It has been a hectic few weeks for UOB’s multichannel strategy. The launch of its digital subbrand, TMRW, is complemented by a number of branch initiatives, including three new branch concepts in Thailand, reports Douglas Blakey

UOB’s omnichannel strategy is going into overdrive. Not content with the launch of the TMRW digital sub-brand, UOB is ramping up its investment in the physical channel. In Thailand, UOB is piloting three branch concepts.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The new outlets are designed to meet the lifestyles and needs of distinct customer segments: families; young professionals and entrepreneurs; and business owners and the upper affluent.

Meantime, in Singapore, UOB is targeting the growing emerging affluent segment. A new branch in Singapore’s Orchard Road will, says UOB, offer a new banking experience designed to shape the wealth creation journey.

Changing lifestyles

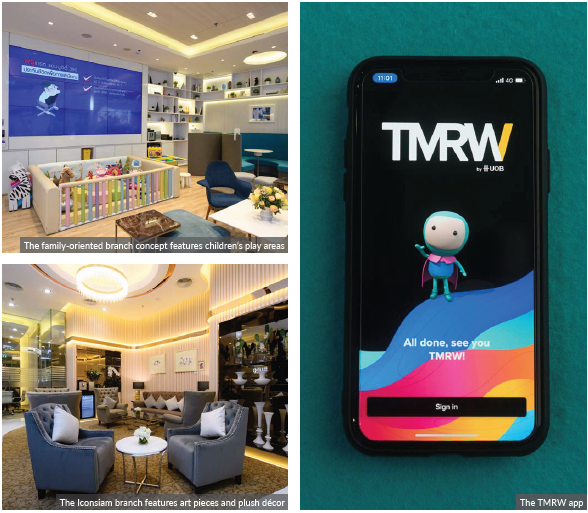

Each of the three prototypes is based on customers’ lifestyles, needs, inspirations and aspirations: there is a club for children, an art gallery-themed concept, and the third features a futuristic design.

Although the concepts are distinctly different, the three pilot branches are centred on offering financial solutions and services for UOB’s customers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataUOB based the prototype branches on its statistical analyses of how customers use the branches, and its research on what customers expect of these centres: UOB’s study revealed that customers preferred to visit a branch for personalised financial advisory services, with 99% of its customers in the upper affluent and family segments saying they visit a branch at least once a month.

In contrast, with the increasing use of technology to make banking simpler, safer and smarter, the young professionals said they would rather conduct their banking transactions through digital channels; however, they also indicated that they would continue to visit a branch for financial advisory services.

Designs for needs

James Rama Phataminviphas, country head of channels and digitalisation at UOB (Thai), says UOB has taken a design thinking approach to enhance the banking experience for each customer segment, with the three branch concepts drawing on insights and understanding of its customers.

“The needs of families, young professionals or entrepreneurs and those of business owners and the upper affluent are different,” he notes.

“Families are mainly focused on their children’s development and would want to plan well for their education; young professionals or entrepreneurs are concerned about their career progression or setting up their own business; the established business owners and the upper affluent customers want help in planning, saving and investing wisely.

“Using data analytics and research, we are focusing on creating solutions to address our customers’ changing needs and ensure that their experience exceeds their expectations.” The bank also paid close attention to each branch’s design and layout.

“In a traditional bank branch, around 70% of the floor space is devoted to tellers and servicing, with 30% dedicated to wealth advisory,” Phataminviphas explains, adding:

“We are reversing this ratio: we know that when our customers visit a branch, it is more likely for financial advice.

“We have reconfigured the branch layout. We have removed traditional teller counters and created spaces for our customers to hold private conversations about their financial needs and aspirations.”

The first branch concept for families at the CentralFestival EastVille shopping mall includes a colourful and inviting area where children can play while their parents are engaged in private discussions with UOB staff. This new branch is open seven days a week from 10.30am to 7.30pm.

UOB Thai: flagshp concept

For business owners and the upper affluent, the branch at the Iconsiam mall has been designed as the flagship UOB Privilege Banking Centre. The interior has plush décor, and inspirational art pieces by various national artists are on display.

Accredited investment consultants stand by to provide financial advisory services and to guide customers through the bank’s comprehensive suite of financial services and solutions. The new UOB Privilege Banking branch at Iconsiam is also open seven days a week from 10.30am to 7.30pm.

The modern and futuristic branch for young professionals and entrepreneurs has more self-service machines and discussion areas than a typical branch. The interior is stylised and minimalist; it also holds the UOB Business Centre, which is the venue of the Smart Business Transformation Programme for SMEs to refine their business models and to adopt digital solutions. The Third Place branch is scheduled for completion by the first quarter of the year.

Emerging affluent

UOB says Singapore’s emerging affluent consumers, although known for their ‘cando’ attitudes, are less certain about growing their wealth through investments.

One in three UOB emerging affluent customers say that while they want to invest, they lack the confidence to do so – this is despite the availability of investment-related information online.

As a result, UOB aims to transform the banking experience for emerging affluent customers by designing an omni-channel wealth creation journey. It integrates the bank’s online and branch services to equip customers with the knowledge needed to make investment decisions confidently.

“In the last year, we surveyed more than 1,200 UOB customers to understand their preferences for investing,” says Jacquelyn Tan, head of Singapore personal financial services at UOB.

“More than half of our emerging affluent consumers want to be able to speak with a financial advisor before making an investment decision. As such, we designed our wealth-creation journey so our customers would know the range of investment options available to them. It also enables us to engage with them at a deeper level.

“We want to help build the financial confidence of Singapore’s increasing number of emerging affluent consumers, and we want to help them become more comfortable in achieving their wealth goals through investing.”

In 2018, there were more than 476,000 emerging affluent consumers in Singapore; the segment is expected to grow by 15% by the end of 2020.

Digital advisory

At the core of UOB’s wealth-creation journey is the launch of a new Wealth Banking branch model that aims to complement the bank’s online channels.

On entering the branches, customers receive a personalised experience through the use of artificial intelligence (AI) and data analytics. UOB customers scan their identification card at the Self-Help Ticketing Kiosk.

Within seconds, they receive information on relevant financial solutions that could be of interest to them, as well as an eQueue number to the customer’s mobile phones. A relationship manager also receives the same set of information, enabling them to serve customers and answer any questions they may have on these financial solutions during their meetings.

The speed with which personalised content is sent to the customer is powered through AI and data analytics. UOB will use this to develop different customer profiles and corresponding suggestions. Relationship managers are also equipped with a purpose-built digital investment advisory platform, providing deeper insights into building a Risk-First investment portfolio to meet the customer’s wealth goals.

Portfolio advisory tools

Known as the UOB Portfolio Advisory Tools, the bank says this is the first such digital service offered specifically to emerging affluent consumers by a Singapore bank.

The UOB Portfolio Advisory Tools draws on more than 12 years of historical market data. This will simulate the expected performance on an investment portfolio against various economic scenarios, such as a bullish market cycle or an economic downturn.

By using data visualisation to illustrate the potential performance of the investment

portfolio based against these scenarios, customers gain a better understanding of how their investments may perform over time.

LOCATION LOCATION LOCATION

The choice of Orchard Road for the location is well thought out: it continues to be one

of the most frequently visited destinations for emerging affluent customers.

Close to 100,000 of this market segment visited the locality in the first six months of 2018.

“From our analysis, we found that our customers not only conducted their banking at locations where they live and work, but also when they shop, play and dine along Orchard Road. As such, we chose to launch our high street Wealth Banking branch at Orchard Road to be sure we remain close to them,” concludes Tan.