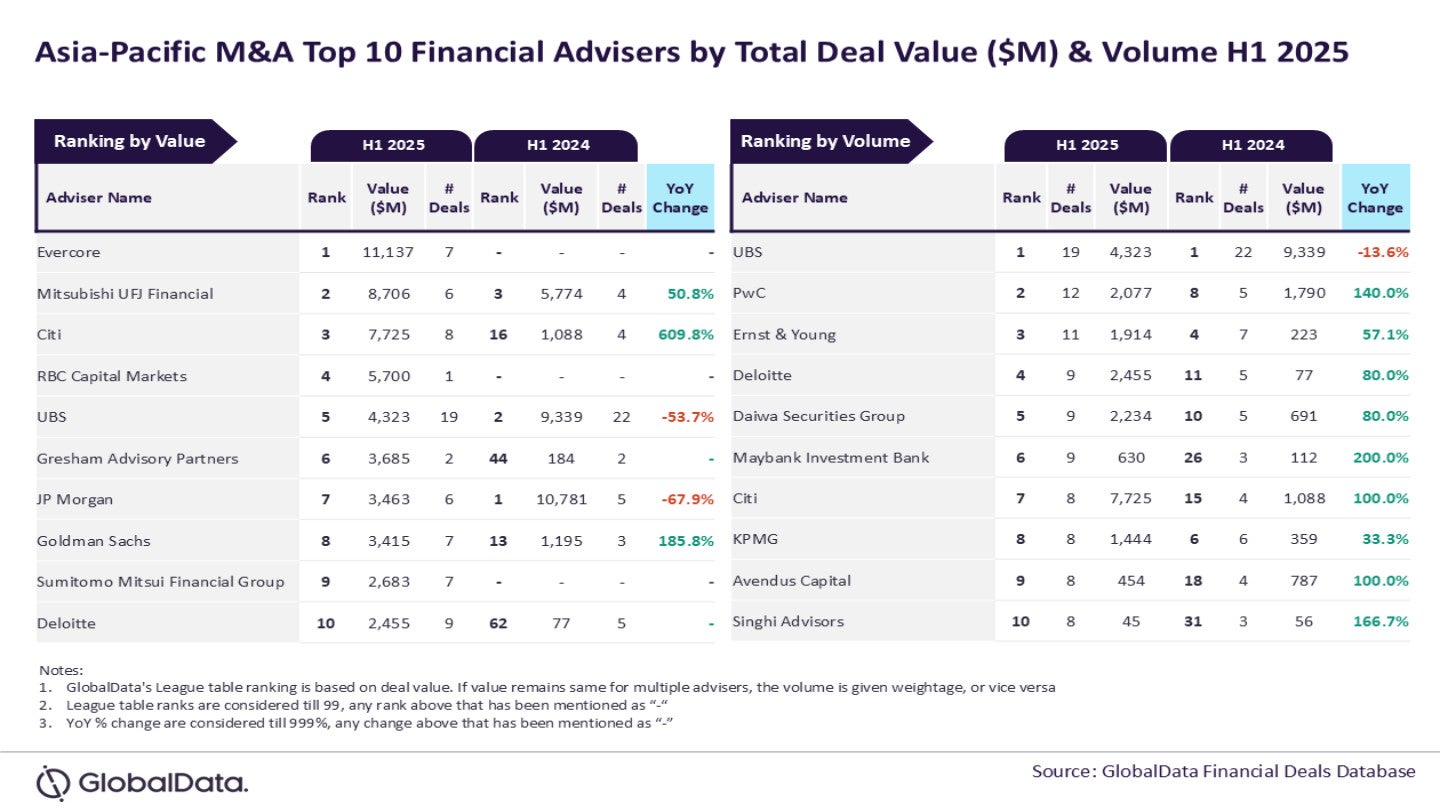

Evercore and UBS have emerged as the leading financial advisers for mergers and acquisitions (M&A) during the first half (H1) of 2025 in the Asia-Pacific (APAC) region, according to the latest league table from GlobalData, a data and analytics firm.

GlobalData’s deals database indicates that Evercore secured the top position in terms of deal value, having advised on transactions totalling $11.1bn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

UBS led in deal volume, providing advisory services for 19 deals.

GlobalData lead analyst Aurojyoti Bose said: “Evercore was the only adviser to surpass $10 billion mark in total deal value during H1 2025. Involvement in three billion-dollar deals* helped it occupy the top position by value. Apart from leading by value, Evercore also held the 10th position by volume during the review period.

“Meanwhile, UBS, which was the top adviser by volume in H1 2024, also managed to retain its leadership position by this metric in H1 2025. Apart from leading by volume, UBS also occupied the fifth position by value.”

Following Evercore in the value-based rankings, Mitsubishi UFJ Financial took second place, advising on deals worth $8.7bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCiti followed with $7.7bn, RBC Capital Markets with $5.7bn, and UBS with $4.3bn.

In terms of deal volume, PwC ranked second with 12 deals, trailed by Ernst & Young with 11 deals. Although both Deloitte and Daiwa Securities Group had nine deals each, Deloitte took the fourth spot because of the deal value.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.