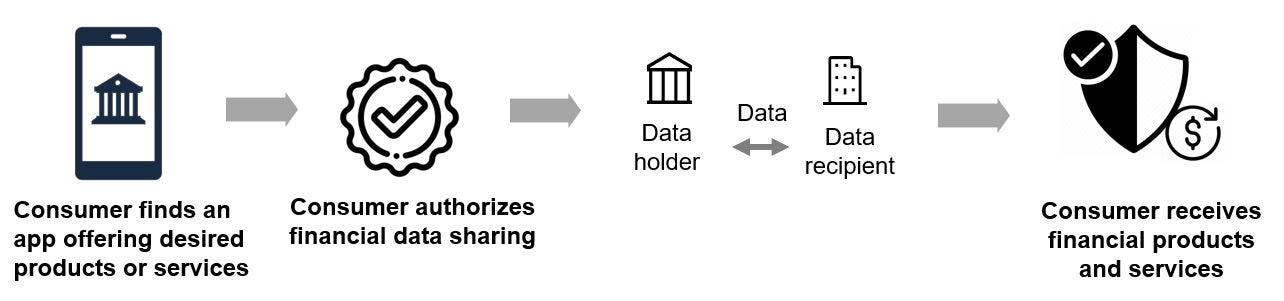

Canada’s Finance Ministry has been holding discussions with stakeholders for several years about introducing open banking, which uses secure application programming interfaces (APIs) to share consumers’ financial information.

In June 2024, the House of Commons passed the Consumer-Driven Banking Act which included the foundational elements of scope and technical standards for open banking and designated the Financial Consumer Agency of Canada (FCAC) as the lead open banking regulatory agency. In its 2024 Fall Economic Statement, the government said it intended to introduce legislation for the remaining elements of the Consumer-Driven Banking Framework, including accreditation and common rules covering national security, liability and privacy.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Department of Finance spokesperson Marie-France Faucher told RBI that the government is committed to establishing a consumer-driven banking framework that fosters a competitive and innovative financial sector. “The remaining elements of the Consumer-Driven Banking Framework will be introduced at the earliest opportunity to ensure Canadian consumers and business can securely benefit from tools helping them reduce costs and improve their financial outcomes,” she said.

Objectives

The government’s open banking framework has three objectives:

- Ensure the financial sector’s continued safety and soundness by addressing security risks arising from existing data-sharing practices such as screen-scraping and establishing oversight of financial data-sharing activities. An estimated 9 million Canadians use screen-scraping to link their accounts at different FIs and fintechs, despite the technology’s security risks;

- Ensure Canadians can securely and confidently exercise their right to access and use their financial data to improve their financial outcomes;

- Establish a cohesive framework with a clear, fair, and transparent approach to accreditation to support the Canadian financial sector’s continued security and stability, including existing FIs, while enabling innovation and competition.

Dan Broten, SVP and Head of Canada’s EQ Bank, said: “Since the first part of the open banking legislation was introduced last Fall, we’ve participated in consultations with the government. But we still await the critical second piece of open banking legislation that will let us proceed with implementation. We hope this comes soon – ideally as a part of the 2025 Fall Economic Statement – and with a clear comprehensive framework allowing FIs to put it into action in a meaningful way.”

Broten said there is an expectation that the government will provide an update on the second part of the open banking legislation this Autumn alongside the Fall Economic Statement. “We hope it releases a comprehensive implementation plan (including draft regulations) allowing a meaningful rollout of open banking to unlock its full potential including common rules, clarity on scope, technical standards, non-functional specifications upfront and how small businesses will be included within the original purview.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataVictoria Mainprize, VP, Policy and General Counsel at the Canadian Credit Union Association, said efforts have been made regarding data security by the federal government to minimise duplication between federal and provincial regulations when implementing Canada’s Consumer-Driven Banking (CDB) Framework. The CCUA is the national trade association for Canada’s credit unions and for non-Quebec-based caisses populaires.

“As most Canadian credit unions are provincially regulated, the federal Finance Minister can designate a provincial regulator to oversee the CDB Framework’s security provisions (as well as privacy, liability, complaints and consumer protection) for the credit unions they regulate,” Mainprize said. “While specific details are still being developed, approval will be needed from the Finance Minister to ensure compliance with the CDB Framework’s standards.”

To ensure provincial credit unions can participate fully in the CDB Framework without facing additional barriers, compared to their federal counterparts, alignment on federal and provincial legislation will be key, as the CDB Framework is being developed primarily with federally regulated FIs in mind, Mainprize said.

Atul Varde, Chief Information and Payments Officer at Servus Credit Union, expects to see some directional guidance concerning open banking implementation timelines in the autumn 2025 Federal Budget. “I recall seeing indications earlier this year to expect an ‘early 2026’ launch timeline, but only time will tell if we’re still on track in that regard. On a balance of probabilities basis, I think Canada will want to differentiate itself in the new geopolitical environment vis-à-vis the US and not delay our open banking launch any further. That would be a statement in itself and would be a foundational enabler to improve our long-lagging business productivity/competitiveness.”

Varde said a concern with a 2026 timeline is that it’s also the year when Canada’s Real-Time Rail payments network is supposed to launch. “I’m not sure the Canadian banking sector was planning to launch the RTR and open banking in the same year, but delays on both programs have us looking at a concurrent launch now as a distinct possibility. One option is to stagger the two launches a bit by phasing them in via waves.”

Steve Boms, the Financial Data and Technology Association’s (FDATA) executive director, warned that, while Canada has laid the groundwork for open banking, further delay risks importing the dysfunction seen in the US, where litigation and reversals have left consumers without clear financial data rights. “A national regime allowing competition to flourish is essential to phase out outdated practices and deliver the consumer choice, security, and expanded services Canadians deserve,” he said.

Preparations

EQ Bank’s Broten said the online bank has prepared for open banking for many years. “Our digital platform will allow us to make changes rapidly once we have the framework details,” he said. “The most challenging work was the foundational technology changes we’ve made over the past decade. Today, all our tech is hosted in the cloud, making it simple to build and scale APIs as needs evolve. Since 2019, we’ve operated on an API-centric architecture, so the heavy lifting is already behind us. Now we’re waiting for the final specifications and framework from the government – once those are in place, we’ll be ready to implement and go live.”

Broten said that, while open banking API usage is limited in Canada, there are examples of the financial services industry implementing open APIs in the absence of an overarching framework. “Many larger banks have made public announcements on their collaborations with various aggregators to provide their customers with access to other apps outside of the bank,” he said. “There’s a high burden to set up these arrangements through bilateral agreements with each software provider. Open banking would provide the framework and standards to do this much more easily and consistently throughout the industry, while not sacrificing safety and security.”

“I understand that (data-sharing API providers) Plaid and Flinks have bilateral data-sharing agreements with a number of the large banks,” said Parna Sabet-Stephenson, Leader of the Financial Services and Technology Group at Canadian law firm Gowling WLG.

Since 2022, EQ Bank has partnered with Flinks and integrated its Flinks Outbound data-sharing technology. “Customers told us they wanted more seamless ways to connect their EQ Bank accounts with the apps they use every day, and this partnership was a meaningful step forward in giving them more control over their financial lives and their data – ahead of a formal open banking framework,” Broten said.

Celina Philpot, Conexus Credit Union’s CEO, said: “We’ve been monitoring open banking implementation in other jurisdictions to learn what went well, what could have been better, and how we can serve our members. For us, it’s all about our members. Implemented correctly, open banking’s main benefit will be more consumer choice from efficient and secure banking data transmission between FIs and apps. A legal framework could also spur entrepreneurs to create products and services people want.”

Philpot noted that Conexus’ primary focus in preparing for open banking is building a solid data and cybersecurity foundation. “We’re considering industry-leading solutions such as the Large Credit Union Coalition’s (LCUC) Caspian One open banking platform,” she said. The LCUC’s purpose is to help large Canadian credit unions implement innovative technologies such as open banking.

Varde said Servus has been implementing APIs that comply with the Financial Data Exchange’s (FDX) financial data-sharing API standard. “We’re also preparing for participation in the Real-Time Rail from Payments Canada which means upgrading our Interac e-Transfer API version to the required level,” he said. “Last but not least, we’ve added machine-learning capabilities to our internal Fraud Management System.”

Plaid

“Plaid works with Canadian banks, credit unions, and fintechs to help them connect through APIs wherever they are available, and we continue to invest in partnerships promoting secure, reliable data sharing,” Plaid spokesperson Freya Petersen said.

“To enable a seamless transition for the ecosystem, Plaid is helping FIs adopt modern data-sharing practices. Plaid advocates an ecosystem where consumers control their data, and where FIs and fintechs can build innovative services on top of safe, transparent connections. Our goal is an API-first environment, and we build options that are easy for banks to leverage to ultimately move away from screen-scraping.

“We believe it’s critical to move forward with a well-designed framework offering clear security, interoperability and governance standards. Plaid, alongside partners like the FDATA, advocates for a tiered accreditation model that considers a participant’s size, use case, and risk profile, rather than a ‘one-size-fits-all’ approach that would create significant barriers for smaller fintechs.

We also call for the Bank of Canada, rather than the Financial Consumer Agency of Canada, to assume the primary governance role due to its existing expertise and infrastructure. A well-designed framework will give Canadians confidence that their data is protected, while enabling Fis and fintechs to deliver new tools and services that improve people’s financial lives. Plaid remains ready to work with policymakers, regulators, and industry partners to help bring open banking to life in Canada.”

Benefits

EQ Bank’s Broten said that, as Canada follows other countries in implementing open banking, it will be able to adopt a lot of proven use cases while creating new ones unique to the Canadian landscape. “It remains to be seen whether and when open banking could be used for payments initiation,” he said. “We won’t see it enabled in Phase 1 of the open banking framework, but read-only access might help facilitate improvements in payments. For example, if Bank A can read a customer’s account balance from Bank B, it could increase trust in the system around the availability of funds, which could speed up transactions.”

Broten said open banking will spur innovation in use cases beyond obvious things like linking accounts, as FIs use and learn from the data. “For example, until some fintechs came up with this in the UK, no one thought open banking could help track rent payments that could then be used to build credit history, but it turned out to be a very helpful use case,” he said. “The Canadian government has highlighted that use case – using rental payment data to build credit scores and demonstrate payment ability for mortgage applications – as an area ripe for innovation.

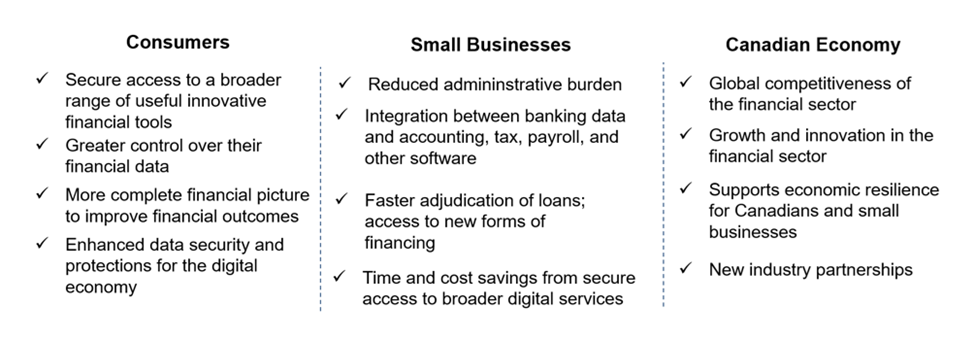

Benefits of Consumer-Driven Banking

Source: The Canadian Bankers Association and the Canadian Credit Union Association

The Canadian Bankers Association’s recommendations for a consumer-driven banking framework with read access, initially enabling approved service providers to only receive consumer financial data with consent:

Recommendations

A Hybrid Model: Canada’s journey towards consumer‑driven banking embraces a principles‑based approach, drawing from industry expertise to deliver on the government’s policy objectives. This model should be economically sustainable to encourage participation, innovation and competition for consumers’ benefit;

Consumer Protection: Ensure consumers receive consistent protections including options for all participants to take reasonable steps to protect consumers against security and fraud risks. These protections would ensure that participants receiving the data will be accountable and liable for the data transfer initiated by customers;

Prohibit Screen-scraping: Prohibit screen-scraping practices within a specified timeframe to safeguard consumers, even by organisations not participating in the framework;

Reciprocity: All participants (including FIs, fintechs, bigtechs and other non-FIs) must adhere to the principle of reciprocity to eliminate any potential data asymmetry. This will empower Canadians to securely access and share their financial data;

A Fit‑For‑Purpose Entity: A proper governance entity with the appropriate mandate, capacity and resources must be created at the outset, recognizing the government’s policy objective of a cross-sector consumer data right, and the need for this entity to successfully supervise the framework across disparate disciplines such as market conduct, privacy and security;

Efficient Implementation: An effective consultative approach to the expansion of scope (breadth of data to be shared, entities that can participate and functionality) following a clear timeline and focusing on leveraging industry strengths for consumer‑centric use cases that will expedite the delivery of consumer-driven banking benefits to Canadians;

Accreditation Framework: Promote consistent consumer protections where participants are subject to common rules, e.g. security, privacy, liability, fraud and data protection, that foster consumer trust in the system;

Regulatory Harmonisation: Leverage existing and applicable regulatory and legislative frameworks where appropriate and foster intergovernmental coordination to avoid duplicative, conflicting, or residual obligations and ensure a consistent consumer experience;

A Single Technical Standard: A principles‑based, market‑driven approach to standards development and a timely announcement on the use of the FDX standard, with which all participants must demonstrate compliance, to ensure interoperability and provide participants with needed clarity to meet government timelines.

Source: The Canadian Bankers Association and the Canadian Credit Union Association