age bracket appreciates their banking services more with 28% saying they are satisfied.