Global retail and commercial banks spent approximately $1trn between 2015 and 2018 to transform their IT and target digital leadership.

Specifically, a large chunk of that investment is dedicated to enabling technologies such as cloud and AI-powered analytics.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Consequently, what has come of that investment? In particular, does digital leadership create superior economics?

A report, ‘Caterpillars, Butterflies and Unicorns, published by Accenture on 20 June asks if digital leadership in banking really matters. In particular, the report compares the economic performance of 161 large traditional banks across 21 markets.

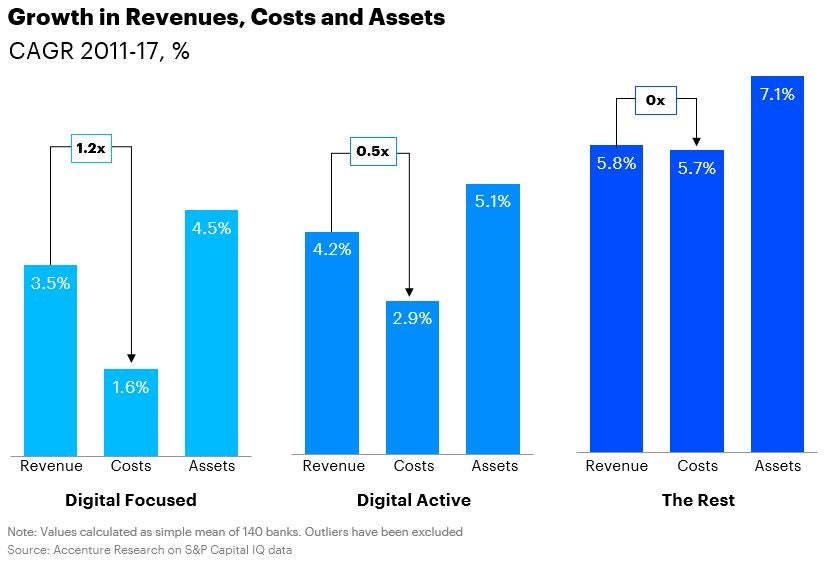

Accenture classifies banks in three groups ranked by their digital maturity. In particular, the report describes 12% as ‘digital focused’ with 38% marked as ‘digital active’. The report marks out the remaining 50% simply as ‘the rest’.

And the key conclusion: banks making the greatest digital advances are the most profitable and highly valuable.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBut this higher profitability is driven, argues Accenture by cost efficiencies rather than revenue growth.

At the same time, the operating expenses for such banks are growing at half the rate of their revenues.

Overall, digital focused banks are the only group with a price-to-book value greater than 1x. Moreover, the gap with the rest of the industry is widening.

A bank’s next move, says the report, depends on its level of digital maturity. It argues that digitally enabled cost reduction is the first necessary step in building a future-ready bank.

Digital leadership: Accenture recommendations

- Make the new truly new

If the end of the customer journey is an existing bank product, adjacent revenue streams will be difficult.

- View unicorns as exceptions, not the rule

Financial services players can only really support broad lifestyle platform plays as opposed to being the central platform

· Own and control platform services you arrange

Controlling platform services will better position banks to earn sustainable revenue from them.

· Be more strategic toward economic outcomes

Reinvent core investment approaches to enable dynamic stage-gating.

· Evolve the business model

Become proposition-centric, featuring digital factories and special processes for procurement, talent management and risk control.